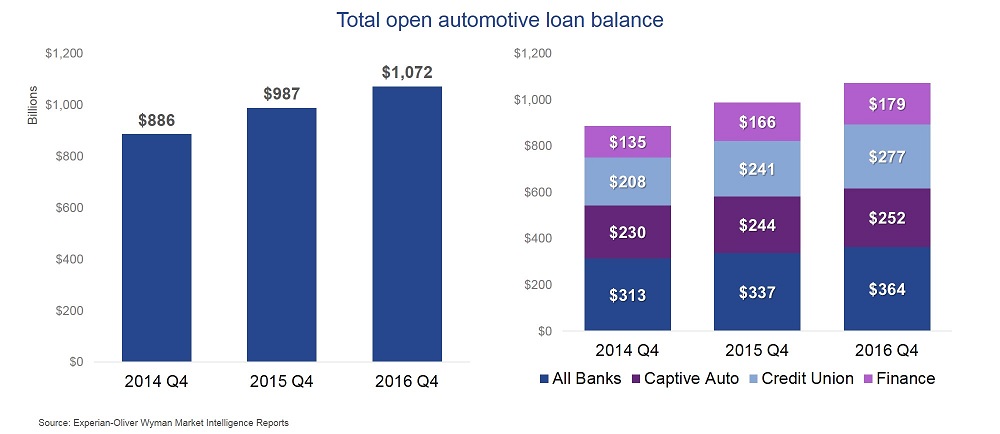

In the third quarter of last year, credit unions surpassed captive auto lenders to become the second largest lender type in the market. The latest results from Experian's “State of the Automotive Finance Market” report showed credit unions remain the second largest lender type in the market with $277 billion in open auto loans. Banks remain the largest lender type, with $364 billion in open loans, while captive auto lenders ($252 billion) and finance companies ($179 billion) rank third and fourth, respectively.

The automotive lending industry remains on an upward trend overall. In Q4 2016, total dollar value for outstanding loan balances reached a record high of $1.072 billion, up from $987 million in Q4 2015 and $886 million in Q4 2014. All lender types experienced growth year-over-year, led by finance companies (up by 22.4%) and credit unions (up by 15.87%). Banks and captives grew at much lower rates (7.64% and 6.26%, respectively).

Part of the reason for the all-time high loan balances is an escalation in the average loan amount for both new and used vehicles. The average loan amount for a new vehicle reached a record high of $30,621 in Q4 2016, while the average loan amount for a used vehicle jumped from $18,850 in Q4 2015 to $19,329 in Q4 2016.

With vehicle prices and loan amounts escalating, consumers continue to look for ways to keep their monthly payments manageable. For example, there is an increase in the popularity of longer loan terms. The number of consumers opting for new vehicle auto loans with terms of 73 to 84 months increased from 29% in Q4 2015 to 32.1% in Q4 2016. In the used car market, 73- to 84-month loans increased from 16.4% in Q4 2015 to 18.2% in Q4 2016.

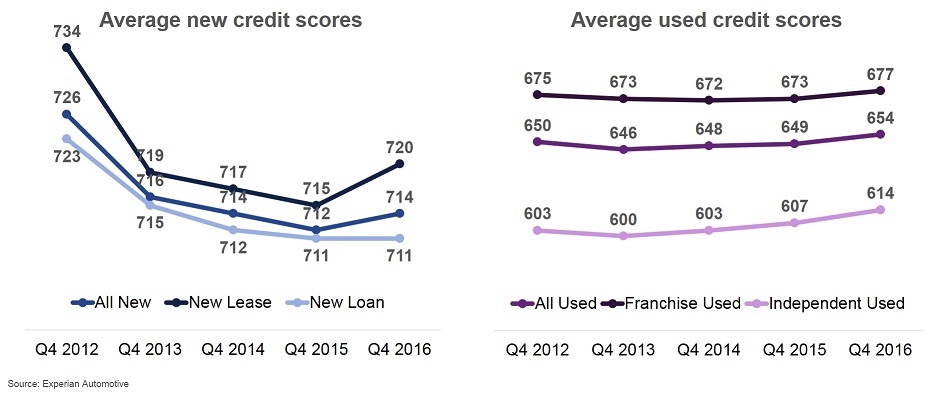

Current market conditions align with the operating philosophies of most credit unions, as the lending industry as a whole has moved toward consumers with better credit. In Q4 2016, the average credit score for a new vehicle loan was 714, up from 712 in Q4 2015. For used vehicles, the average credit score jumped from 649 in Q4 2015 to 654 in Q4 2016. Because credit unions typically loan to consumers with good credit, the shift to higher average credit scores plays to their strengths.

More prime consumers moving to used car financing and driving up the average credit score strengthens credit union portfolios, as credit unions focus heavily on used car financing. Credit unions remain the second largest lender in used car financing – and overall financing – as they grew their used vehicle loan share from 25% in Q4 2015 to 25.4% in Q4 2016. Overall, credit unions grew total market share to 19.1% in Q4 2016 from 18% in Q4 2015.

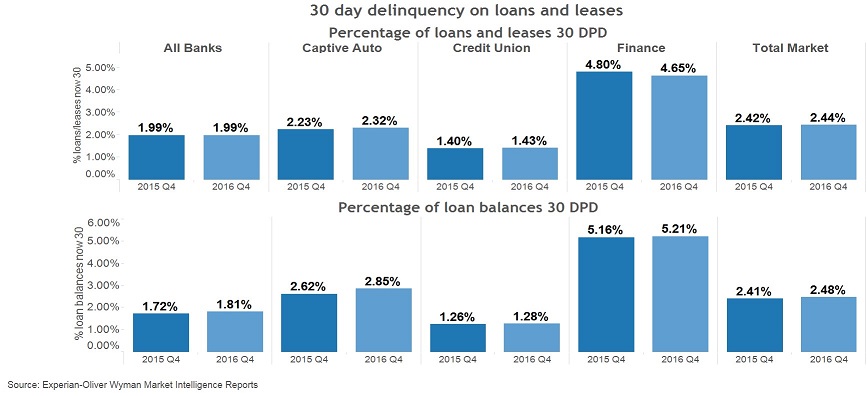

Credit unions continue to have low delinquency rates compared with the rest of the industry. In Q4 2016, the industry average for 30-day delinquencies was up slightly from 2.42% in Q4 2015 to 2.44%. While 30-day delinquencies for credit unions rose slightly (from 1.4% in Q4 2015 to 1.43% in Q4 2016), they are still the lowest in the industry. Banks had a 30-day delinquency rate of 1.99%, captives were at 2.32% and finance companies were at 4.65%.

For 60-day delinquencies, the industry average was 0.78% in Q4 2016, up from 0.71% in Q4 2015. For credit unions, the 60-day delinquency rate was flat at 0.37%. But captives, banks and finance companies all had increases in their 60-day delinquency rates. Captives had the sharpest increase, moving from 0.44% to 0.58%, while banks moved from 0.61% to 0.67% and finance companies went from 1.76% to 1.82%.

The automotive market is poised for another excellent sales year. As NADA economist Steven Szkaly has mentioned, sales in 2017 should reach approximately 17.4 million units. While this is flat compared with 2016, reaching more than 17 million units will make 2017 one of the top five sales years of all time.

At the same time, slight increases in delinquencies are making banks and captive finance companies slightly more wary about making risky loans. This pullback from consumers with lower credit could play well for credit unions, as they can gain market share simply by staying the course.

Melinda Zabritski is Senior Director of Automotive Credit Experian. She can be reached at 714-830-7734 or [email protected].

Melinda Zabritski is Senior Director of Automotive Credit Experian. She can be reached at 714-830-7734 or [email protected].

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.