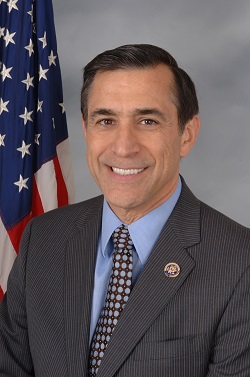

Rep. DarrellIssa (R-Calif.), chairman of the House Oversight Committee, saidCongressional deregulation and the resulting pressure to growforced credit unions to become more like banks. And, that pressurehas fueled banker resentment.

Rep. DarrellIssa (R-Calif.), chairman of the House Oversight Committee, saidCongressional deregulation and the resulting pressure to growforced credit unions to become more like banks. And, that pressurehas fueled banker resentment.

Issa made the comments while speaking at an event sponsored bythe Libertarian-leaning Washington think tank CATO Instituteregarding Operation Choke Point, a Department of Justice initiativethat pressures financial institutions to cut ties with privatecompanies that aren't breaking the law, but could increasereputation risk.

|Issa veered into credit union territory when he said thatcompared to banks, credit unions are a bit more protected fromOperation Choke Point.

|“Credit unions so far have been slightly more insulated,but credit unions have a separate attack which is that when wederegulated credit unions, what we did was we created the same raceto be a large credit union,” he said July 8 at the event, “DOJ'sOperation Choke Point: Illegally Choking Off LegitimateBusinesses?”

|Issa likened a credit union to a fraternal organization thatserves its members. However, he said credit unions are becomingmore like banks over time.

|“What we've done is we've said to credit unions get big or die,and so what you're seeing is they're all changing their stripes andbecoming bank-like. My guess is that ultimately credit unions areon a – unless we change something – they're on a pathway towardchoosing to be banks,” Issa said.

|“Part of the reason is that the banks continue to attack creditunions because they can assemble base capital without taxation andfor some reason, banks have always disliked credit unions, but oncethey started being more bank-like and getting larger, that war hasbeen going on,” he added.

|Reacting to Issa's comments, John Magill, CUNA executive vicepresident of government affairs, stressed that while credit unionsprovide many of the same services as banks, their structure andmission are quite different.

|“Bank attacks and resistance toward credit unions are as old ascredit unions themselves, documented at nearly every stage ofcredit union development in this country going back more than 100years,” Magill said. “But what the banks have never understood isthat credit unions operate under a completely different structure:Not-for-profit, member owned, democratically controlled, volunteerled-financial institutions, focusing on service to members – notshareholders' bottom lines.”

|“It's true that there are many credit unions that are not smallby community bank standards. However, all credit unions adhere tothe same structure — and the focus is on service to their members.It's for that reason that nearly one in three Americans now choosecredit unions as their financial partner,” he added.

|According to CUNA Vice President of Political Affairs TreyHawkins, CULAC contributed $7,750 to Issa's re-election campaign in the2012 cycle, and $7,500 so far for the 2014cycle.

|NAFCU's PAC donated $2,000 to Issa in the 2014 election cycle,according to online records.

|Senior Vice President of Government Affairs and General CounselCarrie Hunt disagreed that credit unions face pressures to grow dueto deregulation. Rather, she said, the issue is a need for economyof scale.

|“Credit union merger trends have been consistent and are due toregulatory burden and a need for economies of scale. ChairmanIssa has highlighted the need for continued regulatory relief forall credit unions , especially smaller ones, in order for them toremain viable. However, regardless of size, credit unionsremain not for profit mutual cooperatives. NAFCU believesthat from a competitive standpoint, the real competitive threat formid-size banks are even larger banks, not credit unions,” shesaid.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.