The $4.5 billion, West Jordan, Utah-based Mountain America Credit Union has a reputation for driving innovation. And that reputation is well-deserved – the credit union's latest mobile product launches allow members to login using biometrics, and apply for and receive funding on a number of loans.

For the biometrics login feature, members can choose to use eye print authentication, fingerprint authentication, or both. Or, they can opt out entirely.

"We do not require our members to use one or the other or both," Shelby Peterson, manager of product strategy for Mountain America, said. "We understand that our members might be weary of one technology over the other, so we really believe that we should give them the ability to choose."

Recommended For You

The credit union developed the technology with the Berkeley, Calif.-based Access Softek for the fingerprint login portion and the Kansas City, Mo.-based EyeVerify for the EyePrint ID technology element. The new authentication options are a response to growing data breach and identity theft threats, Peterson said.

"Security was a huge showstopper for growth," Peterson recalled. "MACU heard its members and their concern for security, which is why we introduced biometrics and made it available for however they want to use it."

Implementing biometrics helps make mobile banking more user-friendly and secure, plus enhances the overall mobile experience for MACU members, she added. The service not only protects members – it makes logging in easier because users don't have to remember or enter a complex password.

The fingerprint login service (developed by Access Softek) is available to MACU members using Apple devices and newer Android devices. During the fingerprint authentication process, an image sensor on a device scans the fingerprint, analyzes its ridges and converts it into a mathematical code. That code is stored in the mobile device and compared against future scans. Users can add fingerprints from up to five fingers, and the device can read fingerprints from any angle.

The credit union also chose to offer the EyeVerify component because it's compatible with more devices.

The credit union also chose to offer the EyeVerify component because it's compatible with more devices.

"Not all smartphones have fingerprint readers," Peterson said. "But most do have the front-facing camera, which makes this option great."

EyeVerify works with an individual's eye print – the map of blood vessels in the whites of the eyes, which is unique to each person. Each person has two eye prints in each eye. The initial enrollment process takes less than a minute and works by capturing an eye print on a smartphone or tablet camera.

"After that, logging in using EyePrint ID is as easy as taking a selfie," Peterson said.

Toby Rush, founder and CEO of EyeVerify, explained, "EyeVerify transforms a picture of your eye into a key that replaces your password."

Only one or two camera megapixels are required, so EyePrint ID can be used with almost any smartphone on the market.

"Users' privacy is incredibly important when dealing with biometrics," Rush emphasized. "We never send the biometric off the device."

MACU's numerous mobile banking features have led the credit union to gain a reputation for driving innovation.

The architecture is also similar to what's employed by Apple, Samsung and other leading technology companies.

"All processing is done locally and a key is calculated from the eye. This also allows the entire process to happen in less than one second," Rush said, adding, "Improving user experience while increasing security and still protecting privacy is a win for everyone. The unique and highly secure nature of eye biometrics, and specifically eye vein biometrics, make it ideal for use in mobile banking."

Since the release, more than 10,000 members have registered for MACU's EyeVerify product – all without marketing. "That's all self-discovery," Peterson explained.

The credit union claims it is the first to combine fingerprint and eye-imaging technology to make biometrics available to all mobile banking members.

"Mountain America is excited to bring this innovation to our members, as biometric features are the future of enhanced online security," Peterson explained. "Biometrics ensures our mobile products are more secure and easier for members to use."

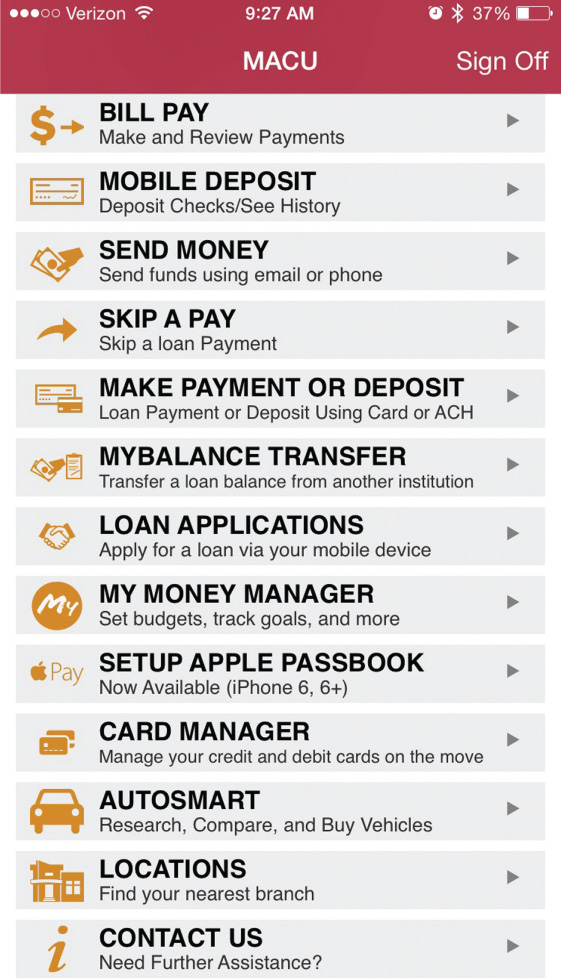

MACU can be considered a pioneering credit union when it comes to mobile banking. It introduced mobile banking about seven years ago, initially just posting balances and transactions pulled from its core system. Over the years, the credit union added features such as mobile deposit capture, person-to-person (P2P) payments, and bill payment.

MACU can be considered a pioneering credit union when it comes to mobile banking. It introduced mobile banking about seven years ago, initially just posting balances and transactions pulled from its core system. Over the years, the credit union added features such as mobile deposit capture, person-to-person (P2P) payments, and bill payment.

And MACU keeps pushing the technology envelope – it recently introduced an end-to-end mobile loan product, through which members can apply for the credit union's Instant Short Term loan, as well as a credit card or personal, auto, RV or motorcycle loan, and receive an immediate decision and funding.

Other mobile MACU features, built in partnership with Access Softek, include:

-

Card Manager, which allows members to freeze or temporarily hold cards that are lost or stolen, request a new card, change a PIN, and set daily spending limits;

-

Quick Balances and Apple Watch, which lets members check balances without logging in;

-

Photo Balance Transfer, which allows mobile users to capture another institution's loan statement by taking a picture and moving the balance over to MACU (this can also be done manually; MACU members successfully transferred $1.3 million through this feature alone in February 2015);

-

The ability to make a loan payment or deposit from any financial institution account using a credit card, debit card or ACH transfer;

-

Autosmart, which lets members shop for vehicles in the MACU app and apply for a auto loan;

-

Skip-A-Payment, which allows members to miss a payment at their convenience (especially popular during the holiday season).

Peterson said since the introducing new mobile features six months ago, MACU's engagement levels with its existing, active app users has gone up 37% and continues to climb.

"We partner with Mountain America to build out their innovative product roadmap," Jonathan Smalley, project manager at Access Softek, explained, adding that since Access Softek's inception, the tech company has prided itself on technological development. "We are very much cutting edge and we love to innovate. Our clients rely on that."

Mobile banking has been a core business for Access Softek from the get-go – Smalley said it was the first provider of a banking app on a smartphone.

"You don't have many people wanting to bank on a Blackberry or a Treo phone anymore, but that is how we got our start," he noted.

Now, MACU is getting ready to roll out its new online banking system, which it has been building in partnership with Access Softek over the last two years. Features will include all-account access through a single login; the use of existing registration credentials; member-based accounts that include access to multiple business or personal accounts through a single location; customized views of account information; dynamic workflows that make transfers and payments easier; and a simplified transfer screen.

"We really believe what we are doing here with Mountain America is going to redefine what it means to bank in an online and mobile experience," Smalley said. "There are some things we are changing in the way the online experience works."

MACU serves more than 525,000 members through online and mobile banking, 84 branches in five states and more than 30,000 ATMs and 5,000 shared branching locations nationwide.

The credit union's dedication to innovation recently led to a 2015 Gartner & 1to1 Media Customer Excellence Award for Innovation in Customer Insight win. This award highlights organizations that are customer-focused and add measurable value through the use of strategy, technology and execution to deliver exceptional customer experiences.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.