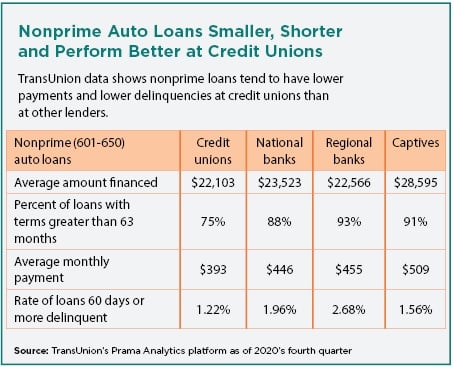

Credit unions are finding more ways to make car loans for people with dings and dents in their credit scores. Some of the tools include trended data showing consumer payment behavior over 30 months, alternative data such as rent or utility payments, and credit- builder programs.

Credit unions are finding more ways to make car loans for people with dings and dents in their credit scores. Some of the tools include trended data showing consumer payment behavior over 30 months, alternative data such as rent or utility payments, and credit- builder programs.

All of them require dedication to lending beyond the safety zone of A and A+ paper, and to building analytical muscles. Sometimes small loans for weak credit require a heavy lift to gauge the risk and price for it.

In the Los Angeles area, Financial Partners Credit Union ($1.8 billion in assets, 85,125 members) is trying to build its profile as a lender to subprime borrowers who are willing to rebuild their credit.

Continue Reading for Free

Register and gain access to:

- Breaking credit union news and analysis, on-site and via our newsletters and custom alerts.

- Weekly Shared Accounts podcast featuring exclusive interviews with industry leaders.

- Educational webcasts, white papers, and ebooks from industry thought leaders.

- Critical coverage of the commercial real estate and financial advisory markets on our other ALM sites, GlobeSt.com and ThinkAdvisor.com.

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.