The NCUA announced on Monday the Temporary Corporate CreditUnion Stabilization Fund received a clean audit opinion for thefifth consecutive year. The agency had previously announced on Feb.18 it also received cleanaudits for the NCUSIF, Operating Fund, Community DevelopmentRevolving Loan Fund and Central Liquidity Facility.

|“KPMG LLP, the independent firm that audits the stabilizationfund's financial statements, issued an unmodified audit opinionwith no reportable findings,” the agency said on Monday.

|The NCUA also said the stabilization fund's financial conditionremained stable throughout 2013, “maintaining sufficient availableliquidity to meet its obligations while its deficit net positioncontinued to decline.”

|The NCUA applied $1.073 billion to the stabilization fund as a result ofthe settlement with JP Morgan in November of last year.

|“With the settlements and the continued improvement in theperformance of the legacy assets underlying the NGN Program,insured credit unions are not currently expected to be chargedanother special premium assessment,” said the financial statementaudit report. “Should adverse conditions develop, such as a severeeconomic downturn, the NCUA Board may impose a special premiumassessment.”

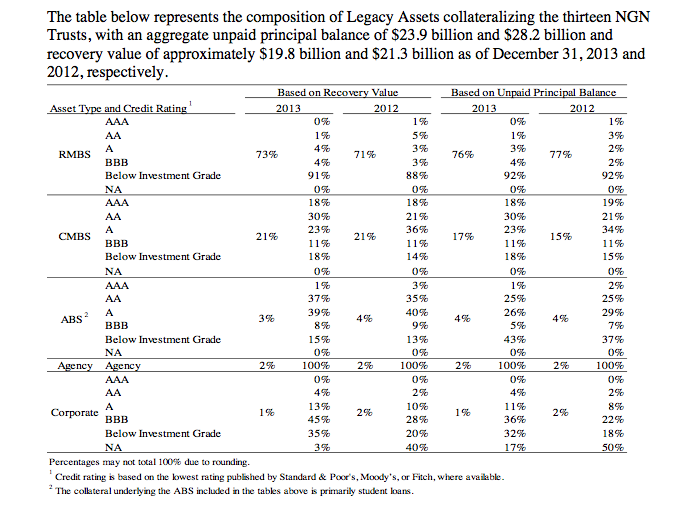

| The report also revealed thatdespite improved loss projections on corporate credit union legacyassets, the credit quality of residential mortgage backedsecurities continues to decline. (Click on the chart atleft to expand.)

The report also revealed thatdespite improved loss projections on corporate credit union legacyassets, the credit quality of residential mortgage backedsecurities continues to decline. (Click on the chart atleft to expand.)

According to the audit report, 88% of residential mortgagebacked securities, which represent 73% of legacy assets were belowinvestment grade in 2012, which increased to 91% in 2013. In 2012,5% were rated AA, which declined to 1% in 2013.

|Likewise, the share of commercial mortgage backed securities inthe legacy asset portfolio also experienced an increase insecurities that fell below investment grade. However, CMBS, whichmake up 21% of legacy assets, also saw an increase in AA-ratedbonds, from 21% in 2012 to 30% in 2013. The NCUA's Chief FinancialOfficer will provide a more detailed report on the stabilizationfund at the agency's monthly board meeting on Thursday.

|“KPMG's latest report, following the board's announcement lastNovember that we do not expect an assessment in 2014, demonstratesthe agency's planning and management are prudent and that we aremaintaining transparency as we work to complete the resolution ofthe corporate credit union crisis,” NCUA Board Chairman Debbie Matzsaid.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.