This past week, six credit unions welcomed newprofessionals to their staff or board, while another credit unionsaid goodbye to a longtime CEO. Plus, a lending CUSO hired a newexecutive.

||

WEST

|The $580 million Clark County Credit Union inLas Vegas promoted Dennae Peoples to executiveassistant. In her new role, Peoples will provide a wide range ofadministrative, project and office support for the CEO and seniormanagement team. Peoples has been a player in the financialservices industry for the past 10 years and has been with the CCCUteam since 2013.

| The $185 millionAltier Credit Union in Tempe, Ariz., namedDavid Skilton president/CEO, a move that will takeeffect Oct. 1, 2016. With more than 20 years of senior executiveexperience in the credit union industry, Skilton joined Altier asSVP/CFO in 2008. He has been responsible for a long list ofaccomplishments, including a net worth recovery strategy thathelped Altier successfully navigate the hardships of the greatrecession.

The $185 millionAltier Credit Union in Tempe, Ariz., namedDavid Skilton president/CEO, a move that will takeeffect Oct. 1, 2016. With more than 20 years of senior executiveexperience in the credit union industry, Skilton joined Altier asSVP/CFO in 2008. He has been responsible for a long list ofaccomplishments, including a net worth recovery strategy thathelped Altier successfully navigate the hardships of the greatrecession.

|

|

|

|

The $4.3 billionEnt Credit Union in Colorado Springs, Colo.,promoted Jeremy Hudson to mortgage loan officer.Hudson will be the second mortgage loan officer dedicated toserving members in the Pueblo area from Ent's Pueblo Main locationat 300 West 5th Street. During his eight-year career with Ent,Hudson has held a number of member service positions of increasingresponsibility. He most recently served as Ent's south servicecenter coordinator.

The $4.3 billionEnt Credit Union in Colorado Springs, Colo.,promoted Jeremy Hudson to mortgage loan officer.Hudson will be the second mortgage loan officer dedicated toserving members in the Pueblo area from Ent's Pueblo Main locationat 300 West 5th Street. During his eight-year career with Ent,Hudson has held a number of member service positions of increasingresponsibility. He most recently served as Ent's south servicecenter coordinator.

|

|

|

|

The $7.5 billionSan Diego County Credit Union in San Diego isdeeply saddened to announce that Rod Calvao, whoserved as president/CEO from 1992 to 2007, passed away peacefullyat the age of 69. Calvao first joined the credit union'ssupervisory committee in January 1973 and was then elected to theboard of directors in December 1974. Over the years, Rod served invarious roles on the board of directors. During Rod's 15-yeartenure as president/CEO of SDCCU, the organization continued tosucceed and grow from 11 branches and $499 million in assets to 24branches and $4 billion in assets.

The $7.5 billionSan Diego County Credit Union in San Diego isdeeply saddened to announce that Rod Calvao, whoserved as president/CEO from 1992 to 2007, passed away peacefullyat the age of 69. Calvao first joined the credit union'ssupervisory committee in January 1973 and was then elected to theboard of directors in December 1974. Over the years, Rod served invarious roles on the board of directors. During Rod's 15-yeartenure as president/CEO of SDCCU, the organization continued tosucceed and grow from 11 branches and $499 million in assets to 24branches and $4 billion in assets.

SOUTH

| The $435 millionBrightStar Credit Union in Sunrise, Fla.,appointed Greg Cassamajor as marketing manager.Cassamajor will be responsible for overseeing the strategicplanning of community outreach and marketing campaigns. A leader inthe banking and finance industry for more than 15 years, Cassamajorhas assisted in increasing revenue and sales at varioushigh-profile financial institutions including Bank of America,Commerce Bank, HSBC Bank and TD Bank.

The $435 millionBrightStar Credit Union in Sunrise, Fla.,appointed Greg Cassamajor as marketing manager.Cassamajor will be responsible for overseeing the strategicplanning of community outreach and marketing campaigns. A leader inthe banking and finance industry for more than 15 years, Cassamajorhas assisted in increasing revenue and sales at varioushigh-profile financial institutions including Bank of America,Commerce Bank, HSBC Bank and TD Bank.

|

MIDWEST

|From Aug. 1-23, 2016, employees from the $1 billionFirefly Credit Union in Burnsville, Minn.,participated in a school supply drive in partnership with 360Communities. The credit union has been donating to local schoolsfor more than 10 years. Crayons were one of the most needed itemsfor this upcoming school year and Firefly guaranteed a 100% crayonmatch. Employees surpassed their goal and donated 32,364 crayonsand with the crayon match implemented, the total came to 64,728crayons donated.

|EAST

| John Murga, CEOof the $133 million Hidden River Credit Union inPottsville, Penn., has been appointed to the board of directors ofthe Pennsylvania Credit Union Association. Murga will fulfill athree-year term that started in May 2016 and represent creditunions in the asset category of $50 million to $250 million. Theboard vacancy is a result of a merger between credit unions withexecutives who both held seats on the association board. Since1998, Murga has served as the CEO of the Pottsville-based creditunion.

John Murga, CEOof the $133 million Hidden River Credit Union inPottsville, Penn., has been appointed to the board of directors ofthe Pennsylvania Credit Union Association. Murga will fulfill athree-year term that started in May 2016 and represent creditunions in the asset category of $50 million to $250 million. Theboard vacancy is a result of a merger between credit unions withexecutives who both held seats on the association board. Since1998, Murga has served as the CEO of the Pottsville-based creditunion.

|

|

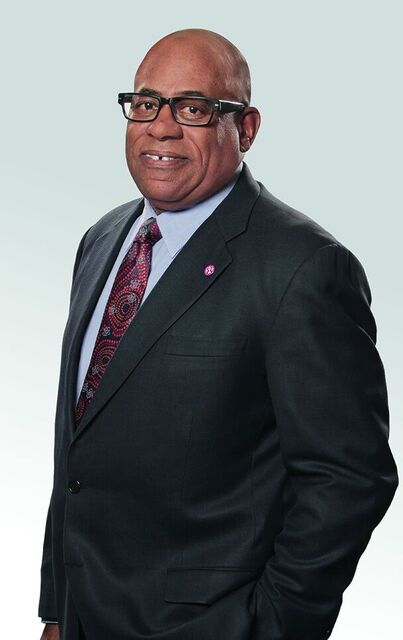

The $2.5 billionMunicipal Credit Union in New York City announcedJames Durrah has assumed the position of chair ofthe board of directors. Durrah, who has served on MCU's board ofdirectors since 2010 and most recently served as first vice chair,replaces former Board Chair Honorable Sylvia G. Ash. In addition toDurrah assuming the position of Board Chair, C. RichardWagner was elevated to the position of first vice chairand Loretta Y. Jones was elevated to the positionof second vice chair. These changes in positions follow the rulesoutlined in MCU's bylaws regarding board vacancies. MCU is alsomoving forward in filling the vacant board seat, per itsbylaws.

The $2.5 billionMunicipal Credit Union in New York City announcedJames Durrah has assumed the position of chair ofthe board of directors. Durrah, who has served on MCU's board ofdirectors since 2010 and most recently served as first vice chair,replaces former Board Chair Honorable Sylvia G. Ash. In addition toDurrah assuming the position of Board Chair, C. RichardWagner was elevated to the position of first vice chairand Loretta Y. Jones was elevated to the positionof second vice chair. These changes in positions follow the rulesoutlined in MCU's bylaws regarding board vacancies. MCU is alsomoving forward in filling the vacant board seat, per itsbylaws.

|

|

|

|

CUSOs

| CU Recovery and The LoanService Center promoted Chris Becker tothe newly created position of COO. In his new role, Becker willdirect the organization in meeting growth, financial andoperational goals. He will work with the leadership team to developoperational strategy and policies to ensure the expectations oftheir clients are met while keeping service as the number onepriority.

CU Recovery and The LoanService Center promoted Chris Becker tothe newly created position of COO. In his new role, Becker willdirect the organization in meeting growth, financial andoperational goals. He will work with the leadership team to developoperational strategy and policies to ensure the expectations oftheir clients are met while keeping service as the number onepriority.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.