The idea that branch banking could suffer the same fate as musicstores and bookstores is typically greeted with a variety ofreactions from disdain to panic to outright denial. There's agrassroots belief among many of the incumbents that branches arestill at the “core” of banking, but if we can see the same trendsoccurring in branching as we've seen in other industries, then wemust be able to draw the same conclusions about the eventual andlikely impact to the industry from a distribution perspective.

|The Death of the Branch

- Day One: Amazon, Apple, Kindle light the fire undere-commerce.

- Day Two: Changing consumer behavior drives down branchuse, profitability.

- Day Three: The inevitable end of bricks-and-mortarbranching.

So let's have a look at the data we can see that shed some lighton the future.

Branch Growth is Flat for the First Time in 100 Years

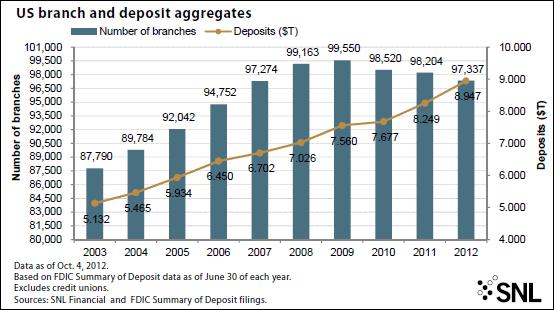

2008 to 2012 were all record years for branch closures in theUnited States with average closures exceeding 2,000 branchesannually (the actual number of closures last year was 2,267). While some new branches werealso opened in those years, there was a net loss of 1-2% each year,which doesn't sound like a lot, but keep in mind that since 1966 there hadonly ever previously been one year (1986) when we'd seen an overalldecline in the total number of branches. In the past four yearswe've seen it every single year.

|

These are U.S. figures but in the U.K. this declinehas been happening since 1990 and we're seeing the same trends inAustralia, New Zealand, France andGermany.

|By the time that FDIC figures are showing annual declines of 5%to 10% in the number of branches operating, it will alreadyprobably be too late for many branch-led businesses to respondproductively, just as it was for the likes of Borders andBlockbuster. So the real issue is that can we see data that mightlead to greater velocity of closures in the near term.

In-Branch Revenue is Declining

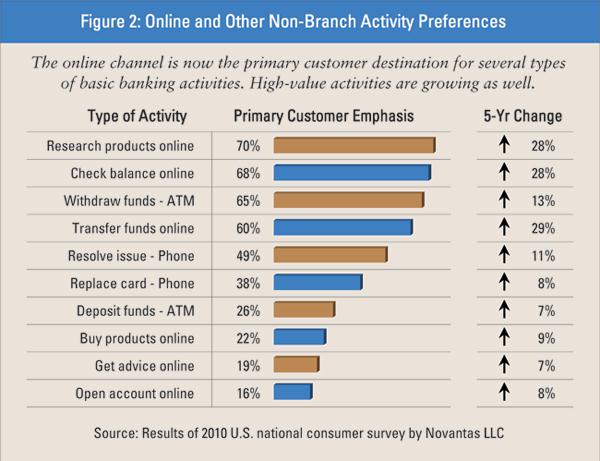

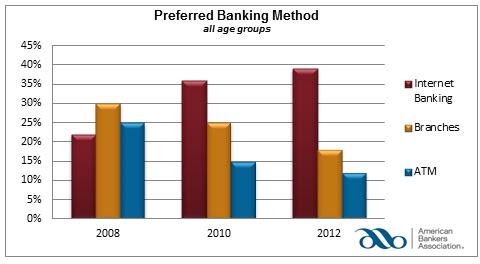

By almost every branch activity measure, preference for branchis declining in day-to-day bank interactions. While account openingis still the preference for three-fourths of new customers, that isdown 11% in the past five years and the decline is speeding up dueto mobile and online account opening options available tocustomers.

|

Activity has clearly shifted to non-branch channelsfor day-to-day banking activities as a result of convenience andease-of-use.

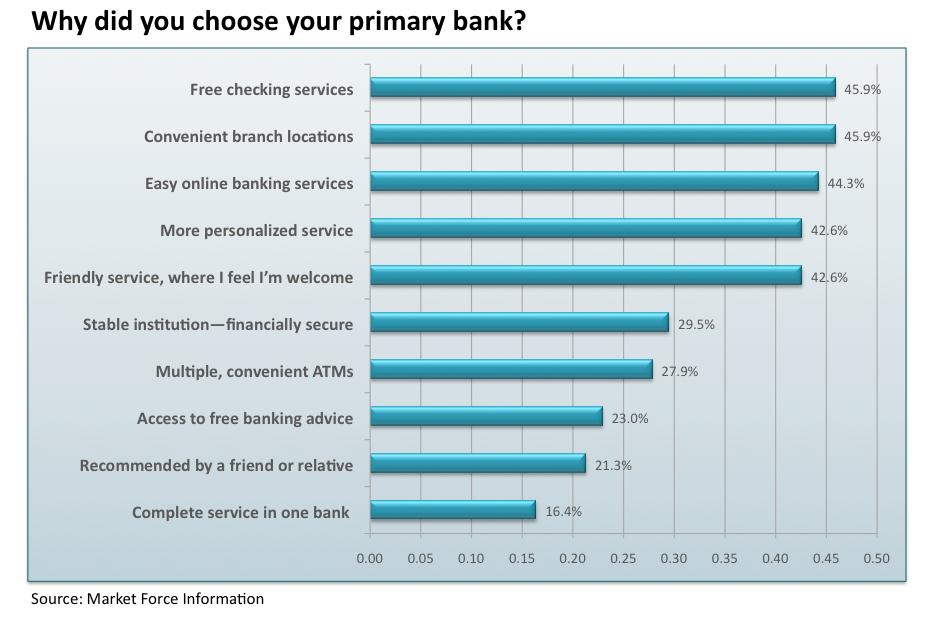

|When looking at branch placement, we're always heavily focusedon branch location as a driver of convenience for customers toaccess the real estate. The truth is today, though, that customersjust find other channels far more convenient. But thatdoesn't always gel with survey responses when we ask customers howthey choose a new bank.

|

The problem with surveys like this is two fold. Firstly thesurveys are asking the wrong questions – where does mobile oronline sit in this survey? Secondly, while psychologicallya branch might still factor into a decision around the choice of apotential financial institution (when you ask in a survey) thatpsychology simply isn't translating into either visits forindividual customers or driving new revenue in-branch.

|While good branches are getting some increase in overallactivity due to natural growth in the customer base, the reality isthat most branch banking has been flattening out on a trendingbasis for close to a decade now.

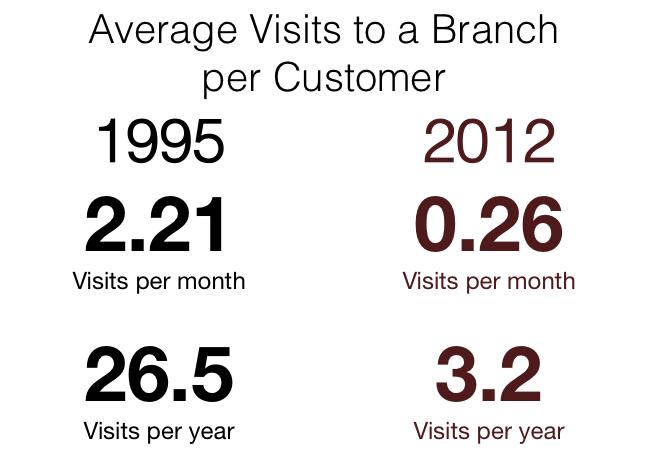

|A great measure of branch activity is simply how often theaverage customer visits a branch every month or every year, butfinding data on annual average visits per customer perbranch is like finding a needle in a haystack. Primarily thisis because prior to the late 90s banks never had an alternativerevenue source outside of the branch. However, it can beascertained by looking at customer transactions or inquiries andsimply aggregating interactions in-branch up to a maximum of onevisit per day regardless of the number oftransactions/enquiries.

|This then gets us the number of days a year the customer visiteda bank branch as a comparative measure. That number is a greatindicator of the viability of the bank branch. So after extensiveresearch I was able to come up with a blended average for the U.S.market by talking to top 10 U.S. banks and a selection of smallercredit union and community banks at a regional and state level. Thenumbers are enlightening:

|

Changing Retail Banking Consumer Branch VisitBehavior (Source: Bank 3.0 research)

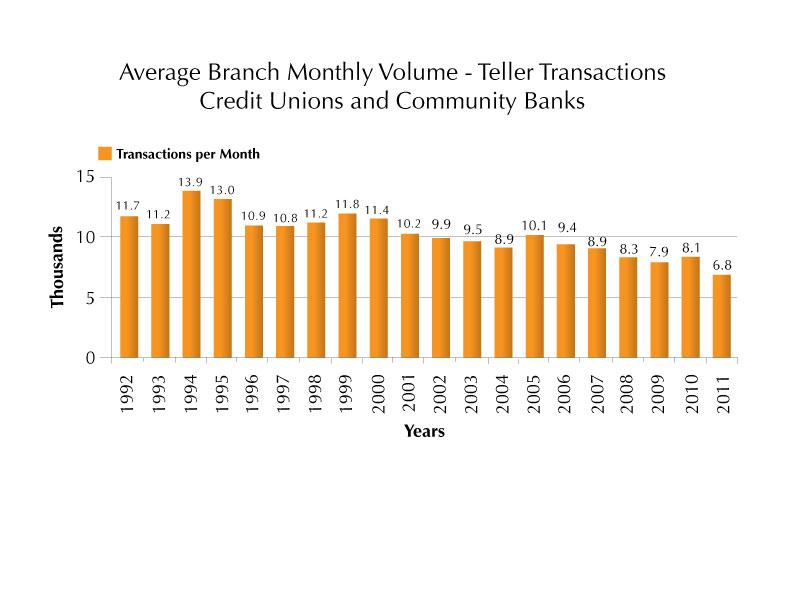

|This decline in average annual visits per year can largely beexplained as a function of changing behavior around transactionalbanking as a result of the appearance of the ATM in the late 1980sfollowed by Internet banking in the late 90s.

|In most developed economies this meant that Internet bankingsurpassed branch as the primary day-to-day channel for bankingsomewhere around 2008-2009. Since then the requirement to go to abank branch for day-to-day transactional activity has beendeclining.

|The ability to research products online has also been steadilyimproving. So while the change in consumer behavior started withtransactional activity, it has now extended to product research andadvice. I just don't need to go to the branch as much as I used to,so these figures should not really surprise anyone.

|

Mobile use is rapidly accelerating, including mobile-only use(See NetBanker analysis from ComScore research). Already half ofsmartphone users in the United States are using mobile bankingregularly (source: FederalReserve Survey) – and that equates to one third of the totalpopulation. This, too, is having an impact on the need tovisit a branch for basic transactional activity, further applyingpressure to behavior that would support branch longevity.

|Think about check deposits. With remote check deposit capturecapability I don't need to go to a branch to even deposit a checkanymore – further reducing my dependence on the physical space.

|

Decline in Average Monthly Branch Transactions(Source: FMSI)

|The problem is if I am not going to a bank branch to do everydaybanking, the likelihood of me engaging in a sales event ordiscussion is also reducing.

Next … Death of the Branch Part 3: The (Falling)Numbers Don't Lie

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.