When CU Times broke the news that the CFPB issued a bulletin warning banks and credit unions that if they fail to meet accuracy obligations when reporting negative account histories to credit reporting companies, the result could be bureau action, readers had plenty to say.

The bulletin stated banks and credit unions must have systems in place to ensure accuracy when they pass on information, such as negative account histories, to checking account reporting or other credit reporting companies.

“The Consumer Financial Protection Bureau is in a unique position to make a difference in improving how the checking account reporting system actually works,” Cordray said. “We are the only federal financial regulator with the authority to supervise both the larger depository institutions and the larger consumer reporting agencies for compliance with federal consumer financial law. Thus we can consider and address these issues comprehensively, engaging directly with both sets of industry participants.”

Readers were quick to point out the potential challenges created by the latest bulletin and discussions turned to whether the CFPB's authority was too overreaching.

Here's a look at what readers had to say online and across our social media channels:

CFPB to Credit Unions: Checking Reporting on Our Radar: Director Cordray says FIs may face bureau action if they do not report accurate account information to credit reporting companies.

CFPB to Credit Unions: Checking Reporting on Our Radar: Director Cordray says FIs may face bureau action if they do not report accurate account information to credit reporting companies.

I have worked for 3 different credit unions over my career. Not one of them, or the dozens where I know other execs, ever tries to report anything other than accurate information. This just one more example of the CFPB's ever expanding search for a non-existent problem where it hopes to find one poor institution and slap it with a huge fine.Given today's news about discrimination within the CFPB maybe Director Cordray should spend some time looking inside his building.

~BillyBobJim

Well said BillyBobJim! The CFPB needs to back down and quit trying to protect consumers from themselves. Consumers need to be educated and be able to balance their finances. This agency is going to put so much burden on institutions, it will eventually affect smaller organizations. Our CU would never intentionally report inaccurate information. It could happen, but never intentionally…

~Scott G

I have worked at a credit union for 21 years. We have extremely low fees of $8 for overdrafts and have tried to help many members who can't seem to handle a checking account. The point is they need to want the help and put forth the effort. Past history is a great indicator of behavior and should be reported accurately. Consumers already have the right to dispute anything that may be inaccurate in their credit and they continue to dispute things that are correctly reported, trying to clean up messes they created, not errors made by financial institutions. Consumers don't like consequences even if their own actions have created them. There are still benefits of having a savings account, which we will always offer unless the member causes a loss to us. Some services & privileges should not be available to members who cannot handle a checking account. That decision is often good for the consumer.

~Lesley

Cordray says “Consumers should not be sidelined out of the basic banking services they need because of the flaws and limitations in a murky system,”.Murky?What a clown. Is this the best we can do in this country?

~Greg

8 Checking Accounts That Don't Overdraft: Check out no-overdraft account benefits, terms and fees offered by these financial institutions.

8 Checking Accounts That Don't Overdraft: Check out no-overdraft account benefits, terms and fees offered by these financial institutions.

Interesting read, but I did notice that many of these FI's are Big Banks that makes millions in fee income every year. Lucky them, they can offer one product that might not generate income. One thing they are missing is personal service. As a very tiny credit union with one location, we attract members that need to be 'coddled' a bit more than a bank can handle. We have many members that still do not use a computer. We have members who stop by several times a week to chat about their lives and get financial advice. We give loans to members with low FICO scores and we have many members that have 'just a debit card', but we are not a 'live' credit union. We still process in daily batches. This means they can use that card at the grocery store, then drive down to the credit union and take all that cash out. When the transaction hits the next morning, the money is gone. If they opt-out, we still can't charge them any kind of fee. They weren't denied at point of sale, because the money was there at that time. How is this our fault again? I guess I should just be grateful that we have such a loyal group of members who have decided that knowing us as well as we know them is more important than having all the latest, greatest gadgets and products out there.

~Ellen Drollette

Cordray Clarifies CFPB Overdraft Intentions : During an NCUA-hosted webinar, Richard Cordray says the bureau wants credit unions to offer members more options.

Cordray Clarifies CFPB Overdraft Intentions : During an NCUA-hosted webinar, Richard Cordray says the bureau wants credit unions to offer members more options.

Maybe the CFPB should consider that the source of the problem isn't just in the products, but the education behind using the products. Should financial institutions make available products that don't take advantage of the consumers/members? Absolutely. Should the users of these products have a basic understanding of how money works? Basic logic says yes. Sadly, I feel that the CFPB would say it doesn't matter. Treat the source of the problem, don't put a Band-Aid over it.

~David Murphy

By the way, an account can go negative because the member deposits a bad check and removes the funds before the NSF deposit returns to the credit union. And NSF fees on checks/ACH debits can take the account negative. If CFPB limits fees on courtesy pay, then the limit is placed on NSF fees because of Reg Z. Cordray did not understand that yesterday when asked.

~JustAPlayer

Since when does he feel it isn't his place to overrule Congress? Cordray is running his own little fiefdom and promoting his own anti-business agenda. This has nothing to do with protecting consumers and, in fact, most of his rule making has hurt consumers by limiting choice and eliminating competition. The CFPB must go away. I can't wait until a new administration comes in and sends him back into the real world.

~BillyBobJim

Would someone please explain to me what a checking account that can't go into the negative is? If you don't allow it to go into the negative, then doesn't that mean you return checks? If you return them, the member gets hit with a huge fee from the payee and possible legal action. I understand a prepaid card that doesn't work when you run out of loaded funds, but once you give a member a box of checks, they can keep on writing them with or without money. Just looking for a little clarification on this.

~Ellen Drollette

Ellen, here's an example: http://www.cutimes.com/2014/12… This is the sort of thing Cordray would like offered to consumers as an option. I realize your credit union may not be able to offer it, but at this point it's only a suggestion. If it became a rule, your asset class would probably be exempted. I'm sure the CFPB would like your feedback on that!

~Heather Anderson

I think this type of card is a great idea Heather! When I was in college I saw countless friends overdraft and struggle with the fees. Great option for young people.

~Brandon Hord

I agree Brandon. It would not only be helpful for students, but also for anyone who struggles to earn enough to cover his/her expenses, or for freelancers who don't get paid on a regular basis.

~Heather Anderson

We already offer this. They still overdraft because the electronic payments hit and there is no money in the account. What am I missing?

~Ellen Drollette

A prepaid debit card. Great from CFPB perspective. Lousy from FinCEN perspective. Unless you have strict controls on depositing into account. My CU only allows the employer to put in funds. Limits AML issues. I really don't want to be in the middle of a CFPB v FinCEN battle.

~JustAPlayer

Electronic payments can still bounce if there is no money in the account.

~Ellen Drollette

Ellen Townsend Brown Because an overdraft without some sort of fee is an interest free loan. Is that fair?

Ellen Townsend Brown Because an overdraft without some sort of fee is an interest free loan. Is that fair?

Mary Babst Vedros Exactly!

Mary Babst Vedros Exactly!

Credit Union Times Credit unions shouldn't have to provide free overdrafts. However, members have been asking for accounts that don't go negative. I think if credit unions were to offer an account that only allowed real time, instant approval access and didn't go negative, it would be popular.

Credit Union Times Credit unions shouldn't have to provide free overdrafts. However, members have been asking for accounts that don't go negative. I think if credit unions were to offer an account that only allowed real time, instant approval access and didn't go negative, it would be popular.

Tammy Doles-Roberts Isn't there a law that you aren't supposed to write checks when there are no funds to back it up? The fee is “just” and if you don't write or promise payments for funds you don't have you wont pay a fee-problem solved.

Tammy Doles-Roberts Isn't there a law that you aren't supposed to write checks when there are no funds to back it up? The fee is “just” and if you don't write or promise payments for funds you don't have you wont pay a fee-problem solved.

Credit Union Times If it's such a weighty legal violation, why allow it? Given the popularity of debit cards, ACH and other electronic transactions that require balance approval, credit unions should even have to take that risk. Young members don't use or want to use checks. They'd rather be denied at POS than pay an overdraft fee. Why not offer that as an option? Members are happy and credit union risk is reduced. I don't understand why that's so difficult. Please tell me what I'm missing because other financial services providers already offer it and are stealing CU market share.

Credit Union Times If it's such a weighty legal violation, why allow it? Given the popularity of debit cards, ACH and other electronic transactions that require balance approval, credit unions should even have to take that risk. Young members don't use or want to use checks. They'd rather be denied at POS than pay an overdraft fee. Why not offer that as an option? Members are happy and credit union risk is reduced. I don't understand why that's so difficult. Please tell me what I'm missing because other financial services providers already offer it and are stealing CU market share.

Jason Ford Balancing a check book isn't algebra. It's 2nd grade math.

Jason Ford Balancing a check book isn't algebra. It's 2nd grade math.

Candice Reed I love this. My CU charges $27. I should feel lucky.

Candice Reed I love this. My CU charges $27. I should feel lucky.

Sarah Snell Cooke My credit union offers a line of credit tied to your checking account, and charges something like 7% interest so if you use it for a couple of weeks it's only a few pennies to the member. Also it only covers checks not point of sale, however you can transfer funds from the LOC before exceeding your funds. I think it's a very reasonable system.

Sarah Snell Cooke My credit union offers a line of credit tied to your checking account, and charges something like 7% interest so if you use it for a couple of weeks it's only a few pennies to the member. Also it only covers checks not point of sale, however you can transfer funds from the LOC before exceeding your funds. I think it's a very reasonable system.

David LeNoir Sr. This is such a simple solution–are you sitting down? If you want to borrow money from your credit union–and can't wait for an approval to do so–just write a check and pay $25 for the convenience. If you don't want to borrow the money, just put your debit card or checkbook away until you have the available funds. Be responsible. You choose–it is not someone else's fault that you chose to borrow the money. If you give a dance, you have to pay the band.

David LeNoir Sr. This is such a simple solution–are you sitting down? If you want to borrow money from your credit union–and can't wait for an approval to do so–just write a check and pay $25 for the convenience. If you don't want to borrow the money, just put your debit card or checkbook away until you have the available funds. Be responsible. You choose–it is not someone else's fault that you chose to borrow the money. If you give a dance, you have to pay the band.

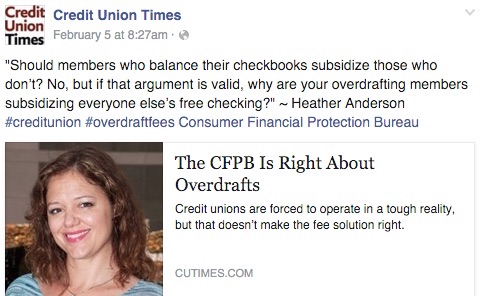

Thought provoking, but short on solutions.

Thought provoking, but short on solutions.

Rich Losea

Every one should pay their owe way. People of modest means don't want a subsidy, they want a fair shake. Many people have left traditional financial services relationships because the were abused! This is both a bank and credit union problem. With technology the group of people who have be force to a refused to be banked category and are not prey for check cashers and money lenders should be brought back to the financial services industry by offering idiot proof relationships that don't penalize people for an inability to balance a checking account. The technology presently is here where checks can be cashed and put into an account with online debit to prevent overdraft. Bill pay would reduce fund available immediately on authorization. The greatest hypocrisy in the modern credit union industry is their commitment to improve the lives of people of modest means. The technology is out there with very few credit unions attempting to adopt it.

Bill Brooks

Credit unions by their very nature are built on subsidizing. In the old days, the borrowers subsidized everyone. The spread on loans and shares was sufficient to cover expenses. (Remember single-rate financing before risk-based lending?) That hasn't been true for some time. So… now we play the fee game. In today's market, it it impossible to fee members for the services everyone else is providing for free. Enter “the marketplace”. In today's marketplace, fees for overdrafts cover more than 100% of net income. Funny, thing though, it's all in the member to control. Believe it or not, most members don't balance their checkbooks (with all the auto-debits/credits and two folks hitting the debit card and no one sharing their purchases — is it any wonder?). They can control their behavior, not the cu. You want to buck the marketplace? Who's your merger partner?! You're going down if you don't fee. And, no one wants to go back to the old way before O/D. How bad was that?!

Gregg Stockdale

Isn't it the members who overdraft that cover the hefty expense of offering checking accounts to those who do not??

Mina Worthington

Ms. Anderson stirs the Inequality pot, yet offers no concrete suggestions on how CU's should solve a social problem of haves and have-nots with a reinvented credit union business model.

Rich Losea

Most of those that use Courtesy Pay / Overdraft Protection, know the costs involved and accept the fee for the temporary use of those funds. It does avoid the double-fee hit (and embarassment) of a bounced check, but too often I see members going into Courtesy Pay multiple times per pay period. It is meant as a Courtesy for occasional use – not something to borrow from whenever wanted. The $30 penalty does not seem to deter behavior.

Michael Torcisi, MBA

Totally agree Michael T! Consumers love OD programs and would rather pay the fee than write a bad check at the local merchant.

Molly Snody

The issue is not overdrafts but how the programs are perceived, I have always voiced the opinion that this is a service based on a credit decision and not a fee system. A person wanting overdraft protection should be scored as an unsecured loan. That is what an institution is providing for the customer or member. The charge is the cost of providing the advance to them.

Tommy Loo

A major concern for many CEOs will be how do they increase their income to offset the HUGE loss in fee income. Most CU's can't make it on spread anymore. If you think there are a lot of mergers now, wait until the CFPB cracks down on courtesy pay.

Gregory Shaver

Technology has taken away the ability of any credit union to establish its own prices (interest rates on loans, dividend rates on shares) as consumers can use any financial organization for those services. Now, the unsecured closed-end loans are being undermined by online lenders who can approve loans immediately and fund within 2-4 days (without the regulatory scrutiny that banks/credit unions have). In the immediate future, we will have an unelected, unaccountable bureaucrat deem that a paid NSF fee is no longer allowed (and who knows if the unpaid NSF fee will be permitted). There goes the ability to provide an quick, efficient service that consumers can choose to have on their accounts without additional paperwork or time delays. How are CUs supposed to do the things demanded (such as money laundering prevention using expensive software) by government without the ability to earn money to pay for it?

Technology has taken away the ability of any credit union to establish its own prices (interest rates on loans, dividend rates on shares) as consumers can use any financial organization for those services. Now, the unsecured closed-end loans are being undermined by online lenders who can approve loans immediately and fund within 2-4 days (without the regulatory scrutiny that banks/credit unions have). In the immediate future, we will have an unelected, unaccountable bureaucrat deem that a paid NSF fee is no longer allowed (and who knows if the unpaid NSF fee will be permitted). There goes the ability to provide an quick, efficient service that consumers can choose to have on their accounts without additional paperwork or time delays. How are CUs supposed to do the things demanded (such as money laundering prevention using expensive software) by government without the ability to earn money to pay for it?

~JustAPlayer

Like most things, the answer lies between two extremes probably. CUs could offer lower fees, however that is simply a bandaid solution to a far deeper systemic issue in the United State: ever decreasing financial literacy.

I think the answer lies less with eliminating fees, and more with CUs and community banks working with youth in and out of schools to increase basic levels of financial literacy. Simply put, kids aren't coming out of high school (or even college in many cases) with the ability to balance checkbooks, maintain a budget, and understand basic financial terms like interest, collateral, or overdraft, and as champions of the community, CUs can be doing better!

~Brandon Hord

Although commenters are understandably focused upon the overdraft aspects of the CFPB's focus, the reality is that the onerous compliance burden from the CFPB's zero tolerance for Fair Credit Reporting Act errors will be the most significant outcome from the interfering federal agency's ideological foray into the financial services deposit account marketplace. I quote CFPB Director Richard Cordray – “Today we are issuing a bulletin warning banks and credit unions that they must meet their legal obligation to have appropriate systems in place with respect to accuracy when they report information, such as negative account histories, to the consumer reporting agencies.” Translate that to mean “costly and complex compliance systems.”

~Marvin Umholtz

I was a poor college student with a checking account. And after college, I didn't make big money, so I was definitely “working poor”. However, I didn't bounce any checks. It's not really rocket science; you just don't write checks/use debit for things you don't have the money in your account to cover. It's a punitive fee that can be entirely avoided.

Being poor has less to do with these fees than being irresponsible. There are many members with lower income levels that manage their checking accounts year-after-year without bouncing checks/over drafting.

So what does the world of banking look like If the CFPB severely limits or eliminates ODP/NSF income? Clearly, credit unions and banks will be forced to look for other sources of income to make up for what NIM does not cover . And that income will likely not come from behavioral based fees, which can be avoided, but from across the board fees that hit everyone.

Just speculating on what it could look like, but much higher interest rates on loans and lower rates on savings (to help increase NIM), no more free checking accounts, fees for using services that have typically been free for everyone (like mobile banking, online banking, bill pay, debit cards, etc.) would all be possible/likely. Staffing cuts/branch closings will probably be necessary as an expense reduction, so service will take several steps back.

And all of this for what? To try and protect a segment of our population that is unwilling to change their behavior and continue to make bad choices? Or just another form of income redistribution?

~Responsibility1

CFPB=(expletive deleted); highly-partisan, still-controversial, and probably-unconstitutional

~Marvin Umholtz

Heather – This is a real dilemma, especially for credit unions. I agree with, and wholeheartedly support, your message about coming up with creative ways to help members in this area. However, the financial reality for credit unions dictates otherwise, which you did note in your article, but let's throw some hard numbers at it to reinforce the magnitude of the challenge being faced.

Heather – This is a real dilemma, especially for credit unions. I agree with, and wholeheartedly support, your message about coming up with creative ways to help members in this area. However, the financial reality for credit unions dictates otherwise, which you did note in your article, but let's throw some hard numbers at it to reinforce the magnitude of the challenge being faced.

In 2014, fee income for federally insured credit unions was $7.2 billion. In that same year, net income was almost $8.8 billion. In other words, fee income represented 82% of credit union net income — eighty two percent. Fee income was 90% of net income in 2013 and 87% in 2012.

Any reduction in fee income without an offsetting reduction in expense, would stifle the credit union industry's ability to grow, make investments in technology to maintain relevance, and offset the increasing cost of compliance.

Is this a cop-out for not seeking solutions? Of course not, but when there is not enough income from margin to cover operating costs, provision expense and capital needs, you have to get it from somewhere else. It's the hard reality credit unions face. Regulation that reduces the opportunity for credit unions to generate income is a very real threat to their long term existence as they currently operate today.

https://www.ncua.gov/DataApps/…

~Mike Higgins

Mike, I disagree. OD fees have been easy money for too many CU's. Instead of looking for other ways to make income, CU's just feed at the overdraft fee trough. If we are supposed to be the “good guys” then use some common sense of OD's. I know way too many CU's that have members using OD as a form of payday lending.

~BillyBobJim

BBJ — I share your sentiment about OD. We are actually on the same team here. However, if OD gets regulated away or reduced, then the alternative is loan sharks, which is not a better choice for members.

~ Mike Higgins

Thank you for the comment, Mike. I definitely appreciate your point. I would rather see fees in exchange for value, not fees assessed punitively. For example, I'd pay a fee for mobile deposit. Some credit unions are also making good fee income selling ads to business members that display in their mobile apps. An ad for a local hardware store would pop up in the mobile app of a member who has a transaction history of purchasing items at Home Depot. I love this idea – what a win-win!

~Heather Anderson

Heather — Agreed. There are two options here: alternative sources of revenue or more efficient operations (or both). On the revenue side, there is a place for behavior modification income, but the value proposition is doing it for less than the market at large. You noted the difference between $29 and $30 is not much of a value proposition. In addition to the ad revenue you noted, credit unions could look at insurance products, including cyber insurance, wealth management, etc. — anything that does not pull on capital.

Building on BBJ's comments, credit unions that are piling up an excessive amount net worth via OD income really have an obligation to return some of it back to their members. I don't like to see that form of profit taking any more than anyone else does.

I still am concerned about it being regulated away. Credit unions are not the only ones looking for other sources of income, so are banks. It's a very competitive landscape out there.

~Mike Higgins

I have a friend who has run multiple credit unions. When asked about fees, she stated “every fee on our fee schedule can be avoided.” Overdraft fees – either for “courtesy pay” or NSF – can be avoided. If you don't have the money, don't write the check or use the card or set up the ACH payment. Simple premise. Besides, overdrafting on debit cards requires the consumer's approval. Don't want that – then don't approve the service. At the credit unions I work(ed) for, if you don't want check/ACH courtesy pay and tell us, you won't get it. Just the NSF fee when we send that payment back to the depositing entity or ACH creator. Why is it the responsibility of the financial institution to create another new product – with the programming AND disclosure language not to mention the expense – just because people think they have all the money to cover whatever they want when they know how much goes into the account on payday?

~ JustAPlayer

I think it's the responsibility of any “financial cooperative” to thoroughly educate consumers on their choices and the impacts of their choices. When it comes to financial literacy, Credit unions can do a much better job. Ideally, they should collectively find a way to 'help” the 47 million Americans that live in poverty. No easy task.

~bclagett

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.