Typically, credit union executives talk to their peers to gather initial feedback on vendors that provide certain products and services. That word-of-mouth exchange can potentially secure long-term contracts.

Hoping to make the search and relationship management more efficient are two of the motivations behind VendorCamp, which launched in October 2013.

Recommended For You

The cloud-based vendor relationship management platform is designed to help credit unions and other financial institutions securely store and manage contracts, achieve the highest levels of due diligence for compliance and purchasing, and share information about their experiences with others, said Christopher Beltran, founder and CEO of VendorCamp in Carmel, Ind.

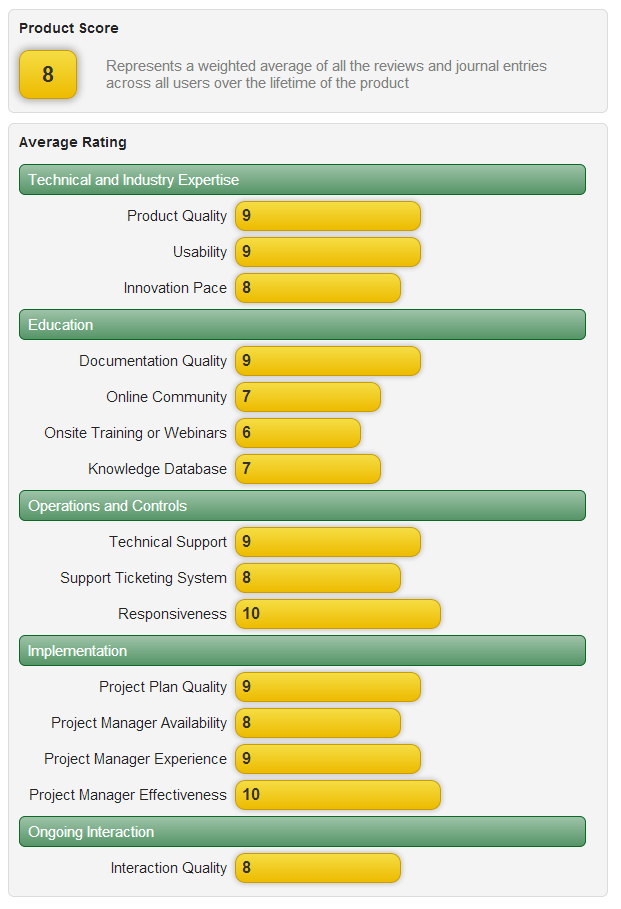

Click on the image above left to expand. Through VendorCamp, clients can read and write reviews for any product or vendor, which are then shared anonymously with other credit unions.

Beltran's name may sound familiar. He is the co-founder of Passageways, a Lafayette, Ind.-based intranet software company that originated in his dorm room at Purdue University. Founded in 2003 with Paroon Chadha, the firm's software is now used by more than 300 community banks, credit unions, hospitals and insurance companies around the world. Beltran said while he is not involved in Passageway's daily operations, he still has ownership in the company.

With VendorCamp, there is no limit to the number of users that a credit union can add to their account, Beltran said. No installation is needed and once contracts are uploaded, VendorCamp's setup service configures everything, he added. Users can then make customized changes, manage checklists, reminders and contracts.

There's also a feature that allows account holders to read and write reviews for any product or vendor, which are then shared anonymously with other credit unions in the community. Every vendor and product has an overall score that can be drilled down into more-specific details, Beltran said.

"For example, credit unions can see how all the core processors compare against metrics like support responsiveness, sales material quality and 'nickel-and-diming,'" he noted.

Users can use the team features to record contract negotiation knowledge and day-to-day team interactions with vendors with ratings to get a solid picture of their relationships at the end of the year, Beltran said.

With its vendor searches, the $694 million Bay Federal Credit Union had to call around either to the references provided by the vendors themselves or to peers who were willing to share, said Carrie Birkhofer, president/CEO of the cooperative in Capitola, Calif. It turned out to be a very inefficient process with leaving messages and waiting for replies from the right person, she recalled.

"Although the service is still in its infancy, we use the available features and like what we have seen so far," Birkhofer said. "One of the great features is the ability to anonymously rate the service of vendors, similar to Angie's List."

Bay Federal was one of the first to sign on with VendorCamp and had the privilege of working closely with the Beltran to provide input on the development of vendor management features that the credit union desired, Birkhofer said. As a result, the software is being developed with the end user in mind to create a rich user experience, she added.

In addition to Bay Federal, three others serve on VendorCamp's advisory team: Bill Arnold, chief information officer at the $2.3 billion Service Credit Union in Portsmouth, N.H., $1.1 billion Greylock Federal Credit Union in Pittsfield, Mass., and the $1 billion Beacon Credit Union in Wabash, Ind. Beltran said while the advisory credit unions don't have an ownership stake in the company, going forward, VendorCamp is open to exploring various involvement strategies.

Beacon CU is gearing up a dedicated vendor manager on its staff to roll out VendorCamp in February, said Ryan Showley, its chief information officer. In the past, Showley would ask his staff to survey the market to locate the top three vendors that would meet the credit union's business needs, tap its core system provider to find out who they partner with and spend time on a well-known industry listserve, which Showley said was cumbersome and time-consuming.

"The shared information is invaluable but the organization style of the data is a decade old," Showley explained.

Beacon CU has more than 50 vendors and applications grouped into critical, medium and low priority based upon how and if the vendor manages its member information, Showley said. Each year, it signs on with more vendors for products that, while benefiting members, the credit union still needs to maintain their contracts, costs, product features and releases, employee acceptance, usability and customer service.

"Dedicating employees to this increasingly overloaded business function has been tenuous at best," Showley said. "We need a system to help us maintain rich relationships with our vendors, manage their information so that we gain the most from their products and services."

With VendorCamp, Beacon CU can get vendor sentiment from its staff all year long, which will make the annual survey process easier, Showley noted. Storing contracts during negotiations and logging those conversations will also help everyone stay in sync and remember what happened when it's time to look back during the renewal process. Reminders with alerts aid staff with timely responses as deadlines loom for renewals and renegotiations that tend to sneak up on busy staff, he said.

In addition, because industry regulators require annual reviews and due diligence, Showley said it is the credit union's responsibility to its members to spend wisely and take ownership of these vendor relationships.

Birkhofer and Showley credit Beltran's talent and vision to execute the ideas that keep collaboration alive and well. Indeed, after looking around the industry to pinpoints problems and through talks with CEOs and CIOs, the frustration with vendor management was a recurring topic, Beltran said. Hard discussions begin in the spring and early summer of 2013 to launch VendorCamp.

"As a software entrepreneur, you have opportunities globally in many industries," said Beltran, whose father, Al Beltran, was once CEO of the $383 million Security 1st Credit Union in McAllen, Texas, and just retired this year. "It's a true pleasure to be introducing a new startup that is focused on improving the lives of back office credit union employees who work with vendors daily, and bringing more value to those relationships."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.