Two credit unions that led the industry in growth over the past year by playing off rising home values in their areas and remaining remarkably stable through the downturn are proof that opportunities continue to emerge in the lending channel.

According to data analyzed by Callahan & Associates for CU Times, the $1.5 billion Michigan Schools and Government Credit Union grew its portfolio of home equity loans and lines of credit by 97% to end the period tracked at just over $690 million.

Recommended For You

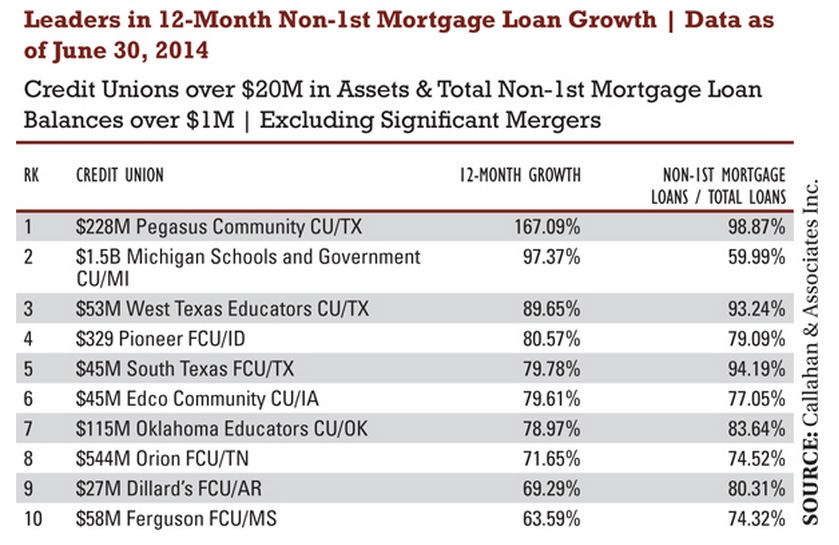

The 97,000-member cooperative in Clinton Township, Mich., ranked second on the list for non-first mortgage growth among credit unions with more than $20 million in assets as of June 30, 2014. Click on the list above to expand.

Lori Dietz, MSGCU vice president for marketing and business development, said the credit union achieved its equity line figures by noticing the rising home values and pent-up demand among its members living in the Detroit suburbs and other parts of Southeastern Michigan.

"We are an educational-based credit union and we knew our members had been through a lot financially," she explained. "But we also got the sense that members had begun to be interested in finally moving forward with things like home renovations and other improvement spending that they had put off during the recession."

Read more: HE demand grows …

The demand drew stronger in the first quarter of 2014, Dietz recalled. In March, the credit union hosted a seminar that ran into two sessions and received a lot of attention.

At the time of seminar, MSGCU discovered home prices in the Detroit area had risen 40% to their pre-Great Recession values. Members had also started thinking about what they could do to improve their properties since they were unlikely to buy others any time soon.

Dietz said the credit union trained its frontline staff to handle questions about home equity loans and lines of credit and to take applications for the loans.

"Our members like using our electronic banking app and site for other things, but they like to apply for home equity loans face to face," she noted.

Meanwhile, the $57 million Ferguson Federal Credit Union in Monticello, Miss., built its success on the stable home values in its field of membership and a charter change to attain its strong home equity numbers, Leslie Pitts, president/CEO, said.

The 3,700-member credit union grew its home equity lending portfolio by roughly 64% to nearly $14 million, according to CU Times' list of for non-first mortgage growth among credit unions with more than $20 million in assets as of June 30, 2014. It ranked 10th on the list.

Pitts, who described Ferguson as "in the sticks," said the rural setting and culture helped keep land and real estate prices stable and favorable to home equity lending.

The land value's stability came about because the area did not have huge run-up in home and land values before the Great Recession, Pitts said. As a result, Ferguson did not experience a significant price drop after the downturn.

The affinity that people felt towards the land – in many cases, connections went back several generations – meant homeowners felt more comfortable taking out home equity loans to renovate and improve their properties rather than selling them.

When Pitts took the helm at Ferguson in 2013, she recalculated and reconfigured the loan rates on products such as home equity loans to make them more competitive.

"We had rates as high as 6.00%, so why would anyone want to come and take out a loan with us," she recalled.

Pitts acknowledged the credit union currently prices loans by risk. However, back then, it did not, which scared off borrowers with better credit scores who could get loans elsewhere.

She attributed a community charter expansion in April 2014 as Ferguson's main reason for the credit union's success. Its field of membership went from serving employees at two paper mills to anyone serving in the surrounding county.

"We had a lot of people who knew we were here but couldn't join us even though they needed our loans," Pitts said. "Expanding our pool of possible members meant that we had a larger pool of potential borrowers."

With the charter change, Ferguson has added 70 to 80 members each month, according to Pitts.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.