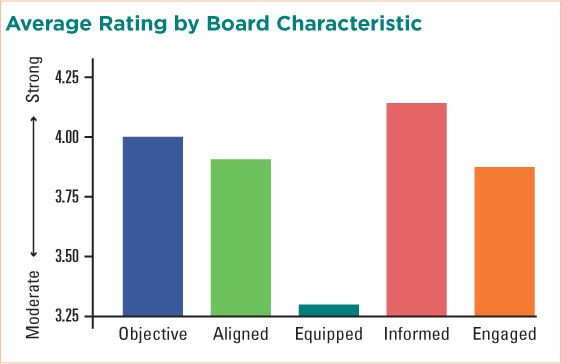

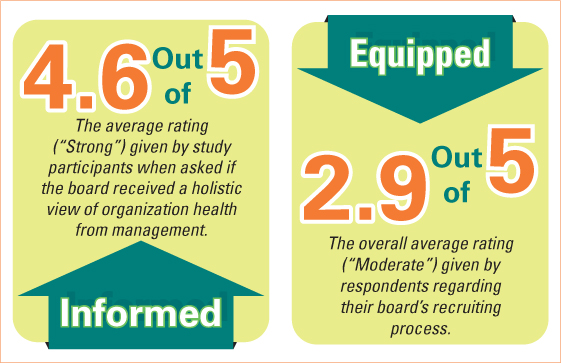

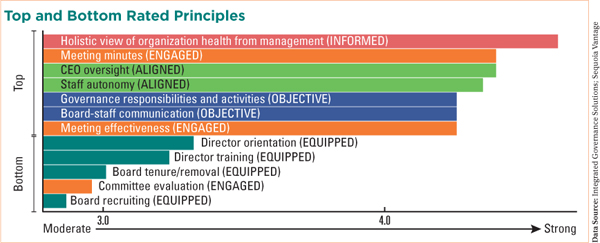

While some credit union CEOs and senior managers feel theirboards are well-informed, they rated board recruiting, directororientation and training and director tenure and removal as areasripe for improvement.

|That was one of the findings from the Credit Union GovernanceStudy commissioned by Sequoia Vantage and performed by IntegratedGovernance Solutions.

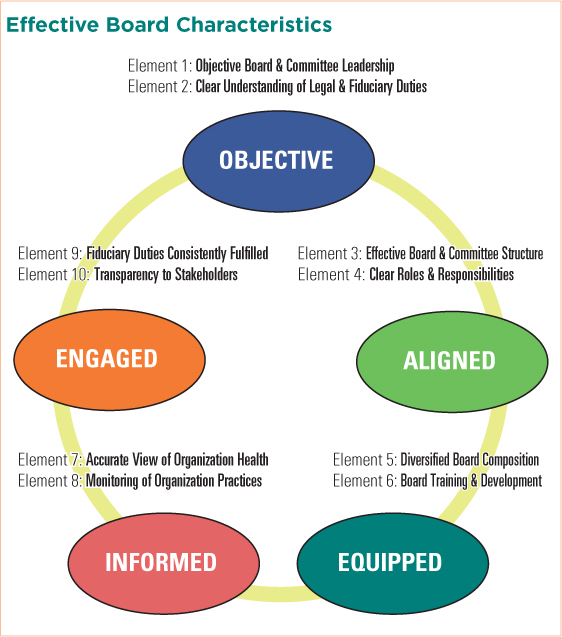

|The respondents said board and risk management governancepractices were quite healthy overall but some boards may beinadequately equipped to govern in the challenging marketplace ofthe future.

|Among the recommendations for unlocking the value of a creditunion board, the study suggested equipping directors with wisecounsel and effective oversight, streamlining board reporting andensuring the voice of the member is heard.

|Twenty-two credit unions with assets ranging from $18 million to$1.7 billion and memberships from 3,800 to 167,000 completed a33-question, online assessment regarding their board and riskmanagement governance practices. Respondents consisted of seniormanagement from vice presidents to CEOs, 77% of which were creditunion CEOs. The study was conducted from April 1 to Oct. 31,2013.

|For information about access to the full study,contact David Seibert of Sequoia Vantage at(651)-200-6800.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.