As a result of this evolution, credit unions that want todeliver the best member service are faced with deliveringexperiences tailored for each channel, while maintaining a threadof consistency throughout.

|Understanding where, how and why members use different digitalbanking channels positions credit unions to take on this challengeand exceed member expectations with robust digital offerings.

A Device Does Not Define a Channel

To offer a truly tailored experience, credit unions shouldleverage each digital device's capabilities to boost thefunctionality of the channels. For example, smartphones are fittedwith cameras that can be used to capture information, tablets offertactile functionality and a portability that encourages leisurelybrowsing, and PCs have keyboards, a mouse and a large screen thatfacilitates the input and review of information.

|However, the device in and of itself does not define thechannel. To optimize each of the channels, credit unions must alsoconsider where and how members use the device and the context andreasons for its use.

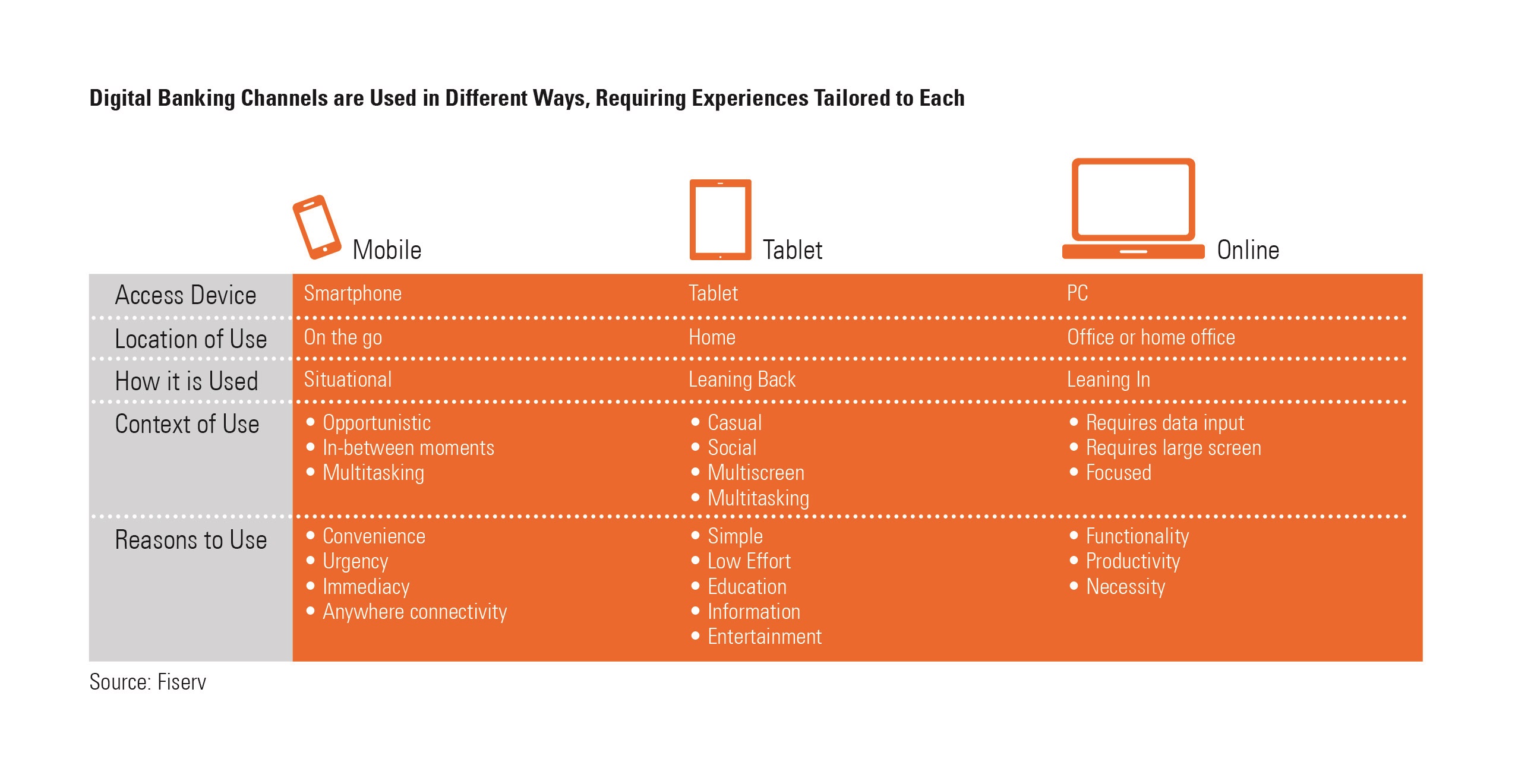

|Recent qualitative research conducted by Fiserv user experienceexperts, provides insights into consumer behaviours across digitalchannels, as summarized in the following table.

|Evaluating Members' Channel Use

| The research demonstrates why onesize certainly does not fit all when it comes to a greatmulti-channel experience.

The research demonstrates why onesize certainly does not fit all when it comes to a greatmulti-channel experience.

(Click on image at left to see expanded)

|For example:

Mobile. Brief, on-the-go interactions that takeplace in the mobile channel necessitate easy navigation and quickaccess to information such as account balances or ATM locations.Mobile users may also look for the ability to execute just-in-timetransactions such as transferring funds prior to making apurchase.

|For members engaged with mobile technology, services like remotecheck capture and the delivery of contextually relevant data (suchas rewards earning and redemption opportunities presented during atransaction) are also a good fit.

|Tablet. The casual, at-home use of tabletsencourages relaxed browsing in a lean-back posture. Tablet usersdesire simple, visually compelling content that is navigated withswipes and taps. As they sit in their living room they can talkwith their family or friends about a suggested product, askquestions about the product via chat, then take action aftergetting input.

|The context of tablet use, in combination with its capacity toprovide relevant content and chat capabilities to connect withcustomer service representatives, provides a compelling valueproposition to credit unions who may have struggled to engagetask-focused PC users for cross-sell opportunities.

Online. PCs are used for tasks that requireconsiderable effort such as data input, budgeting and taxpreparation which would often be cumbersome on a mobile phone ortablet. Users typically sit down and lean in to focus, often in aroom away from others. Tasks such as detailed PFM categorization,budgeting and tax preparation lend themselves well to the onlinechannel.

Consistent Information, Coherent Design

|While members expect tailored experiences for each channel, theyalso desire consistency in their banking interactions. Thecombination of these expectations – for both tailored experiencesand consistency of information – means that members want theirdigital interactions to share a common thread, rather than involvea patchwork of disparate experiences that create confusion.

|This includes displaying the same account names and accountinformation, ensuring the same passwords and preferences can beused, and having the same look and feel across channels. Above all,it is essential that data is accurate, real-time andconsistent.

|By providing tailored user experiences across the mobile, tabletand online channels, credit unions will ensure delivery of theright functionality on the right device while also providingconsistent information and a coherent experience andappearance.

|As new ways of banking emerge, the role of existing channels maychange, but the importance of delivering tailored experiences andconsistent information across all channels will continue to beessential in delivering the ideal user experience.

|Steve Shaw isvice president of strategic marketing, Digital Channels &Electronic Payments Divisions, at Fiserv Inc. in Brookfield,Wis.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.