More credit unions saw improvements last year in the NCUA examination process, but experienced a decline in their examiners' capabilities, according to the September issue of Economic & CU Monitor, NAFCU's monthly newsletter.

Monitoring the exam process and lobbying NCUA for improvements on behalf of its members is something that NAFCU has been doing for some time, trade association officials said in follow up interviews.

The dichotomy among anecdotal responses creates interesting comparisons, according to Carrie Hunt, NAFCU's senior vice president of government affairs and general counsel.

The dichotomy among anecdotal responses creates interesting comparisons, according to Carrie Hunt, NAFCU's senior vice president of government affairs and general counsel.

“Our goal is to have everyone have a fair exam that is not problematic to the credit union,” Hunt said Monday. “We want to make sure the transparency is there to make that happen.”

(Click on the image at left to see expanded version.)

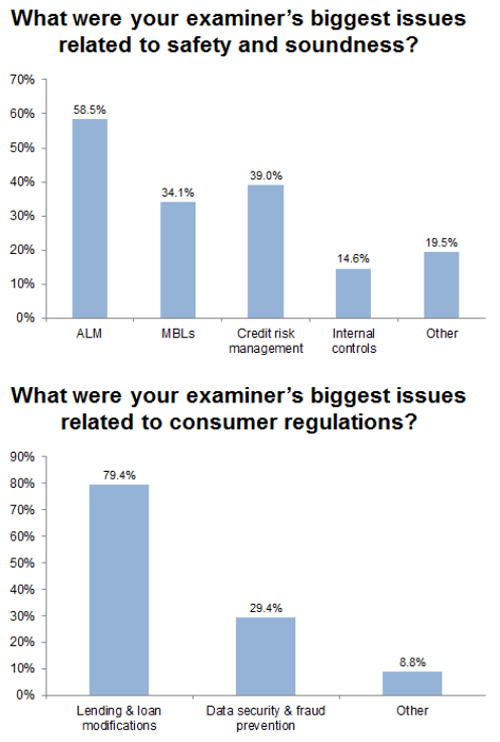

Credit unions responding to this year's survey provided mixed results. Roughly one in eight, or 12.2%, said the exam process was worse than in the past, while 24.5% said the process was better. Conversely, 8.3% of respondents found their examiner to be more competent than in the past, while 14.6 % found the examiner less competent.

In addition, 8.7% of survey participants claimed that exam report clarity had improved, while 6.5% thought that clarity had worsened.

“The most surprising result concerned whether exam process had improved,” said David Carrier, NAFCU's chief economist and director of research. “When we asked the same questions in August 2012, 0% of credit unions responding said the process was better, while this time more than 24% said it was better.

“Paradoxically, 14.6% of this year's respondents found examiners less competent, while 8.3% found them less competent in August 2012.”

One possible variable that may have influenced the conflicting score was the reduction in the number of Documents of Resolution credit unions received, Carrier said. The majority of those receiving a DOR asking for a correction felt the examiner had made a major issue out of a minor one, but the number of DORs themselves had gone down compared to last year.

“I don't know enough about the exam process to know with certainty, but the clue I got was the number of credit unions receiving a DOR this year was 35.4%, whereas last time it was 51.4%,” Carrier said.

“I can understand why people might be feeling more warm and fuzzy this time than last time. That they found the process more helpful than they have in the past that would be my interpretation of the data,” the NAFCU chief economist said.

John Fairbanks, NCUA spokesman, said, “NCUA is constantly working to streamline and modernize regulation, providing relief wherever possible while protecting the safety and soundness of the industry and the Share Insurance Fund. “

He added, “Likewise, the agency continually works to improve the consistency, transparency and professionalism of the examination process.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.