The Republican proposal to cap mortgage interest tax deductions at $500,000 in principal is three times more likely to hurt homeowners in Democratic-leaning counties than in counties where more voted for Donald Trump, according to an analysis of data from ATTOM Data Solutions and others.

Republicans unveiled their tax bill last week. Its call for a reduction in the home mortgage interest deduction brought immediate criticism from home builders and others. The House Ways and Means Committee begins considering amendments this week.

ATTOM Data Solutions of Los Angeles counted the number of mortgages exceeding the $500,000 cap in 2,294 of the nation's 3,141 counties. ATTOM found 325,286 originations so far this year for these large mortgages, or 5.4% of the 6.1 million total.

The political effect is seen by pairing the ATTOM data with a county-level election dataset of 3,141 counties compiled by The Guardian, a British newspaper, and townhall.com, a conservative website. The two data sets matched for 2,294 counties, accounting for 93% of the total presidential vote.

In the 424 counties where more votes went to Hillary Clinton than to Donald Trump, mortgages worth more than $500,000 accounted for 261,842, or 7.7%, of the total 3.4 million purchase and refinance mortgages.

In the remaining 1,870 counties where more votes went to Trump, only 63,444, or 2.4%, of the 2.7 million mortgages were over $500,000.

A homeowner with a mortgage over $500,000 was twice as likely to live in a “blue” state than a “red” one. The 23 states with a Clinton plurality had 223,024, or 69%, of the nation's large mortgages.

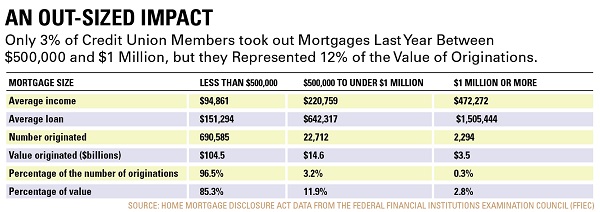

Credit unions have a slightly lower proportion of big mortgages nationally. Home Mortgage Disclosure Act (HMDA) origination data for 2016 shows mortgages of more than $500,000 accounted for 3.5% of the number of owner-occupant, single-family mortgages, and 14.7% of their value.

Mortgage interest deductions now stop after the first $1 million of home loans. Republicans propose lowering the cap to $500,000.

The proposed tax increase affects only the amount exceeding the cap. So a homeowner with a $1.3 million mortgage now gets tax deductions on $1 million of that loan and $300,000 is excluded. If changed, the homeowner would deduct based on $500,000 and $800,000 would be excluded.

Based on last year's credit union originations, the current law excludes about $1.2 billion in credit union mortgage value beyond the $1 million cap.

With the cap lowered to $500,000, an additional $4.4 billion would be excluded from deductions for those with loans of $500,000 to $1 million.

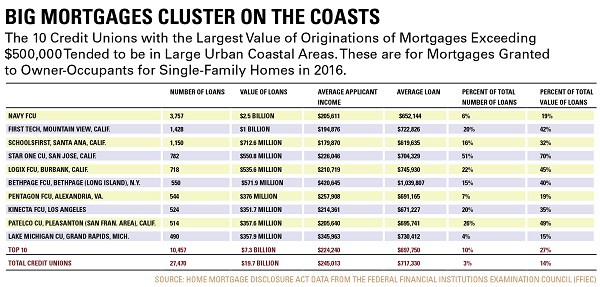

The 10 credit unions that granted the largest amount of mortgages exceeding $500,000 accounted for 37% of the loan value for single-family homes to owner-occupants last year, according to HMDA data.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.