The lending environment is undergoing an evolution.The continual entry of new players—especially on the Internet—hassharpened competitive knives that are cutting into credit unionincome. Business loans are an avenue for lenders to travel, sincenon-interest income is becoming so critical to survival.

The lending environment is undergoing an evolution.The continual entry of new players—especially on the Internet—hassharpened competitive knives that are cutting into credit unionincome. Business loans are an avenue for lenders to travel, sincenon-interest income is becoming so critical to survival.

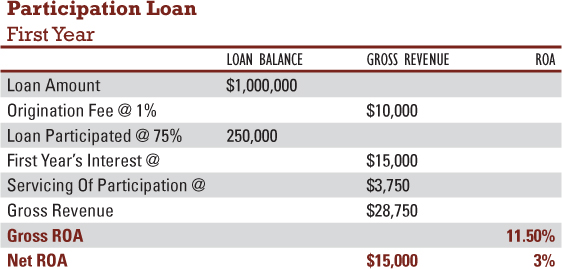

The following three examples show how auto, participation andSBA 7a loans add to an organization's revenue stream during thefirst year. The table shows a the traditional auto loan—the breadand butter of the credit union portfolio—has become morecompetitive as captive finance companies have the advantage ofbeing at the point of sale. And there is little opportunity fornoninterest income, unless other products are sold with the autoloan. An aggregate loan of $1 million earns a gross ROA of 2.99%for the first year. After expenses of underwriting, servicing,systems and staff the loan earns an estimated net ROA of 75 basispoints.

|Participation loans are a welcome addition to the portfolio fora number of reasons. For starters, they include origination andservicing fees. There is currently an oversupply of buyers forparticipation loans, but also an underdeveloped market of loanoriginators. Noninterest income could represents 48% of totalincome on such a loan.

|One of the unsung benefits of participation loans is that theparticipated portion of the loan doesn't count towards the 12.25%cap. This restrictive regulation is a drag on business lendinggrowth. Legislative efforts to unharness the cap have stalled.Participation loans can help alleviate the effects of the cap.

|Credit unions typically follow two strategies with businesslending. Lend and hold emphasizes interest income—not feeincome—and can result in the illusion of a higher-yielding loanportfolio due to a high loan-to-share ratio. This old school beliefmaintains that more loans on the books translate into a higherloan-to-share ratio, which equals more revenue. The loan-to-shareratio, though, doesn't show the speed and turn of the profit beingearned. Interest income is time-based and is restricted, while feeincome isn't.

|

The lend and sell strategy emphasizes noninterest or fee income.The loan that generates the highest level of non-interest income isthe highest driver of increasing ROA. The more loans that are soldand fees earned, the more profits generated and the lower the costof funds. To increase ROA and capital accumulation, a lend and sellstrategy is the best choice.

|The first year of a participation loan with an origination feeof 1%, interest income of 6% on the portion of the loan that wasn'tparticipated out, and the servicing fee of participation at 50basis points. The gross ROA after the first year of theparticipation loan is 11.50%, and after expenses, earns anestimated 3% net ROA.

|SBA loans offer a number of benefits to business lenders,including the potential for a higher ROA and fee income. And likeparticipation loans, the guaranteed portion of the loan doesn'tcount toward the cap.

|On such a loan, 75% of the $1 million loan was sold on thesecondary market. The first year's interest on the unguaranteedportion of the loan and loan servicing brings the gross revenue to$97,500. The gross ROA is 39%. After expenses, the net ROA is5%.

|The economy is still in recovery while the lending marketcontinues to limp along. Participation and SBA 7a loans are waysfor credit unions to increase fee income and ROA while assistingsmall businesses, their local markets and the national economy.

|Kent Moon is president/CEO of Member Business Lending LLC inWest Jordan, Utah.

Contact

801-230-1044 [email protected]

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.