As some credit unions continue to shift their focus towards courting younger potential members, baby boomers still have money to spend and shouldn't be counted out.

Jeffry Martin, president of auto buying CUSO Autoland Inc., backed that observation up by looking at sales activity at the Chatsworth, Calif.-based firm.

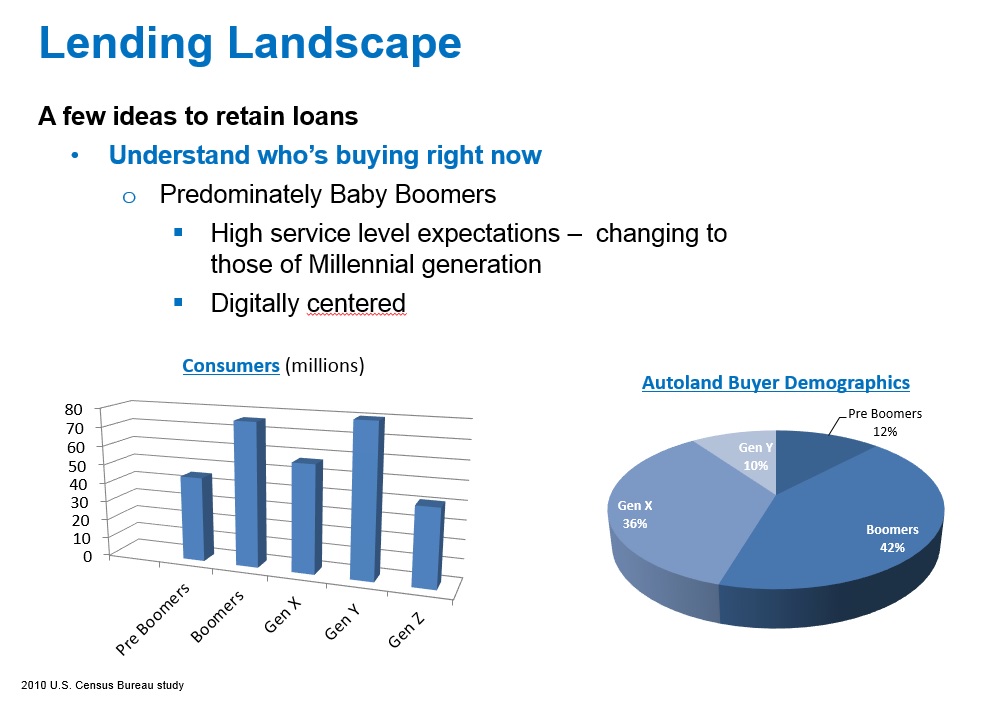

He said recent data showed that boomers represented 42% of Autoland's sales while Millennials only represented 10%.

He said recent data showed that boomers represented 42% of Autoland's sales while Millennials only represented 10%.

“While most industries are heavily focused on influencing consumer behavior of the Millennial generation, the majority of today's U.S. auto sales still rest with baby boomers,” Martin said.

(Click on image at left to expand.)

Autoland serves more than 200 credit unions nationwide, representing more than eight million credit union members. The CUSO said it has delivered more than $1.8 billion in direct auto loans to credit union partners over the past 10 years.

During a recent auto lending symposium conducted by the California and Nevada Credit Union Leagues and the Northwest Credit Union Association, Martin said he urged the audience to strike a balance between boomers and Millennials.

“Our message is to structure their loan programs, service capabilities and marketing to appeal to both groups with an understanding that boomers currently have greater purchase power and credit quality,” Martin noted.

Consumers in the 55- to 64-year-old age range are most likely to buy a new car, according to a study, Marketing Implications of the Changing Age Composition of Vehicle Buyers in the U.S., from the University of Michigan's Transportation Research Institute.

Coming in first was the 45- to 54-year old age bracket that also includes boomers, the data showed.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.