How are climate-related risks and opportunities affecting yourorganization's businesses, strategy and financial planning?Increasingly, companies are asking themselves that question toprepare for an uncertain future.

|Indeed, the impact of climate risk is a topic that regulatorsare considering as well. The Financial Stability Board set upthe Task Force on Climate-related FinancialDisclosures “to help identify the information needed byinvestors, lenders and insurance underwriters to appropriatelyassess and price climate-related risks and opportunities.”

|These voluntary disclosures would give stakeholders a clearerpicture of how companies perceive and are addressing climate risks.And the National Association of Insurance Commissioners' InsurerClimate Risk Disclosure Survey, adopted in 2010, is now mandatoryfor larger insurers.

|The Actuaries Climate Index (ACI), amonitoring tool launched in November 2016 by four North Americanactuarial organizations, may be helpful to insurance companies inanswering these types of questions and in managing climate-relatedrisks and opportunities.

|Why are actuaries weighing in on climaterisk?

Actuaries are experienced in the assessment and mitigation ofthe financial consequences of risks and in the summarization andpresentation of complex data for decision-making. A changingclimate is having a financial impact on insurance consumers andproviders, and actuaries are well positioned to conduct deepanalysis to map out what has been happening in recent decades. TheActuaries Climate Index was developed by the Climate ChangeCommittee, a joint effort of the American Academy ofActuaries, the Canadian Institute of Actuaries,the Casualty Actuarial Society, and the Society ofActuaries.

||

What is the Actuaries Climate Index?

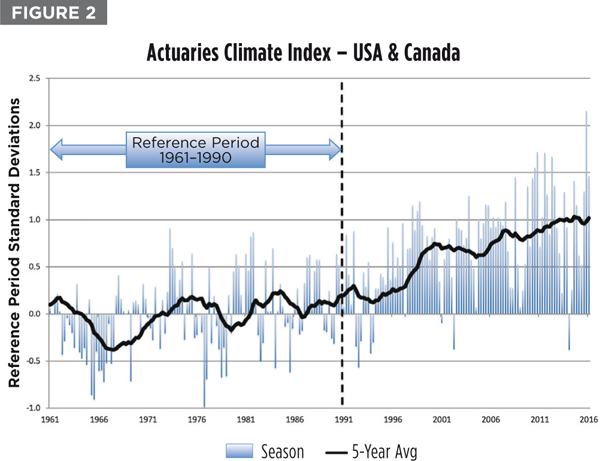

The ACI is an educational tool designed to help informactuaries, public policymakers and the general public about climatetrends and their potential impact. A quarterly measure of changesin extreme weather events and sea levels, the ACI is based onanalysis of quarterly seasonal data for six different indexcomponents collected from 1961 through the latest available season,compared to the 30-year reference period of 1961 to 1990. The ACIis available online at ActuariesClimateIndex.org.

|The ACI divides the continental United States and Canada into 12different regions. Higher index values indicate an increase in theoccurrence of extreme weather events.

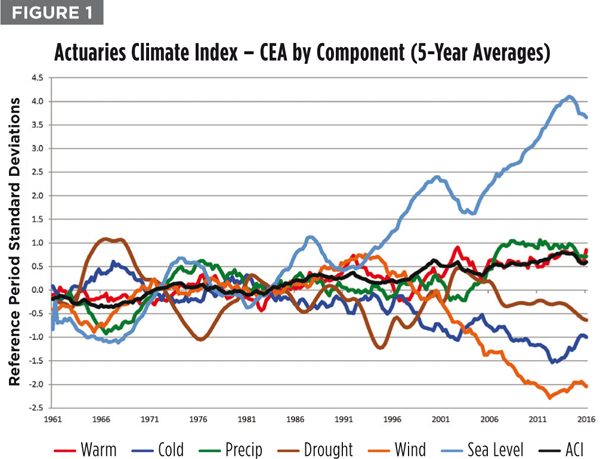

|The risk measured by the ACI is relative to the averagefrequencies during the reference period of 1961–1990. The data isfrom neutral, scientific sources, generating objective,evidence-based results on extreme weather events. According to thedata analysis, 1.02 is the current five-year moving average valuefor the index. The index value remained below 0.25 during thereference period, reached a value of 0.5 in 1998, and first reached1.0 in 2013. These values indicate an increase in the frequency ofextreme weather occurrences and changes in sea levels to asustained level above any single season (out of 120) during thereference period.

|The ACI data is available for free on the website, which showsgraphs and maps of the data by region and component. There is aguided tour to the website and documentation explaining how theindex was developed and how it is calculated.

|A second index, the Actuaries Climate Risk Index (ACRI), isbased on the historical correlations of economic losses, mortality,and injuries to the ACI data, and is expected to be launched laterthis year. Regions used in the ACI follow state and provincialborders as shown in Figure 2.

|The six components of the Actuaries Climate Index are:

|Warm temperatures (above the 90th percentile)

|Cold temperatures (below the 10th percentile)

|Heavy precipitation (maximum 5-day rainfall in each month)

|Drought (measured by consecutive dry days)

|Wind (above the 90th percentile)

|Sea level

|For the purpose of combining the six components, the seasonaldifferences versus the reference period are divided by thestatistical measure of variability in the reference period, thestandard deviation. This approach allows such inherently differentquantities to be combined in a single index while preserving theaccuracy of the components. For each component, the index valueindicates how unusual that season's value is, compared to thereference period mean and standard deviation for that season.Hence, each component is in units of the standard deviation of thatquantity.

|The index components are approximately normally distributed,therefore, about one-third of the time one expects that indexvalues will be outside the interval ±1, and one-sixth of the timeit will be greater than +1. When it comes to the composite ACI,constructed as a combination of the components, the standarddeviation is significantly less than 1, and thus a composite indexvalue of 1 indicates a more unusual event than a similar value atthe component level.

||

How insurers can use the Actuaries ClimateIndex

Data by region and component can be used to focus on areas whereclaim activity is most important to an insurance company. Concernedabout sea levels or heavy rain in the northeastern United States?Data for the Central East Atlantic region (CEA) will show that sealevel rise has been greater there than in any other region and thatperiods of heavy precipitation have been much more significant inrecent years. Seasonal data underlying graphs such as Figure 3could be modeled against claims data to help assess the risk — andthen companies can incorporate their insights into pricing,underwriting, product development or claim department strategy.Monthly ACI data is also available.

|The risk management implications of climate change will onlycontinue to grow if current trends continue. Companies thatincorporate climate data in their strategic planning will have acompetitive edge. They will also be better able to answer climatedisclosures and provide convincing information to regulators,shareholders and lenders that will demonstrate that they areeffectively managing risks.

|Climate change will have varying effects by class of business;property, casualty, life and health insurers will identifydifferent risks and opportunities. Reinsurers will also beinterested to know how their reinsureds are monitoring this aspectof their business. The ACI should also be useful to non-insurers intheir financial planning and risk management.

|Coverage decisions, such as where and whether to provideproperty or flood insurance, can be informed by historical climatestatistics. Actuaries are increasingly using predictive models tomeasure correlations and trends for use in pricing, underwriting,claims management, marketing and enterprise risk management. TheActuaries Climate Index data is an important new input to thesemodels. Where possible, the index components measure extremes,rather than averages, because extremes have the largest impact onpeople and property.

|Some might say that climate change is gradual and should be amanageable risk for the insurance industry. At a presentation toactuaries in 2015, the audience was polled about how concerned theproperty and casualty insurance industry should be about the risksof climate change. Of the 121 poll respondents, 43% indicated thatthe risks of climate change are inadequately addressed. Is yourcompany in this group?

|The Actuaries Climate Index and the Actuaries Climate Risk Indexwill be useful additions to the analytical toolkit of insurers andother companies as they look to manage the risks of a changingclimate.

|Douglas J. Collins is a retired actuary and chair of theCasualty Actuarial Society's Climate Change Committee. He workedfor eight years at The Travelers, and spent the remainder of hiscareer as a consulting actuary and principal with Tillinghast,Nelson & Warren, and its successor organization, Towers Perrinin the U.S., Bermuda and Europe.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.