Snubbed by lenders, entrepreneurs are taking their pitches to the people to secure funds for what some might consider risky investments.

Snubbed by lenders, entrepreneurs are taking their pitches to the people to secure funds for what some might consider risky investments.

One of the latest players entering the crowdfunding space help auto dealerships build capital by offering competitive loans with the ability to earn interest each quarter.

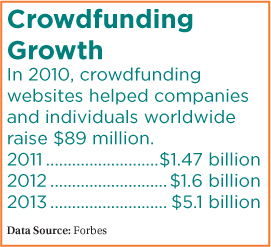

Crowdfunding is rapidly becoming an alternative way to raise money and in some cases, eliminating middlemen such as credit unions and banks. The general idea is the person seeking capital will solicit financial contributions from the public through a campaign that is often created online. In return, donors traditionally receive a future return on their investment.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.