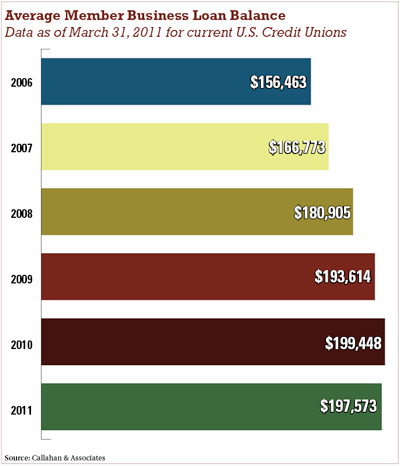

Perhaps reflective of the overall economy, after steadily climbing for the past few years average member business loan balances among U.S. credit unions fell slightly in the 12-month period ending March 31, according to Peer-to-Peer data from Callahan & Associates.

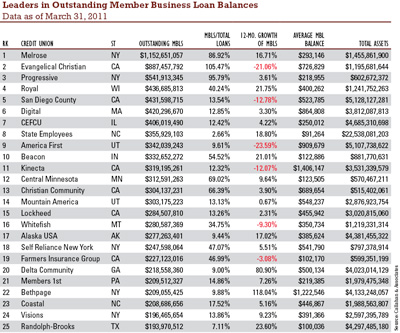

Some of the largest portfolios are held by credit unions with relatively small memberships but large asset bases.

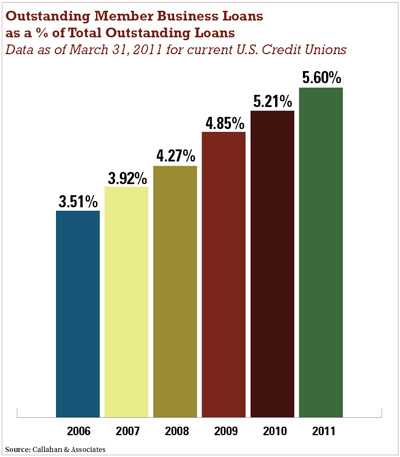

Meanwhile, outstanding member business loans as a percentage of outstanding total loans continued a steady incline, according to the same data.

The largest member business loan portfolios in terms of outstanding balances are held by the 25,000-member, $1.4 billion Melrose Credit Union in New York and the 12,000-member, $1.2 billion Evangelical Christian Credit Union in California.

These tables also appeared in the Aug. 31 print edition of Credit Union Times.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.