If one thing has become glaringly evident in this long-running election season, it's the broad discontent among Americans about their financial circumstances. The sentiment is notably strong among those at greatest risk to the vicissitudes of the economy and the markets because of their nearness to retirement — baby boomers.

According to a new study from the Insured Retirement Institute, “Boomer Expectations for Retirement,” a sixth annual update on the group's retirement preparedness, financial concerns among America's 76-plus million boomers are significant and rising. The fragility of their financial condition was apparent in a range of questions posed by IRI, from whether they'll have to cover healthcare expenses in retirement to their ability to provide for surviving family members after their passing.

The trend line is clear in a core measure of the survey: Economic satisfaction. As the study shows, this has dropped sharply since 2014. This year, just 43% of boomers say they're happy with their lives from an economic vantage point, down from 65% in 2014 and 77% in 2013.

A key reason for the precipitous dip: Fewer boomers are confident in their future and ability to manage their finances. These drivers of economic satisfaction, the report notes, have “fallen almost continuously” since IRI's inaugural report on boomer retirement expectations in 2011.

The drop isn't limited to boomers. According to a recent IRI report, just more than six in 10 (64%) of GenXers are content with their lot, down from 83% five years ago.

Conversely, a growing number of boomers are planning to retire later. More than one in four boomers (26%) intend to leave the workforce at age 70 or later, up from 17% in 2011. A larger group (33%) plans to retire between the ages of 65 and 69, up from the 26% IRI reported in 2011 and 2012. Again, financial confidence — or lack thereof — underpins the trend.

“Confidence [among boomers] in having enough money to live comfortably throughout retirement, that they are doing a good job preparing financially for retirement, and that they will have enough money for health care expenses and long-term care, have all fallen,” the report stated. “These drops in confidence are likely directly related to a lack of planning and growing uncertainty about the future, as well as lower retirement savings and increased concern about retirement expenses.”

This concern is mirrored in boomers' reduced confidence relative to prior years as to whether they:

- Will have enough money to last throughout retirement: (24% in 2016 vs. 27% in 2015);

- Are doing well financially preparing for retirement (22% vs. 25%);

- Will have enough money for healthcare expenses in retirement (27% vs. 28%); and

- Will have enough money to pay for long-term care expenses (16% vs. 19%).

Departing from the downward trend, a marginally higher percentage of boomers surveyed this year said they will be “more financially secure” than their parents in retirement (37% in 2016 vs. 36% in 2015). This year's result also matched that of 2011, though it is down from 2012 (41%).

How might they have better prepared for retirement? Most of the boomers polled in 2016 said they should have started saving earlier (64%). Likewise, a majority agreed that they should have saved more (62%), though fewer than one in five (17%) acknowledged they should have maximized employer plan benefits.

In each of these areas, the help of a financial services professional could have made a difference. Yet just over a quarter of boomers (27%) sought the assistance of an adviser. Among those doing without one, fewer than four in 10 (39%) endeavored to calculate how much they would need in retirement.

Rules of thumbs used for making such determinations (e.g., saving 10% or 15% of one's income) often prove inadequate when a wild card enters the mix: Out-of-pocket healthcare expenses in retirement. This number can vary widely, depending on the individual's health status, insurance coverage and lifestyle.

A majority of boomers surveyed this year (51%) pegged the cost of healthcare as a percentage of income at between 10% and 30%. This is down from 57% in 2015 and 60% in 2014.

Smaller percentages estimated the cost at 10% or less (30% in 2016, down from 21% in 2015) or more than 30% of their income (19% in 2016 vs. 22% in 2015).

Whatever the actual price tag, a lot of the boomers polled could have a tough time meeting post-retirement healthcare expenses given their current financial difficulties.

“Most notably, 30% of boomers have stopped contributing to their retirement accounts, have found it more difficult to pay mortgages or rent, and have postponed plans to retire — all higher than in recent years,” the report stated. “And almost twice as many have taken premature withdrawals from retirement accounts.”

“While premature withdrawals are not as common as in 2011, this was trending down prior to spiking this year,” the report added. “With large numbers of working boomers so close to retirement, this is a worrisome development.”

The survey also revealed that:

- Sixteen percent of boomers believe they will be able to pay for the cost of long-term care, down from 24% in 2012.

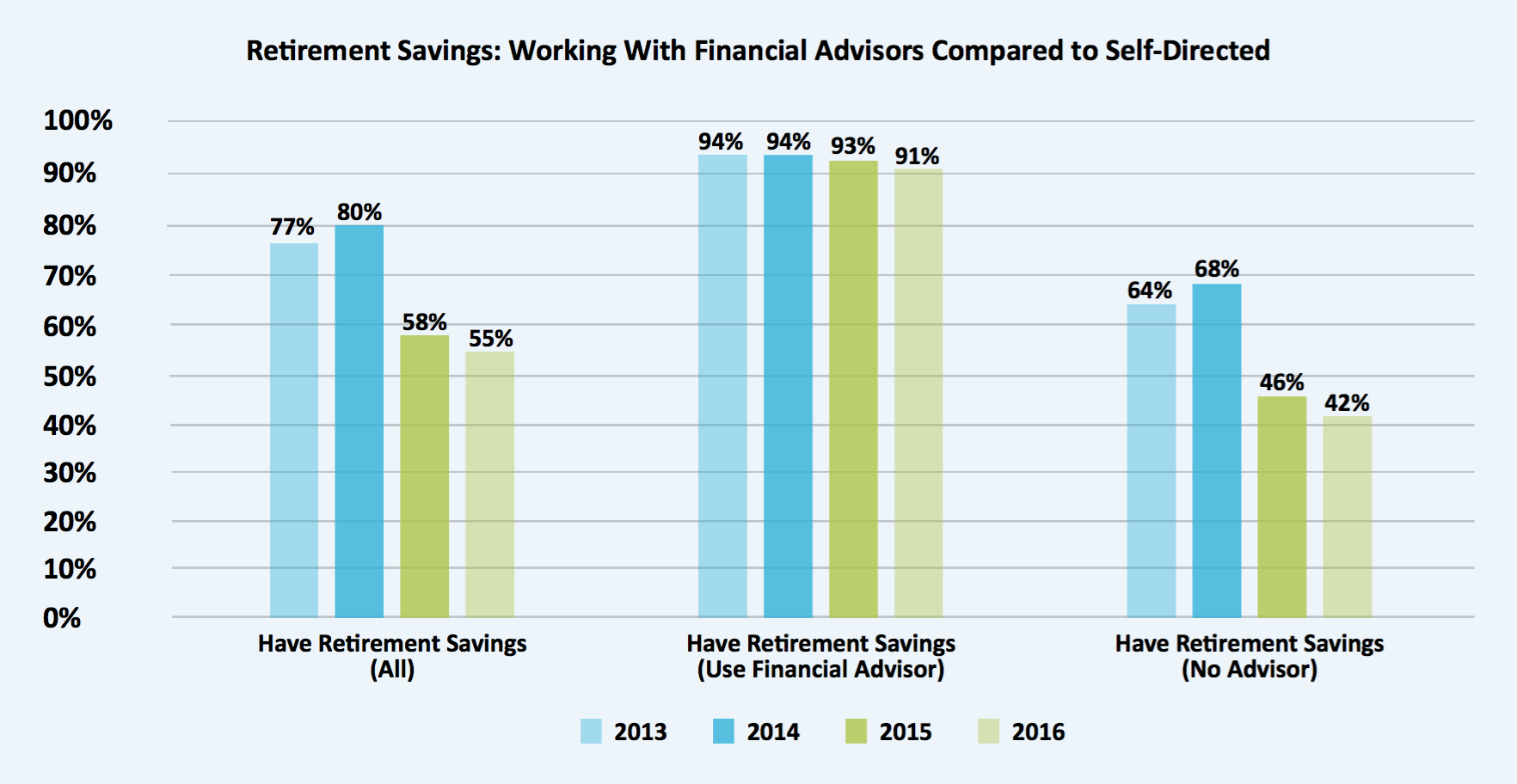

- Only 55% of boomers have money saved for retirement, down from 58% last year and from more than three in four in prior years.

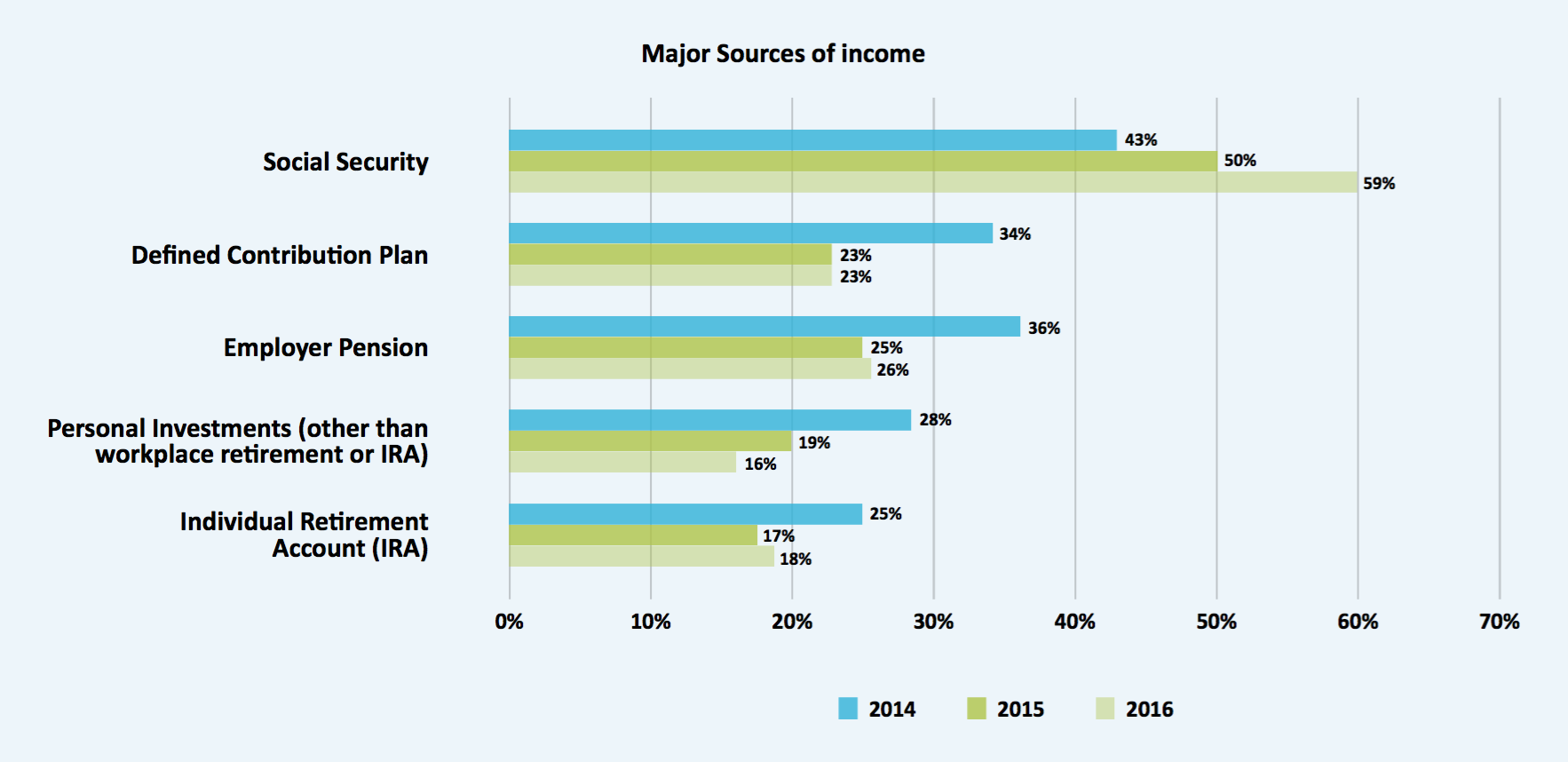

- Boomers citing Social Security as a major source of retirement income jumped to 59%, versus 42% five years ago.

- Only one in four boomers expect significant income from an employer-provided pension. Those citing defined contribution plans as a major source of income dipped to 23% in 2016 from 34% in 2014.

- Sixty percent of boomers believe their retirement income will cover basic expenses and some travel and leisure, yet only 55% have retirement savings.

See the bar charts beginning on the next few pages for additional highlights from the IRI study.

As this chart shows, more boomers this year than in 2015 or 2014 envision Social Security as a major source of retirement income. Conversely, fewer of those who IRI polled believe that defined contribution plans, employer pensions, individual retirement accounts or other personal assets will serve as significant sources of income.

As this chart shows, more boomers this year than in 2015 or 2014 envision Social Security as a major source of retirement income. Conversely, fewer of those who IRI polled believe that defined contribution plans, employer pensions, individual retirement accounts or other personal assets will serve as significant sources of income.

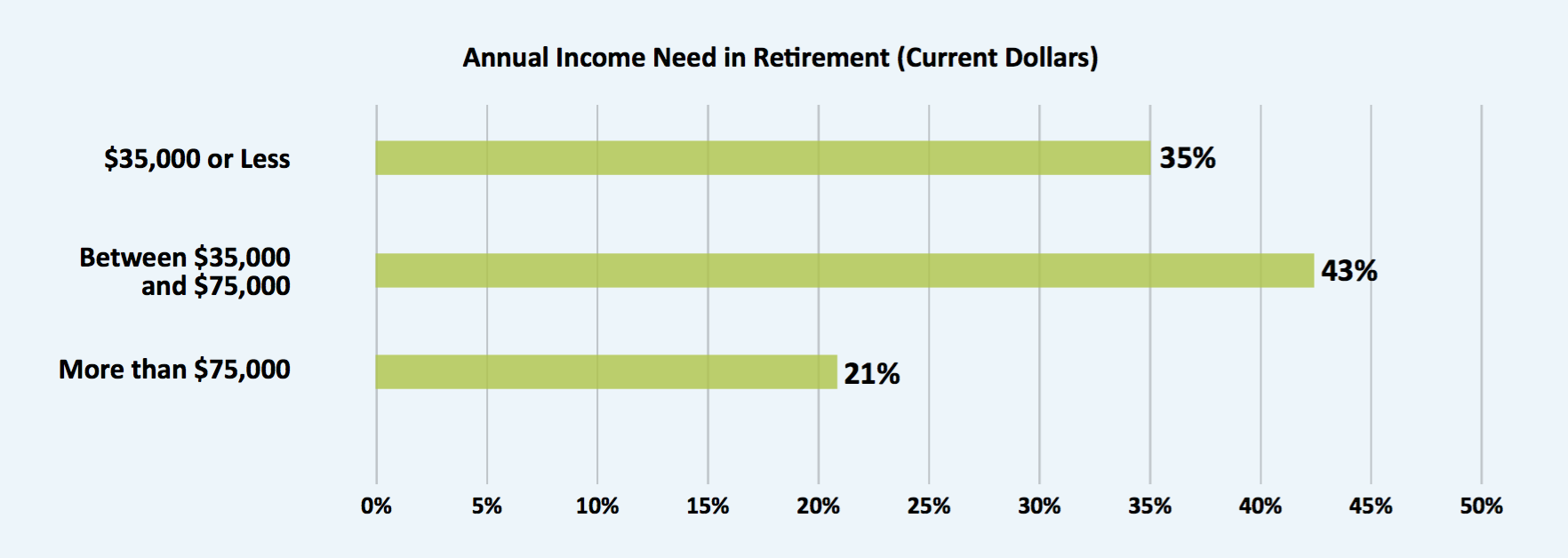

The study's authors described boomers' estimates regarding total retirement income needs as “somewhat accurate.” More than six in 10 (64%) pegged the dollar amount at $35,000-plus. Actual average expenses in 2013 for the ages 65 to 74 totaled $46,757.

The study's authors described boomers' estimates regarding total retirement income needs as “somewhat accurate.” More than six in 10 (64%) pegged the dollar amount at $35,000-plus. Actual average expenses in 2013 for the ages 65 to 74 totaled $46,757.

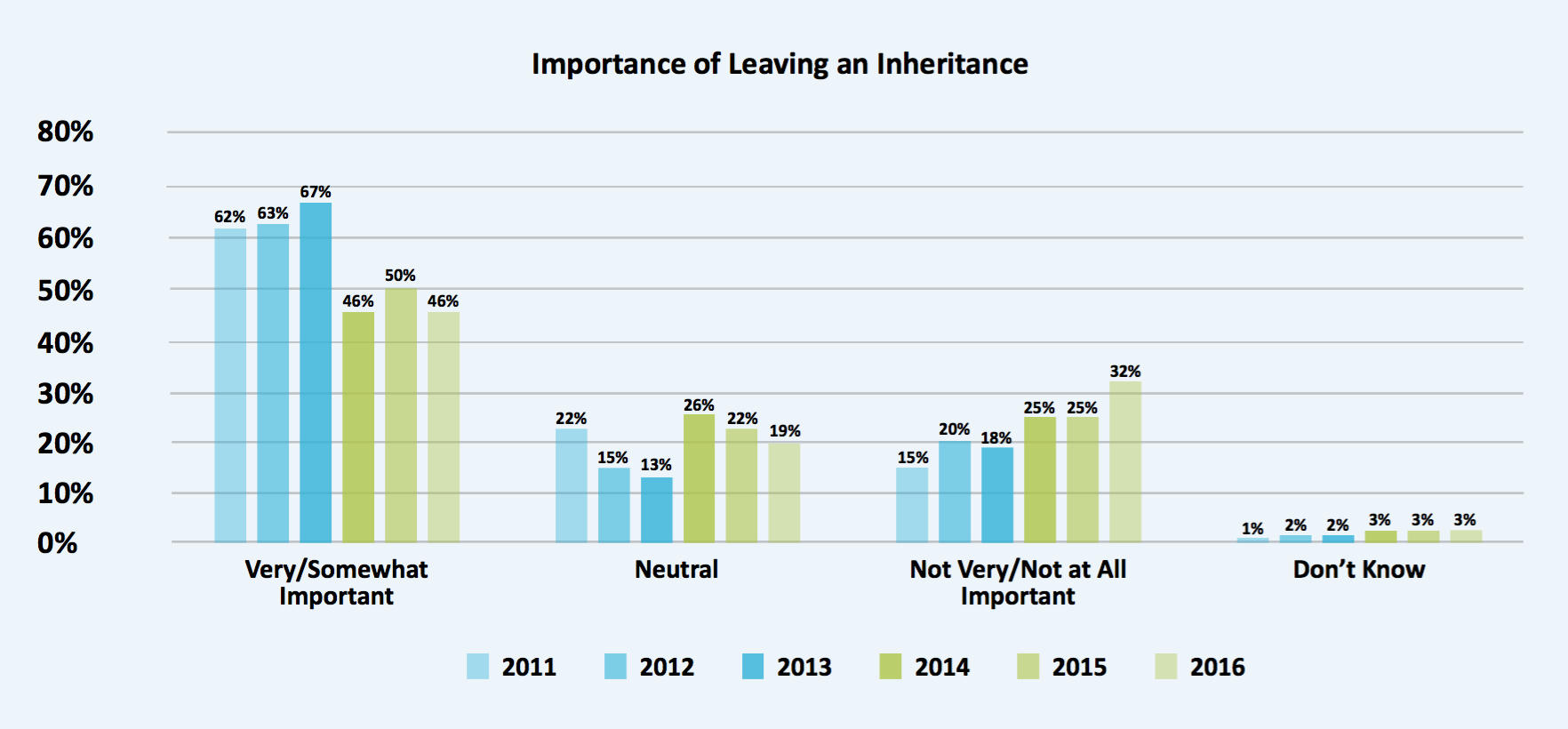

As to leaving to an inheritance for surviving family members, a sizable minority of boomers polled in 2016 (46%) said this is “very or somewhat important.” But the number has been declining. As recently as 2013, two-thirds of boomers ranked bequest as a moderate to high priority.

As to leaving to an inheritance for surviving family members, a sizable minority of boomers polled in 2016 (46%) said this is “very or somewhat important.” But the number has been declining. As recently as 2013, two-thirds of boomers ranked bequest as a moderate to high priority.

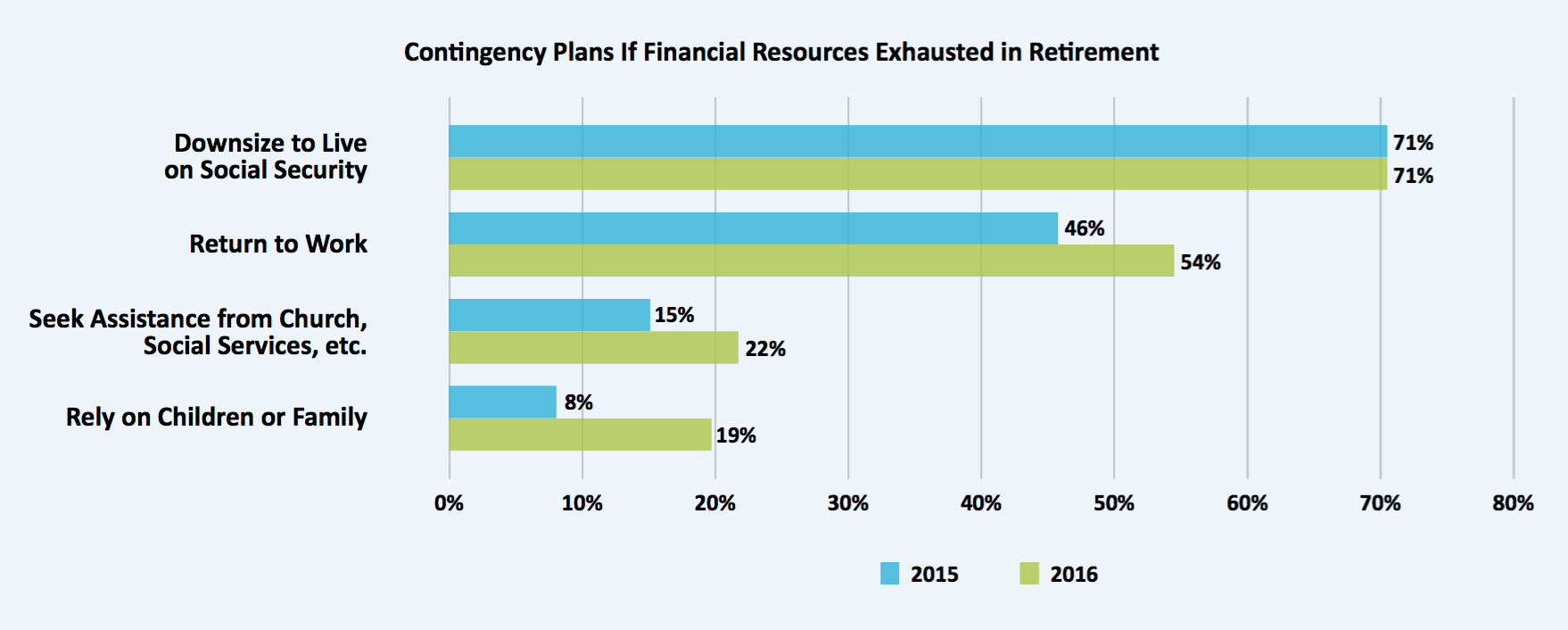

Should their nest eggs run dry, a large majority of boomers (71%) said they would “downsize to live on Social Security,” the same percentage as in 2015. Others would return to work, seek outside assistance or turn to family members.

Should their nest eggs run dry, a large majority of boomers (71%) said they would “downsize to live on Social Security,” the same percentage as in 2015. Others would return to work, seek outside assistance or turn to family members.

Boomers stand a better chance of avoiding these outcomes by working with a financial adviser. As this chart shows, more than nine in 10 of those surveyed between 2013 and 2016 had retirement savings. This contrasted with declining percentages among those without an adviser: This year, just 42% could lay claim to a nest egg.

Boomers stand a better chance of avoiding these outcomes by working with a financial adviser. As this chart shows, more than nine in 10 of those surveyed between 2013 and 2016 had retirement savings. This contrasted with declining percentages among those without an adviser: This year, just 42% could lay claim to a nest egg.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.