As income from net interest margin has dried up, Ben Rogers,research director at the Filene Research Institute, said more andmore has had to come from noninterest income.

|“But rather than waiting on the clouds, many credit unions havebeen building enough NII to guarantee that the river of net incomedoesn't run dry,” Rogers said. “As they look for additionalsources, they need to be sure they're giving members value, notjust extracting it.”

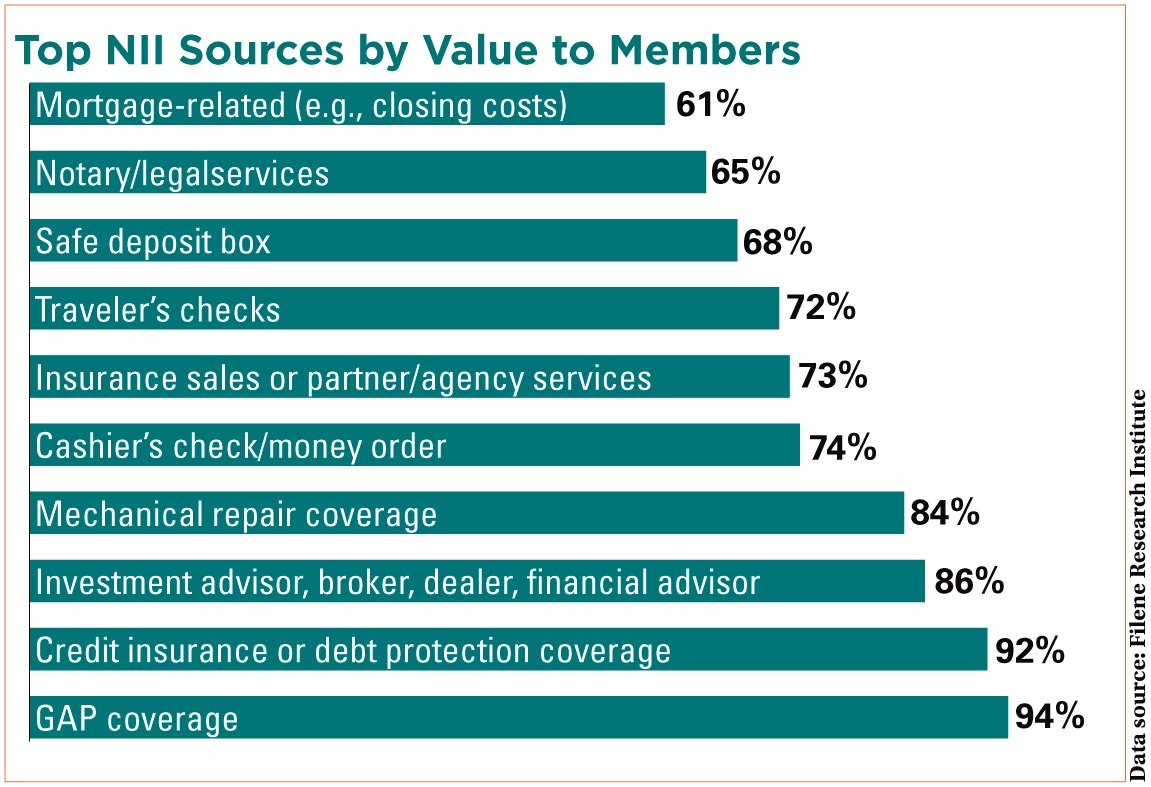

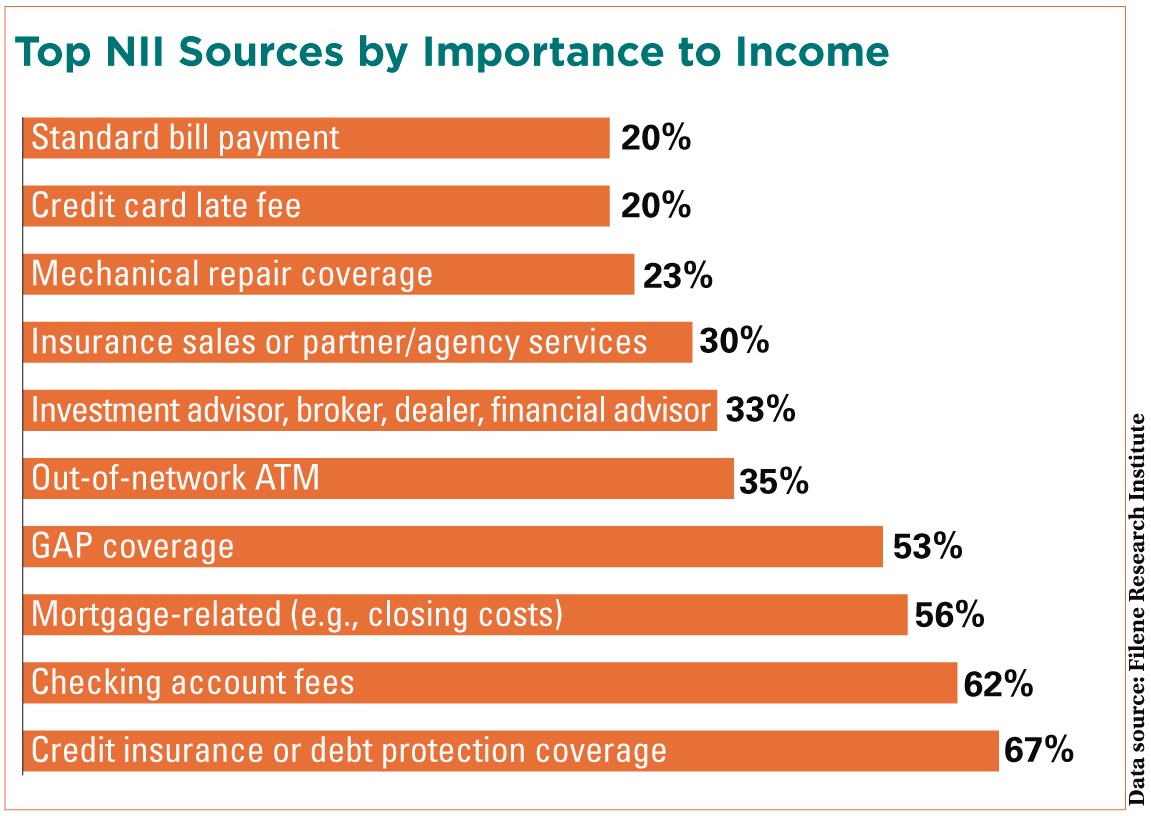

||Filene recently conducted research seeking to balance twoimportant credit union imperatives: the need for NII that supportsthe operating costs of the credit union, and the imperative thatcredit union leaders feel to charge fees that are fair and thatsupport services that add value to members, Rogers said.

|Click on the graphs at left toexpand.

| “The tension is real. Toomany or ill-advised fees and credit unions run the risk ofalienating members and losing their cooperative difference,” hewarned.

“The tension is real. Toomany or ill-advised fees and credit unions run the risk ofalienating members and losing their cooperative difference,” hewarned.

Read more on how credit unions can strike that balance in theFilene report: InSearch of Member-Friendly Noninterest Income.

|The report is the latest in a series of exclusive content fromFilene available to readers of Credit UnionTimes.

|Also, check out these other Filene reports:

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.