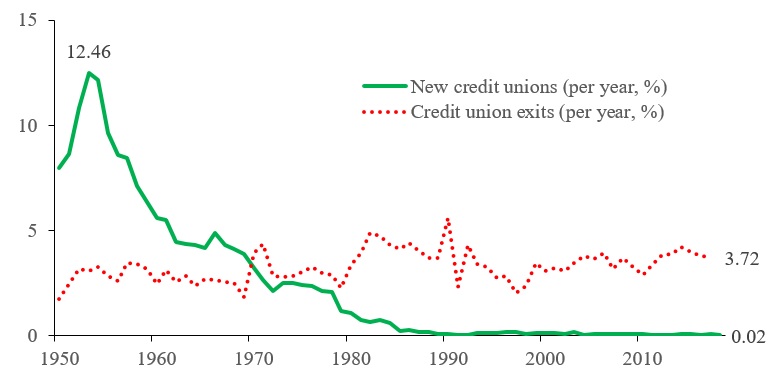

Figure 1: New credit unions and credit union exits, 1950 to 2018. Source: Filene Research Institute

Figure 1: New credit unions and credit union exits, 1950 to 2018. Source: Filene Research Institute

Consolidation in the credit union system is no longer simply a trend – it's a truism. The numbers are so familiar as to risk cliché: From a peak of more than 23,000 in 1969, the number of credit unions dropped to around 5,600 in 2018 – a decrease of 76% – even as the number of members continued to grow alongside system assets. Most of this consolidation was the result of voluntarily mergers, but the vast majority of credit unions that were "merged away" were small, totaling less than 10% of the total credit union system assets. There were over 10,000 credit unions with less than $1 million in assets in 1979 and about 250 in 2018.

Continue Reading for Free

Register and gain access to:

- Breaking credit union news and analysis, on-site and via our newsletters and custom alerts.

- Weekly Shared Accounts podcast featuring exclusive interviews with industry leaders.

- Educational webcasts, white papers, and ebooks from industry thought leaders.

- Critical coverage of the commercial real estate and financial advisory markets on our other ALM sites, GlobeSt.com and ThinkAdvisor.com.

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.