Money is flowing out of banks and into credit unions, especially from Bank of America and especially into bigger credit unions.

That's according to Andera Inc., a Rhode Island-based provider of online account opening and switch kit technologies to more than 500 credit unions and banks.

That role puts Andera and companies like it in a position to see the money move, and it indeed did up to and on Bank Transfer Day.

“At Andera, because we've got a representative sample of the nation's financial institutions as clients, we're kind of like the National Earthquake Information Center for events like these,” said its chief marketing officer, Bob Chatham.

“It looks like a few people actually put down the remote over this past weekend and did move some money. Not on an oh-my-God-the-world-is-a-dramatically-different-place-afterwards scale, but kind of like a 4.5 magnitude earthquake in Virginia. You feel the shudder, and people are talking about it,” Chatham said.

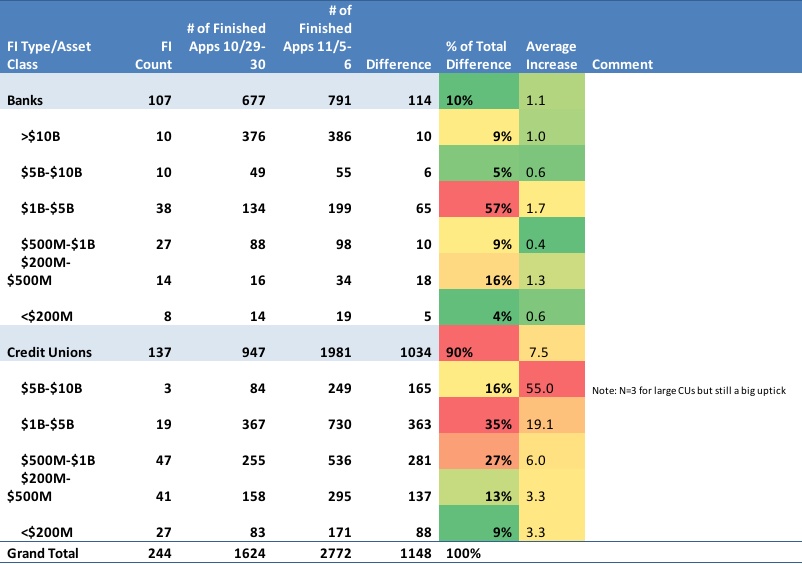

Chatham said Andera's client credit unions saw an average of 7.5 opened accounts over the weekend, with $500 million to $1 billion credit unions averaging six new accounts, billion-dollar and up CUs all recording at least 19 new openings and $5 billion plus credit unions averaging 55 new accounts.

The Andera executive added, “We don't have any of the truly large demonized institutions as clients — B of A, Wells, Citi — so most of our bank clients saw effectively no change or minor drops in their average online account opening volumes between the two weekends.”

Meanwhile, Andera can track where the money is coming from, at least through the widely used ACH channel.

“Our credit union clients continue to take an increasing share of their ACH transfers from BofA, with the last four weeks averaging north of 20% up from around 10% of transfers during the summer,” Chatham said, noting a particular spike when the now-rescinded $5 a month debit fee was announced.

He also noted that the average ACH transfer from Bank of America has been $750 since July, compared with $114 for large regional banks.

“The amount transferred into CUs is trending up; the amount out of banks is relatively flat. The fact that the BofA value is higher into CUs might indicate that people are closing the account since they're moving a larger sum of money out of it, but we can't prove that,” Chatham said.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.