Whilecommercial and industrial lending can be critical lines ofbusiness for lenders, getting caught up in a frenzy to finance moreloans may cause some missteps that could wound portfolios for yearsto come.

Whilecommercial and industrial lending can be critical lines ofbusiness for lenders, getting caught up in a frenzy to finance moreloans may cause some missteps that could wound portfolios for yearsto come.

According to the Aite Group report, The Booming C&IMarket: Bankers Beware, because rates can fluctuate with thesupply of credit in the marketplace, loan officers at credit unionsand banks alike must closely manage and nurture each relationshipand monitor every credit exposure in the lending lines ofbusiness.

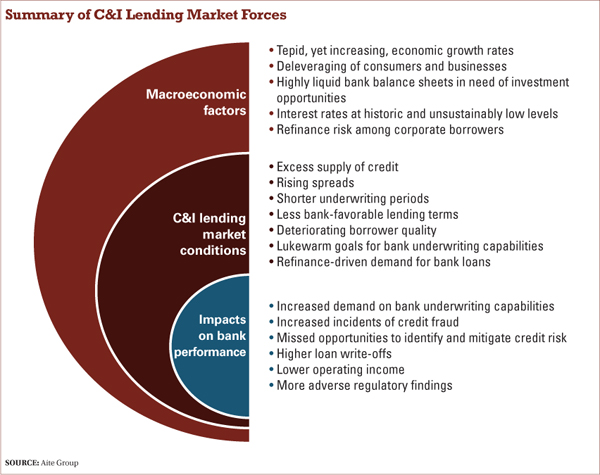

|A list of risks summarized in the graph above. (Click on thegraph to exapnd.)

|Those standards are still important as the demand for bank loanscontinues to increase, said David O'Connell, senior analyst inwholesale banking at Aite and author of the report. Since 2008, lowinterest rates have made credit available to companies that wouldotherwise be unable to borrow.

|With many public and private debt issuances bearing terms ofbetween three and five years, Aite expects many public debtborrowers to fail to refinance with their current non-bank debtproviders. When such companies seek alternate forms of finance, theexpectation is the demand for banks' commercial loans will increasesignificantly.

|Higher spreads on bank loans are another area to watch becauseas more companies seek bank-provided debt, banks will be in aposition to charge higher spreads over their cost of funds. Spreadsgenerally increase and decrease with borrowing rates, O'Connellsaid.

|For credit unions, the potential risks of riding the loan demandand higher spread wave could have stronger implications than fortheir bank counterparts.

|“Credit unions are going upmarket with heavier participation incommercial lending,” O'Connell said. “My prediction is there willbe a bunch of borrowers with unsuccessful credit risk in a low rateenvironment that will not be as creditworthy when rates go back upfrom where they are now. There's going to be a lot of competitionto do two things: book loans or turn down the right loans.”

|Indeed, with competition for commercial and investment loansheating up, the increase in reserves could represent a move deeperinto the risk pool for some banks, according to SNL Financial, aCharlottesville, Va.-based research firm.

|In the second quarter, reserves for commercial loans totaled $26.9 billion, up from $26.57 billionin the first quarter and $25.2 billion in the 2013 second quarterat commercial and savings banks.

|As reserves rise, lenders and risk managers at banks who seelending appetite outpacing their underwriting capabilities shouldconsider advocating for either slower C&I portfolio growth orbetter underwriting capabilities, according to the report.

|Aite surveyed senior IT executives at 20 large banks based inNorth America. When asked about their loan underwritingcapabilities, 62% of respondents said they were “satisfied” withthese capabilities and the same percentage sought to have “stellar”underwriting capabilities, O'Connell said.

|Although those percentages were high, O'Connell said there werethree key concerns hiding beneath the surface.

|First, underwriting is one of only four core bankingcompetencies, O'Connell said. Though seemingly complex, thebusiness of banking really only comprises gathering deposits,deploying the proceeds as loans, ensuring that loans get repaid,and providing related services, according to the report.

|“Aite Group is concerned that a greater majority of banks do notseek stellar capabilities for a skill that is a key bank competencyand crucial to the maintenance of profitability levels,” the reportread.

|Second, underwriting can be a competitive differentiator, O'Connellnoted. When lenders and analysts underwrite loans, they strike abalance between the desire to win a piece of business and the needto book a loan that will not deteriorate in credit quality,something that is not easily done.

|The credit mandate requires as much protection in the form ofcovenants, collateral and guarantees as possible; a spread overcost of funds that compensates for the riskiness of a loan is alsorequired, the report read. But in order to win business,underwriters also have to avoid structuring a deal soconservatively that a rival bank offers more favorable terms andwins the business away.

|O'Connell said the more support underwriters receive and themore these capabilities are accompanied by stellar goals, thebetter a bank will be at winning new business without structuringweak loans.

|“Underwriting speed is also critical to competitive outcomes;the faster a bank can underwrite a loan in a way that accommodatesits risk appetite, the more often it will win business incompetitive situations,” he said.

|Third, underwriting impacts regulatory outcomes. O'Connell saidduring audits, bank examiners have always focused heavily on banks' underwritingcapabilities, including how their credit policy is designed, howthose rules are enforced, how well staff underwrites loans, and howwell underwriting is documented.

|As a result of the global financial crisis of 2008, various bankregulators in the United States now use stress testing to evaluatethe banks they regulate, O'Connell said. Within these demanding andbroadly scoped tests are evaluations of a bank's ability to managerisk with appropriate underwriting.

|“Banks shouldn't take their eye off the ball to focus oncompetitive threats,” O'Connell said. “Competitiveness should notcome at the expense of banks' core competencies.”

|Banks' core business is in gathering deposits, deploying theresulting liquidity as loans, and managing the resulting risks intheir loan portfolios, he added.

|“If banks don't adequately invest in their credit riskmanagement and underwriting, the resulting losses will become a farbigger problem than any threat of disintermediation,” O'Connellsaid.

|Meanwhile, credit unions are in a keen position to make the mostof their conservative lending standards practiced during the heightof the Great Recession, another business lending veteran said.

|Member business loans increased by 44% since 2008 whilecommercial loans at smaller community banks have declined by morethan $120 billion or 25%, said Larry Middleman, president/CEO of CUBusiness Group LLC, a business lending and services CUSO thatserves more than 460 credit unions in 45 states.

|Middleman also noted the strong commercial real estate activityin eight of the 12 Federal Reserve Districts, and that four of 10 small businessesare looking for loans this year.

|With this demand, there are a variety of innovative businesseslending options available to credit unions today, he offered.

|“From government-guaranteed lending to equipment leasing toonline working capital loans, credit unions can choose from a menuof lending options to offer their members,” Middleman said. “Andall of these allow the credit union to keep the core businessrelationship while supplementing with additional products andgenerating fee income for the credit union.”

|Overall, commercial loan dollars at banks dropped 10% between2008 and 2011, and have now recovered to 2008 figures, he said.Additionally, credit union charge-offs have stayed well below thoseof banks.

|“Credit unions stayed below the magical 1% charge-off rate forbusiness loans, meaning less than 1% of total business loanbalances,” Middleman said. “On the other hand, commercial bankcharge-off rates went as high as 2.45% in 2009. Given thedifficulties of the recession, this performance by credit unions isquite admirable.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.