Lenders are always challenged with finding innovative ways to grow their portfolios. As the appeal of broad-market direct marketing dwindles in our highly competitive marketplace, lending institutions are moving to more-targeted acquisition strategies by leveraging a deeper understanding of a member's lifetime value.

Lenders are always challenged with finding innovative ways to grow their portfolios. As the appeal of broad-market direct marketing dwindles in our highly competitive marketplace, lending institutions are moving to more-targeted acquisition strategies by leveraging a deeper understanding of a member's lifetime value.

A key component of this effort is defining and quantifying loyalty—a concept that is easy to understand in theory but quite hard to isolate and measure in practice. TransUnion has performed several studies in the past that successfully quantified loyalty as a function of the number of relationships a member has with a given lender—also called on-us relationships. Our most recent study is our broadest yet, using a large sample of both DDA (share draft and savings) and credit data from two contributing lenders. This study is an attempt to further quantify loyalty along a number of distinct dimensions and to explore its value as an incremental risk assessment tool.

As a starting point, we looked at loyalty in terms of the number of relationships between the member and the financial institution. Consistent with earlier studies, we found that there was a positive relationship between credit performance and the number of on-us accounts—credit or deposit—held by a member, even when controlling for credit score. We also found that the inclusion of DDA accounts to derive the total number of on-us relationships validated a broadly accepted and intuitive fact: DDA members generally present less risk than non-DDA members.

Recommended For You

However, a more granular view of the DDA population can yield even greater risk differentiation. For example, a segmentation of members based on DDA balance showed that while higher balances were strongly correlated with lower risk, members in the lowest DDA balance tiers were significantly riskier than those who did not have a DDA relationship on-us at all. This relationship appeared to be stronger still when measured relative to the size of the credit card balance of the member. These more in-depth views of deposit data can significantly enhance an institution's understanding of member value and improve its risk assessment.

In addition to looking at loyalty as a static measure, our study explored the value of historical relationships along two additional dimensions: sequential loyalty and tenure.

In addition to looking at loyalty as a static measure, our study explored the value of historical relationships along two additional dimensions: sequential loyalty and tenure.

(Click image at left to see expanded version)

We found that sequential loyalty—which looks at the number of relationships that a member has had with a financial institution within a given product type (think consecutive auto loans)—was a good predictor of risk for closed-end loans.

This effect was strong at differentiating on-us risk but negligible at influencing off-us risk, which indicated that sequential loyalty is not merely a proxy for credit experience with high-end products but rather a genuine measure of loyalty. In the case of tenure, as expected there was a positive relationship with credit performance, but interestingly enough that relationship weakened significantly once we controlled for credit score.

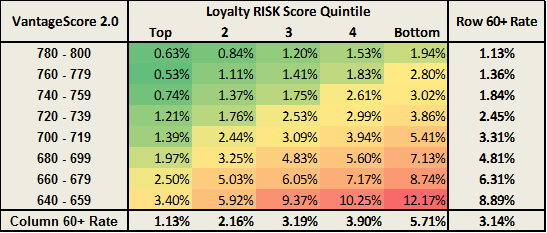

To synthesize these findings into an analytical solution with practical applications, we built a loyalty-based credit risk score. This model captured a number of the different dimensions of loyalty and proved an outstanding complement to standard measures of risk assessment. As the dual score matrix in Table 1 illustrates, a loyalty-based score can provide a high degree of risk differentiation even within narrow bands of a traditional credit risk score.

The ability of the two scores to complement each other in the estimation of risk creates a number of opportunities for strategic applications. For example, a lender interested in increasing the wallet penetration of its existing portfolio may use loyalty drivers to fine-tune its pricing tiers for top-scoring members and entice greater card use through rate reductions. Loyalty is a complex dynamic that can be easily confounded with other effects. Fortunately, our study finds that loyalty can successfully be identified, quantified and employed as a strong differentiator of credit performance—one that is inadequately captured today by standard risk assessment tools.

Ezra Becker is a vice president of research and consulting for TransUnion.

Contact

[email protected] or 312-985-2999

Antoni Guitart is a vice president of research for TransUnion.

Contact

[email protected] or 312-985-2999

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.