Instead, loan growth tends to be fueled by maintaining a strong organizational and business model, being agile to make timely decisions to balance liquidity with loan demands, and leveraging management tools to keep the loan production engine humming even through a tough economy.

For 15 years in a row, the $2.4 billion University of Iowa Community Credit Union in North Liberty, Iowa, said it has posted an average annual loan growth of 19.5% and currently manages a loan-to-share ratio of 115.98%.

Recommended For You

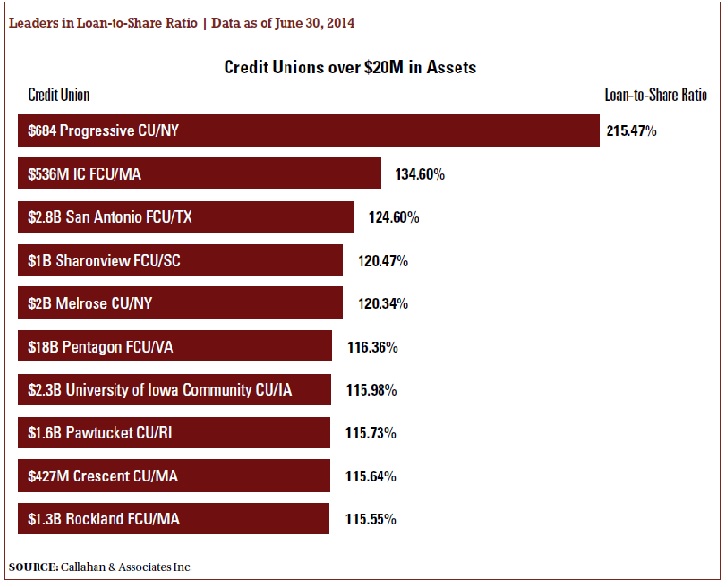

The cooperative ranked No. 7 on the Top 10 list of loan-to-share ratio leaders, according to data analyzed by Callahan & Associates for CU Times.

Jeff Disterhoft, president/CEO of UICCU, credited the cooperative's success to changes made to its organizational structure and business model in October 1999. Rather than appointing one senior executive in charge of all lending operations, the credit union decided on hiring an executive for retail, commercial and mortgage.

"What that has done is that it created a fair amount of good-natured competitiveness among the three heads to grow their respective portfolios and, at the same time, it allows each of them to myopically focus on their portfolios and I think that focus has allowed them to grow," Disterhoft said.

"In some regards, it also diversifies our risk a little bit," he continued. "In any given year, one of the three may have a slow year, but the likelihood of all three having a slow year is pretty slim."

Disterhoft also described his credit union's business model in three parts and as a little unique relative to peers.

"It starts off with efficiency, making sure we run as efficiently as absolutely possible," he explained. "If we do that successfully, we will have money left over at the end of the day."

The second part of the cooperative's business model is value, Disterhoft said. With the money left over from the credit union's efficiency, it can deliver more value with better pricing and return for members. The third part is to pay its employees with above-market compensation and to serve the community.

In addition to helping the UICCU consistently grow its loans by double digits, its business model also has enabled the cooperative to annually grow deposits by 18.8% since 1999, Disterhoft said.

Notwithstanding its strong deposit growth, the credit union does borrow about 12% to 14% of its assets from the Federal Home Loan Bank in Des Moines.

"It has proven to be a cost effective alternative for us relative to borrowing from our members in some cases," he said. "In that regard, it really has allowed us to lower our cost structure and pay even a higher rate to our existing depositors."

Read more: When loan demands outpaces deposit growth …

The economic recovery created such a strong loan demand that it outpaced deposit growth at the $1 billion Sharonview Federal Credit Union, which was ranked in the CU Times top 20 list with a 120.47% loan-to-share ratio.

William Partin Jr., president/CEO of the Fort Mill, S.C.-based cooperative, believed members are expecting interest rates to rise and are holding off on investing in any new certificates of deposits.

"We had a 15-month special CD, which actually worked well in April during bonus and tax time, but as we moved through the year and the media started focusing on rates inching up in 2015, less and less folks were excited about getting into a 15-month CD," he said.

As a result, Partin knows his credit union needs to be agile and move quickly to increase deposits to meet a strong loan demand expected to continue next year.

"We should be at about a 3% deposit growth for 2014," he said. "We know that's a little behind the industry average, so we have to get more aggressive in 2015."

Sharonview's goal is to grow deposits by 6% to 7% and increase loans by 8% next year, Partin said.

Part of the credit union's plan next year is to stay on the shorter side of the maturity curve on some CDs and look at longer-term CD specials that will allow members to do a one-time bump up to catch a higher yield.

Sharonview is also streamlining its free checking account offerings from four to two and beefing up its investment division from two to four employees, Partin said.

"We're launching a new money market account that is tied to our investment services group that is about 25 basis points higher than our premium money market account," he said. "We are trying to make that a value add for 2015."

Before the Great Recession hit, the $1.7 billion, St. Joseph, Mich.-based United Federal Credit Union loan-to-share ratio hit a high water market of 132%. When the economy began its meltdown, consumers stopped spending and deposits streamed in so fast that the credit union's loan-to-share ratio plunged into the 90s.

"That's very low for us," Gary Easterling, president/CEO of United, said. "We prefer our loan-to-deposit ratio to be somewhere in the 110% to 130% range, but we've been talking whether, with our capital position, we can take it higher."

As of June 2014, United's loan-to-share ratio stood at 114.9% and is ranked 11th on the CU Times Top 10 list.

Easterling recalled while some people were saying that nobody wanted to borrow during the recession, United's loan growth never slowed down.

"Our objective is always to allow our retail team to sell, sell and sell loans and what that means is that we have to be very smart and very agile in managing our balance sheet without disrupting the retail loan team," he explained.

By managing on the back end by selling mortgage loans, loan participations or making additional borrowings, United can always keep its retail side active, Easterling said.

"And, we were able to do that throughout the entire recession. That's why we never missed a beat on lending."

However, Easterling had concerns that deposit growth was slowing down because consumers are plowing more money back into the bull market and other investments.

"Part of the legacy we have built is when our members think of their borrowing needs, they usually think of us first and sometimes, when they think of their deposit needs they are not thinking of us first," he said.

Easterling added, "From a marketing and sales strategy standpoint, we are going into the New Year trying to remedy that. We've been running some rather unique deposit promotions recently just to prod the marketplace to see where we can evoke a reaction."

United is offering above market certificate specials and it's also promoting a checking and debit account with a rewards program, according to Easterling. The credit union also is queuing up other deposit promotions for 2015.

"We know that based on our current balance sheet model our deposit acquisition is going to be the constraining factor," Easterling said. "We would prefer to get our liquidity from our members but borrowing from the Federal Home Loan Bank is one of our strategies."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.