A report from researchers Celent claims that financial institutions will continue to upgrade to new core systems, perhaps at a slightly faster rate than presently as institutions wrestle with antique cores that do not necessarily respond to 21st century banking needs and which also may require old-time computer skills – such as Cobol programming – that are not in high supply in today’s market.

Celent predicted in its new report – “Global Core Banking: Steady But Unspectacular Growth” – that the core banking market in the US and Canada will grow at a 3.7% rate over the next four years.

Celent predicted in its new report – “Global Core Banking: Steady But Unspectacular Growth” – that the core banking market in the US and Canada will grow at a 3.7% rate over the next four years.

In an interview, study co-author Stephen Greer said that, “It’s true that very few cores switch in the U.S. Institutions are slow to change.”

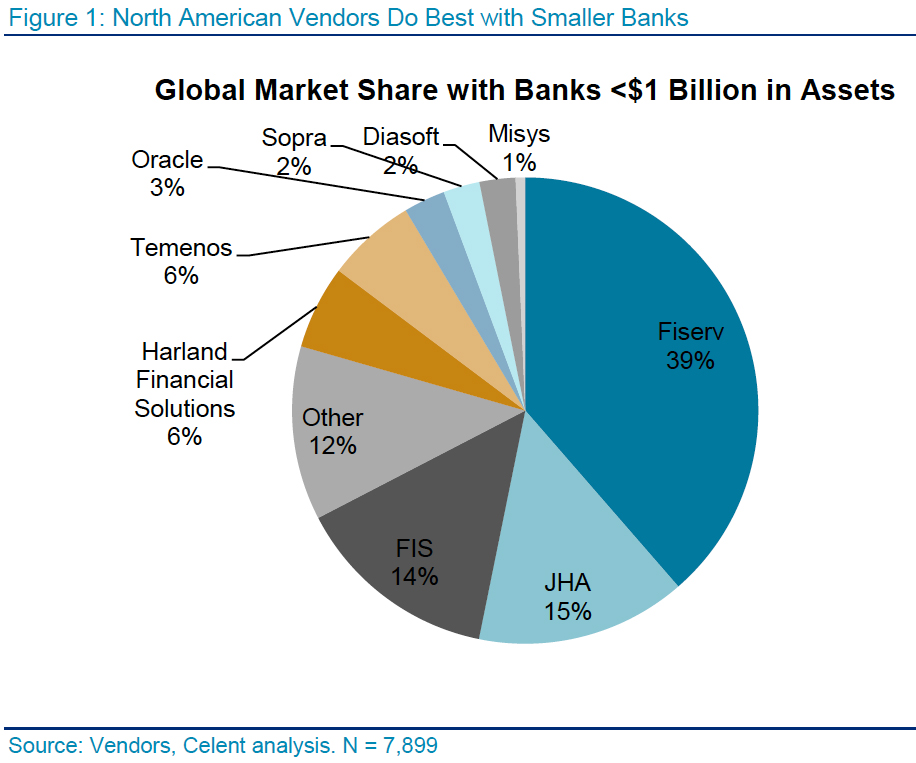

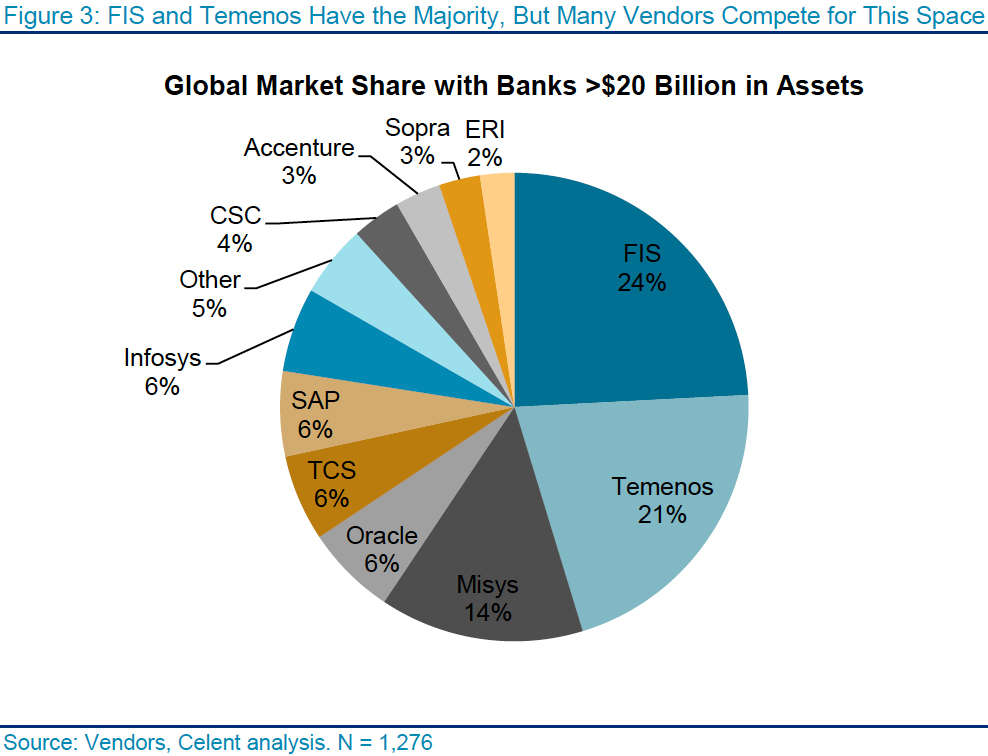

(Click on each of the pie charts to see expanded versions.)

But, he indicated, Celent expects to see more movement, especially as financial institutions decide to embrace hosted cores. Another factor, said Greer, will be the entry of core providers from overseas.“International vendors have no credibility in the U.S.,” admitted Greer. “They need to raise their visibility with headline-grabbing implementations.”

But, he indicated, Celent expects to see more movement, especially as financial institutions decide to embrace hosted cores. Another factor, said Greer, will be the entry of core providers from overseas.“International vendors have no credibility in the U.S.,” admitted Greer. “They need to raise their visibility with headline-grabbing implementations.”

He indicated that may well happen.

Greer added, “We are of the opinion that hosted cores are becoming more popular. We see more banks engaging in hosted. It’s more economical. There had been apprehension about losing control. We think it is a better option for most smaller banks; they lack the scale to run their core in-house. For credit unions in particular, hosted is a good option. They are smaller” and, suggested Greer, they will often save money while getting better security and more robust technology after switching to a hosted core.”

Greer added, “We are of the opinion that hosted cores are becoming more popular. We see more banks engaging in hosted. It’s more economical. There had been apprehension about losing control. We think it is a better option for most smaller banks; they lack the scale to run their core in-house. For credit unions in particular, hosted is a good option. They are smaller” and, suggested Greer, they will often save money while getting better security and more robust technology after switching to a hosted core.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.