Times are good for themembers of Workers' Credit Union, who can collectively brag thatthey are billionaires.

Times are good for themembers of Workers' Credit Union, who can collectively brag thatthey are billionaires.

The Fitchburg, Mass.-based credit union reached the $1 billionasset milestone during the third quarter last year, according tofinancial performance reports posted on the NCUA's website.

|This year, the party continues as WCU celebrates its100th anniversary.

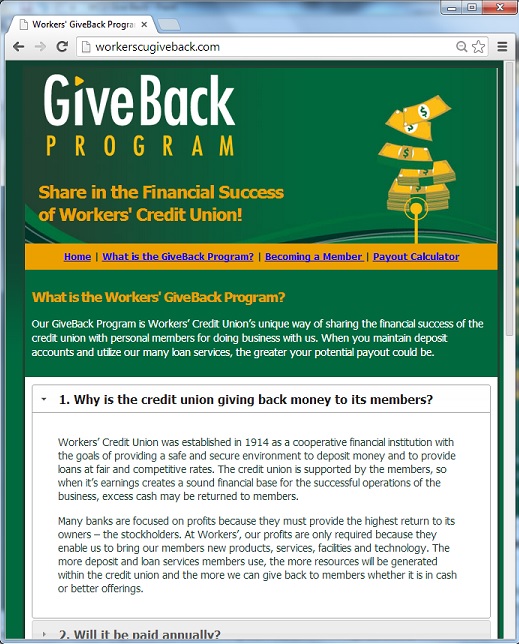

|And, WCU gave back more than $2 million to its members, thefirst such payout in the credit union's history. The credit unioncreated a microsite promoting and explaining the payout.(Click on the screen shot at left toexpand.)

|Money was deposited into member's accounts Feb. 13. The payoutincluded 30 basis points for checking accounts, 20 basis points forsavings, consumer loans and checking account lines of credit, and10 basis points for mortgages, refinances, home equity loans andequity lines, and CDs.

|President/CEO Doug Petersen said as far as he knows, it's thefirst such dividend paid by a credit union in CentralMassachusetts.

|“The credit union has always had good financial results,”Petersen said. “We have a very strong capital ratio: 12.3%. At thispoint we looked ahead three, four, five years. We thought ratherthan building capital the money would be of better use in ourmembers' hands than it would be in our hands. This gives them anopportunity to benefit from one of our strategic advantages.”

|So what has put the credit union in such a solid position?

|Petersen immediately credited the many employees who, heemphasized, do a very, very good job.

|But it's not just one thing, he continued.

|The Great Recession presented issues, but didn't hurt the creditunion too much.

|Mergers have played a role in the credit union's growth, and thecooperative has always operated under a community charter.

|Mortgages have been another factor fueling success. Petersenindicated credit unions in the Northeast have been more involved inmortgage lending than in many other regions. He believes WCU has asolid reputation in its market area, prompting members to turn tothe credit union when they buy a home.

|The credit union has also expanded its external sales staff toboost visibility in the community and meet with real estate agents.Given the number of large banks in cities like Boston, it's easy toassume WCU would face strong mortgage competition.

|But Petersen sketches a positive picture.

|“We're headquartered in Fitchburg, and they callFitchburg-Leominster the twin cities. They both have about 45,000residents. So we're in a lot of smaller towns. We have great marketshare in those towns and that helps our visibility,” he said.

|Even so, the large banks are indeed competitors. There's also aroster of non-traditional lenders such as Quicken Loans, which isone of the top five mortgage producers in the area. Petersenconsiders that significant, since Quicken has no brick-and-mortarlocations to establish and reinforce identity.

|“Today you compete with everyone,” Petersen declared. “Thehyper-competition is always a concern. That forces us to be true toour roots and be very, very focused. We want to improve the dailylives of our members, and that's what we live by. It's all aboutexecution, and it goes back to our people.”

|Read more about Workers' Credit Union and how it's foundsuccess in the April 2 print issue of CU Times.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.