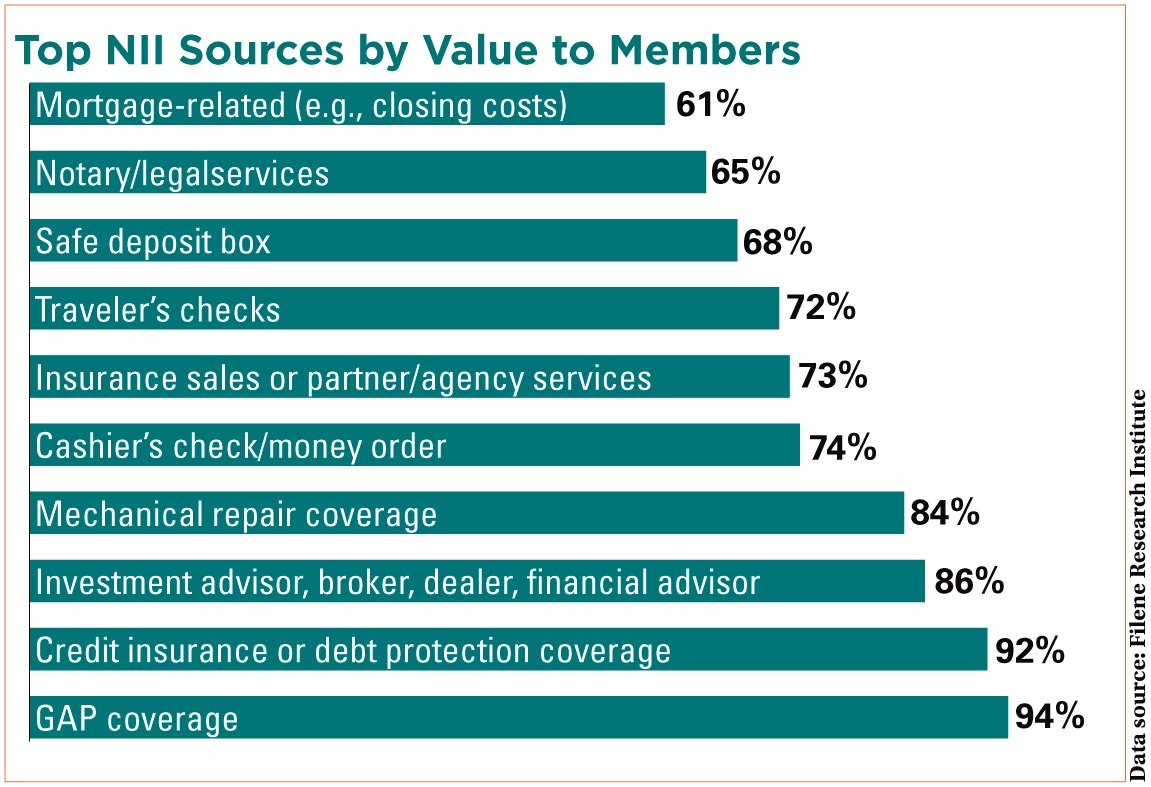

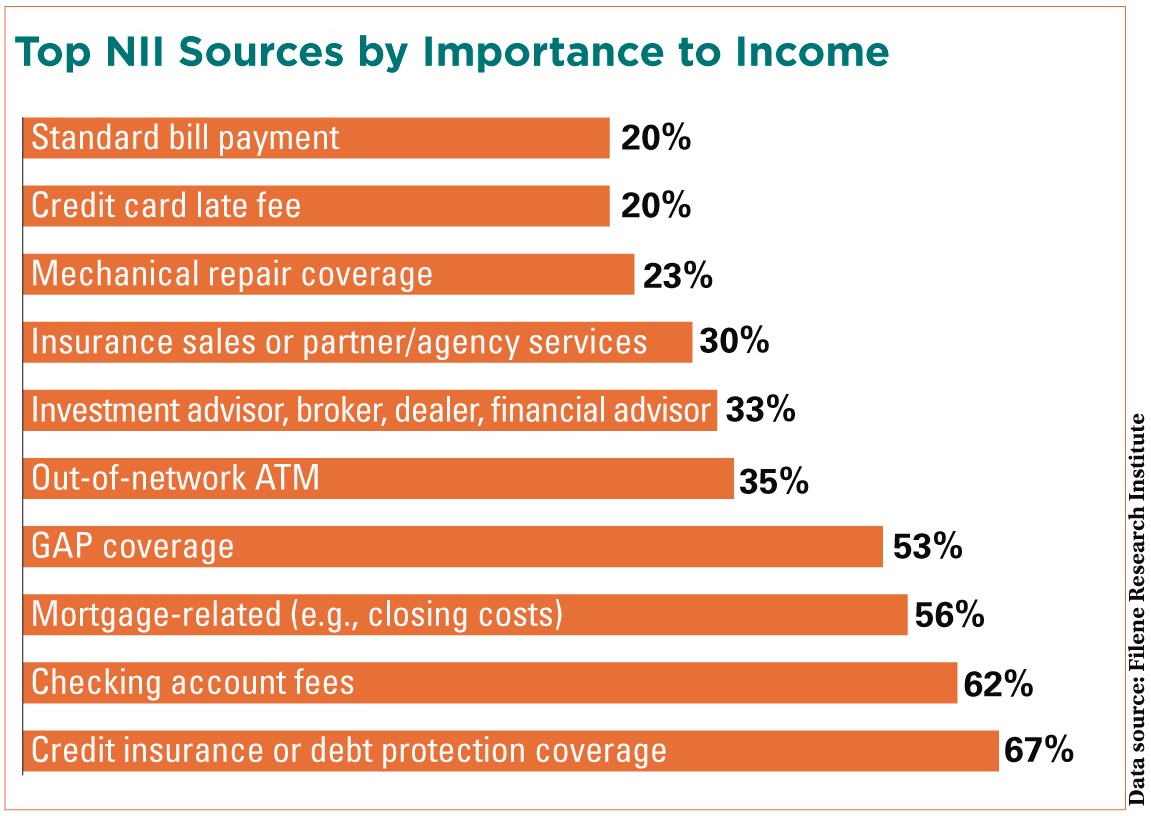

As income from net interest margin has dried up, Ben Rogers, research director at the Filene Research Institute, said more and more has had to come from noninterest income.

“But rather than waiting on the clouds, many credit unions have been building enough NII to guarantee that the river of net income doesn't run dry,” Rogers said. “As they look for additional sources, they need to be sure they're giving members value, not just extracting it.”

Filene recently conducted research seeking to balance two important credit union imperatives: the need for NII that supports the operating costs of the credit union, and the imperative that credit union leaders feel to charge fees that are fair and that support services that add value to members, Rogers said.

Click on the graphs at left to expand.

“The tension is real. Too many or ill-advised fees and credit unions run the risk of alienating members and losing their cooperative difference,” he warned.

“The tension is real. Too many or ill-advised fees and credit unions run the risk of alienating members and losing their cooperative difference,” he warned.

Read more on how credit unions can strike that balance in the Filene report: In Search of Member-Friendly Noninterest Income.

The report is the latest in a series of exclusive content from Filene available to readers of Credit Union Times.

Also, check out these other Filene reports:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.