The reaction among the roomful of credit union boardmembers was shock and awe.

The reaction among the roomful of credit union boardmembers was shock and awe.

During the course of CUNA's Credit Union Roundtable for BoardLeadership in Chicago last summer, one person said that his creditunion chairman was paid $10,000 a year and the vice chairman got$8,000 a year, said Gary Klotz, chair of the $500 million Community Choice Credit Unionin Farmington Hills, Mich. “The reaction in the room was almostone of disbelief that they were paying them anything.”

|Klotz, a proponent of volunteer boards, was also astonished tofind out recently that the $18,000 the two board members receivedin compensation was modest compared to what dozens of credit unionboard members in other states received incompensation.

|More on Board Director Pay

Part Two – Liability, Demands Make Pay Necessary

Editorial – Time to Talk Turkey on 'Volunteer Boards'

Only a small percentage of credit unions pay directors in moststates that allow board compensation. In Texas, for example, fewerthan 20 credit unions, or less than 10% of the state-charteredcredit unions, pay board directors. In Nevada, none of its threestate-chartered CUs pay their boards. However, all ninestate-chartered Rhode Island CUs pay directors, and five of the sixstate-chartered Maryland CUs also compensate directors.

|(Click on each of the graphics below to see expandedversions.)

| What's more, most credit unions pay small stipendsthat range from a few hundred dollars to $7,000 a year.

What's more, most credit unions pay small stipendsthat range from a few hundred dollars to $7,000 a year.

But some board members receive considerably more incompensation.

|A Credit Union Times review of federal documents showsthat a board member at an Indiana credit union received an annualstipend of $93,109 for working two hours a week on board business.A board treasurer at a Pennsylvania credit union made $65,836annually for spending four hours a week on board work. At a RhodeIsland credit union, the board chair made $39,100 for eight hours aweek of board work. A board chair at a Maryland credit union got a$25,300 annual stipend for working one hour a week. And a boardchair at a Wisconsin credit union received a $21,305 annual stipendfor working 10 hours a week on board business.

|In addition to Indiana, Pennsylvania, Rhode Island, Maryland andWisconsin, other states – Georgia, Minnesota, Kentucky, Alabama,New Jersey, Nevada and North Dakota – permit state-chartered creditunions to compensate board members, according to list compiled byCUNA. In Nevada and Wisconsin, officers of the board and committeemembers are allowed to receive compensation. CUNA did not listTexas, which permits state-chartered credit unions to pay directorsa fee for attending board meetings, according to the Texas CreditUnion Department.

|Arkansas, Colorado, Idaho, Mississippi, Montana and Vermontallow compensation for only the board treasurer, according toCUNA.

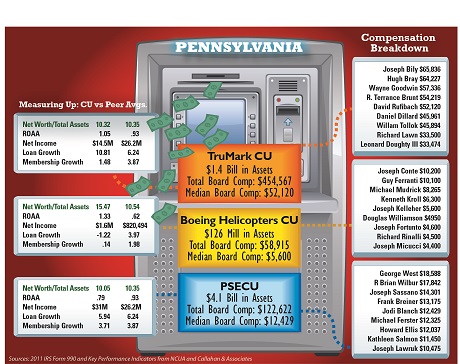

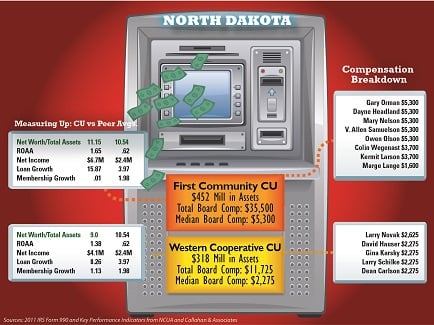

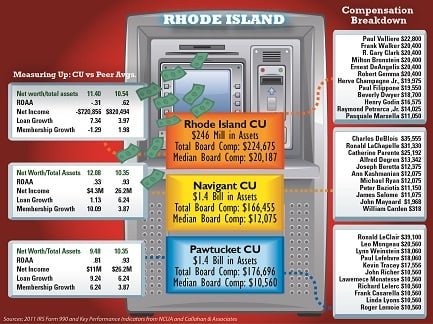

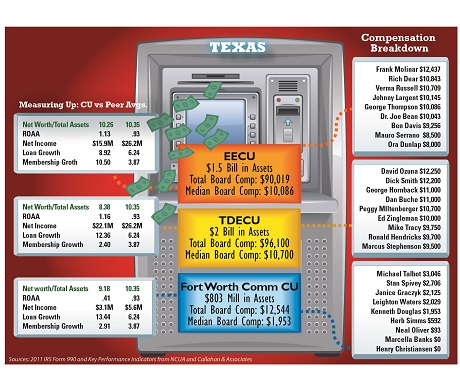

|| For this article, CreditUnion Times compiled charts that list three of the largeststate-chartered credit unions from each state that pay their boardmembers. The charts also review how these credit unions performedfinancially in 2012 compared to their peers to see if they tendedto perform any better, any worse or about the same as credit unionsin their peer group, the vast majority of which do not pay theirboard members.

For this article, CreditUnion Times compiled charts that list three of the largeststate-chartered credit unions from each state that pay their boardmembers. The charts also review how these credit unions performedfinancially in 2012 compared to their peers to see if they tendedto perform any better, any worse or about the same as credit unionsin their peer group, the vast majority of which do not pay theirboard members.

The industry's long-standing debate over whether to pay or notto pay directors has heated up again after state legislators inTennessee and Washington passed legislation in the spring givingstate-chartered credit unions the option to pay board directors.The new laws will become effective in July.

|More states will follow suit with similar laws, predictsLin Hodges, president/CEO of the $1.3 billion Associated CreditUnion in Norcross, Ga., because it's difficult to recruitqualified board members. And some CEOs argue it's only right toprovide reasonable compensation to directors who are spending moretime than ever on credit union business making complicateddecisions and facing increased liability risks.

|But those who favor a volunteer board say it has successfullyworked for decades and exemplifies the credit union difference overbanks. Besides, if credit unions pay board members, it may attractthose who are only serving for the money, they say.

| Credit Union Timesreviewed more than 250 IRS Form 990 documents filed bystate-chartered credit unions in 2011. To maintain their tax-exemptstatus, federal law requires state-chartered credit unions tosubmit an IRS Form 990 annually to report financial and operationalinformation, including compensation of directors and executives

Credit Union Timesreviewed more than 250 IRS Form 990 documents filed bystate-chartered credit unions in 2011. To maintain their tax-exemptstatus, federal law requires state-chartered credit unions tosubmit an IRS Form 990 annually to report financial and operationalinformation, including compensation of directors and executives

The review found that most state-chartered credit unions do notpay board members. But the IRS Form 990s revealed that many creditunions are paying their board members sizeable stipends for workingone to five hours a week on board business, while a few others areworking eight, nine or 10 hours a week.

|Here are a few samplings gleaned from IRS documents.

|In Rhode Island, all nine state-chartered credit unionscollectively paid their 100 board members more than $1 million incompensation in 2011.

|In Pennsylvania, the $1.4 billion Trumark Financial Credit Union in Trevose, Pa., provides itsnine board members with the highest compensation amount in theU.S., paying a total of $452,567. The annual stipends per boardmember ranged from $33,474 to $65,836, with a median compensationof $52,120.

|Eleven board members at the $2.3 billion Teachers Credit Unionin South Bend, Ind., received a total of $356,749, with annualstipends ranging from $8,491 to $93,109. The median compensationwas $22,350.

|The $246 million Rhode Island Credit Union in Providencecompensated its 11 board members with a total of $227,045. Theannual stipends ranged from $11,050 to $22,800, with the medianstipend at $20,187.

|In Maryland, the $2.7 billion State Employees Credit Union inLinthicum paid its board of 10 directors a total of $217,462.Annual stipends ranged from $2,500 to $29,060. The median stipendwas $22,687.

|At the $2 billion Texas Dow Employees Credit Union in LakeJackson, nine board members received a total compensation of$96,150. Annual stipends were from $9,500 to $12,500, with a medianannual stipend of $10,700.

|The seven board members at the $1.3 billion Royal Credit Unionin Eau Claire, Wis., got compensation totaling $83,075, with annualstipends from $8,670 to $21,305. The median stipend was$10,130.

|In Georgia, the 15 board members of the $1.3billion Associated Credit Union in Norcross were collectively paid$76,000, with stipends from $3,000 to $6,000, and a median boardstipend of $5,500.

|The $452 million First Community Credit Union in Jamestown,N.D., paid its eight board members a total of $35,500, withstipends from $1,600 to $5,300 and a median annual stipend of$5,300.

|And in Minnesota, the nine board members of the $559 millionPostalCredit Union in Woodbury received a total compensation of$12,876, with stipends that ranged from $650 to $1,874 and a medianannual stipend of $1,479. The state's largest credit union, the$3.9 billion Wings Financial, only paid its board chair, MichaelCooper, a $12,000 stipend in 2011. The other five directors did notreceive compensation.

|Credit unions in Pennsylvania and Maryland, as well as a few inTexas, Indiana and Wisconsin, paid their board members highercompensation levels than credit unions in Georgia, Minnesota andNorth Dakota. In Alabama, Kentucky and New Jersey, very few creditunions paid board directors, with compensation ranging from a fewhundred dollars to $7,000 annually.

|These stipend totals, however, do not include compensationcredit unions paid to credit and supervisory committee members. TheIRS does not require credit unions to report committee members'compensation because they do not vote on board business.

|Some credit union professionals criticized compensation paid toboard members in Pennsylvania, Rhode Island, Indiana, Wisconsin andMaryland, arguing the stipends were far too high and questionedwhat credit unions were getting in return for these sizeablestipends.

|“What value are you getting from a board member for $12,000?”asked Richard Odenthal, president/CEO of the $718 million Central Minnesota Credit Union in Melrose. “Paying boardmembers $100 a meeting is not outlandish, but paying a board member$12,000 a year? Then someone may ask what are you doing for thatamount of compensation?”

|Central Minnesota does not pay its board members though it'sbeen discussed from time to time.

|“From my perspective as a CEO, if you compensate them, will youget people who are just in it for the money?” Odenthal asked. “Ihave worked in the banking world too, and I've seen how that works.Sometimes those [paid board positions] are patronage positions morethan anything else.”

|Klotz of Community Choice CU questioned what those credit unionsare getting in terms of time commitment and expertise thatjustifies that kind of money.

|“They must be spending an awful lot of time on credit unionactivities,” he said. “But you have to ask, what are they doing?Are they functioning as a board or are they functioning as supermanagers?”

|Most of the credit unions in their IRS 990 forms reported boardmembers, on average, work one to four or five hours a week on boardbusiness. A few other credit unions reported board members workedeight to 10 hours a week.

|Of the 26 CEOs at credit unions that pay board members contactedby Credit Union Times, eight agreed to interviews. The other CEOseither declined an interview or did not respond to interviewrequests.

|The CEOs interviewed said their boards are made up ofprofessionals such as small business owners, certified publicaccountants, lawyers, executives, real estate developers, insurancebrokers and doctors who leverage their expertise and talents thatkeep the credit union financially sound and help it grow.

|Details of what the CEOs had to say will appear next week inpart two of this article.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.