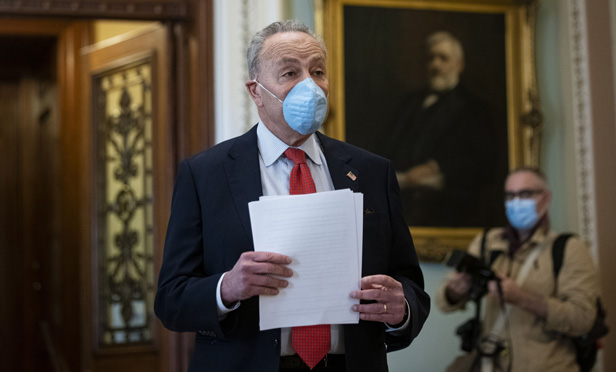

Sen. Chuck Schumer, D-N.Y. (Photo: Al Drago/Bloomberg)

Sen. Chuck Schumer, D-N.Y. (Photo: Al Drago/Bloomberg)

Sens. Chuck Schumer, D-N.Y., and Ben Cardin, D-Md., failed Tuesday afternoon in getting the Senate to pass, under a unanimous consent vote, a bill to require the Small Business Administration to provide daily and weekly reporting on the Paycheck Protection Program.

The bill would have required public daily and weekly reporting on the small-business lending programs, broken down by geography, demographics and types of industry.

Schumer voiced his concern that there is no COVID-19 related action scheduled on the Senate floor for the entire week.

The legislation should have bipartisan support, Schumer said. "Who should be against transparency?" he asked, adding that at least 200 publicly traded companies have managed to secure PPP loans, including some who are contributors to President Donald Trump.

"Unfortunately, Republicans blocked our effort to provide transparency for the small-business programs — the PPP, and the [Economic Injury Disaster Loans]. We all know that a good amount of the money is going where it shouldn't," he said in a media briefing after his remarks on the Senate floor.

The reporting in the bill was to include the names of the businesses, nonprofits and lenders and the loan or grant amounts in a standardized and downloadable format, and also evaluate whether the Trump administration's implementation effectively reached underserved and underbanked borrowers.

Sen. Marco Rubio, R-Fla., said on the Senate floor that passing such legislation Tuesday was not the "right approach," as requiring the SBA to provide such data now would "stop or slow down" the PPP loan process.

The PPP, Rubio said, "by far … has been the most successful part of the CARES Act" that was worked on in a bipartisan way.

"Does the program have problems? Sure," Rubio said. "The biggest problem is that it was underfunded, from the very beginning."

He added that while he's "glad" that large firms securing loans is "being addressed," only 0.35% of PPP loans have been taken by public companies.

"Let's find out what data points the SBA has at their disposal," Rubio continued, stating that considering such legislation may be appropriate at another time.

Schumer countered, however, that "the more data we have and the sooner we have it the better; it will make the program stronger, not slow it down."

He said at the briefing that he hoped his "Republican friends will reconsider" the bill this week. "We have to have oversight."

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.