In what may have significant implications for ATM deployment and other aspects of credit union operations, a study from Javelin Strategy and Research has found that debit and credit cards have overtaken cash for the bulk of sales volume at the retail point of sale.

The study relied upon survey results from a representative sample of 3,210 consumers, U.S. Census figures and data drawn from the major card brands and U.S. government agencies.

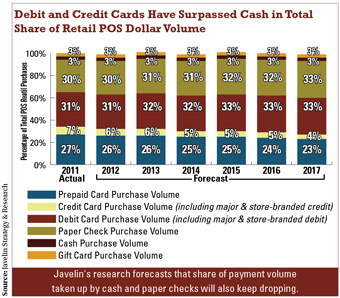

The study found that consumers still use cash to pay for things at the retail point of sale, but that purchases with cash, while numerous, were of generally lower value. Higher value transactions tended to go to debit and credit cards, with debit cards accounting for 31% of retail sales volume, credit cards 29% and cash only 27%. Further, the study forecast that cash would only represent 23% of sales volume by 2017.

“Cash may be the most commonly used payment option for POS retail transactions, but frequent usage does not necessarily translate to a higher sales volume,” the research firm wrote in its forecast.

The study also found that payments on mobile devices represented the fastest growing payment segment in terms of sales volume and forecast that mobile payment sales volume will hit $1.4 billion by 2017.

“Mobile phone POS growth is hindered by a lack of both consumer adoption and merchant acceptance, but industrywide investments will help propel the growth of mobile POS payments,” Javelin wrote. It forecast that this emerging payment option will grow from $362.6 million in 2011 to $1.4 billion in 2017. “Though the forecast growth for mobile POS payments will increase share only from 0.01% in 2011 to 0.03% in 2017, mobile POS payments are undeniably on an upward trajectory and represent a future game changer."

Additionally, prepaid cards were forecast to overtake gift cards in terms of sales volume by 2014 and will reach $139.4 billion by 2017 as sales volume on gift cards is forecast to fall to $108.7 billion by 2017.

Additionally, prepaid cards were forecast to overtake gift cards in terms of sales volume by 2014 and will reach $139.4 billion by 2017 as sales volume on gift cards is forecast to fall to $108.7 billion by 2017.

Javelin's research also indicated that the share of payment volume taken up by paper checks will also keep dropping, from $267.6 billion in 2011 to $166 billion by 2017.

“Although paper checks are in no way obsolete and remain a common payment method for bills, the POS use of paper checks is predicted to continue falling from $267.6 billion in 2011 to $166.0 billion by 2017. The decline of traditional paper payment options– specifically, cash and paper checks–will be absorbed by card-based options, with the bulk of dollar volume transferring to credit cards,” Javelin wrote.

If the study is accurate, it will be the first to signal a significant shift in consumer behavior. But cash has defenders who pointed out that it still has plenty of uses.

“Cash is one of the most successful human technologies of all time,” said Mike Lee, CEO of the ATM Industry Association, an international trade group serving the ATM industry. “And today it represents 84% of all global transactions. Unfortunately, some of the global card schemes, in particular Visa, have aggressively declared war on cash in order to increase the sale of their plastic cards,” Lee said. “We believe in the peaceful co-existence of cash, cards and other payments, such as online and mobile transactions. We are calling for an end to this war in payments.”

Andrew Schrage, co-owner of Money Crashers Personal Finance, an online publication that covers many aspects of finance and financial services, thought it unlikely that cash would be able to completely avoid the erosion of its influence by cards. He noted that the percentage of things that people have to use cash to purchase diminishes steadily, but he also thought the trend represented more of a trickle of change than a torrent.

He referenced an article called, “Cash is King,” that Money Crashers had published that laid out several reasons that both businesses and individuals still find cash useful. Cash is still the medium of exchange between individuals, Schrage noted, and had begun to grow a bit in appeal as an easier medium for transactions like the private purchase of cars and other assets.

In addition, he pointed out that cards were not a direct competitor with cash. “Not everyone can qualify for a credit card or obtain a debit card,” he said.

Further, the cards carry a higher expense and fee burden than cash does, so it’s not like cash has no advantages over cards, especially for lower income consumers, he added.

Eli Lehrer, president of R Street, a think tank headquartered in Washington that often addresses credit union and ATM issues agreed that the overall trend was against cash and added that trend could be good for credit unions. He observed that, even with CO-OP Network's thousands of fee-free ATMs, many credit unions still suffered a disadvantage in terms of convenience when compared to larger banks in ATM availability. A decline in the importance of ATMs to the average consumer can only help level that competitive field.

“Even with CO-OP Network ATMs, you are still left with mostly credit union locations along with 7-Elevens and Costco,” Lehrer observed. “If you happen to be in place without a lot of credit unions and where 7-Eleven does not have large footprint, you can be without a fee-free ATM.”

He also pointed out that most credit unions are not directly impacted by the Durbin Amendment regulations, which give them a competitive advantage in debit cards over very large banks.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.