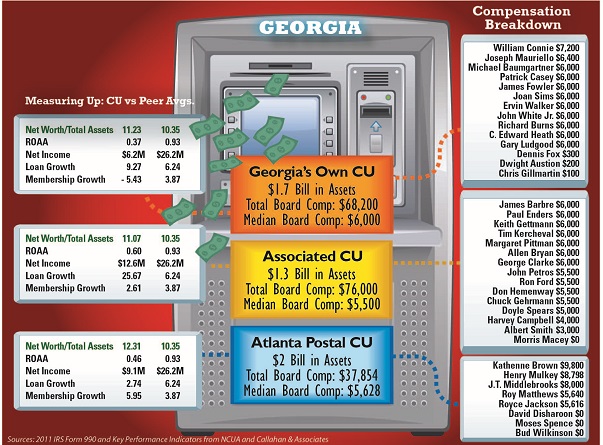

We compensate board members more out of a sense of fairness thananything else,” explained Lin Hodges, president/CEO of AssociatedCredit Union of Norcross, Ga.

|“I just don't think we should use the argument that peopleshould serve on a volunteer board because we have a higher calling.I just don't think that recognizes today's busy world and the wayour financial institutions have changed. It has become dramaticallymore difficult,” Hodges added.

|Only a small percentage of credit unions pay directors in stateswhere board compensation is permitted to pay directors. What'smore, most credit unions pay small stipends that range from a fewhundred dollars or about $1,000 to $7,000 a year. However, in atleast one instance, that pay exceeds $90,000 a year.

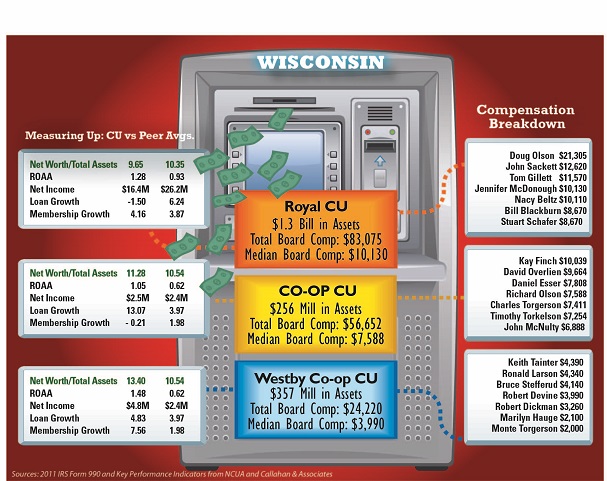

|For this article, Credit Union Times compiled chartsthat list three of the largest state-chartered credit unions fromeach state that pay their board members. The charts also review howthese credit unions performed financially in 2012 compared to theirpeers to see if they tended to perform any better, any worse orabout the same as credit unions in their peer group, the vastmajority of which do not pay their board members.

|Credit Union Times reviewed more than 250 IRS Form 990documents filed by state-chartered credit unions in 2011. Tomaintain their tax-exempt status, federal law requiresstate-chartered credit unions to submit an IRS Form 990 annually toreport financial and operational information, includingcompensation of directors and executives. The IRS Form 990srevealed that many credit unions are paying their board memberssizeable stipends for working one to five hours a week on boardbusiness, while a few others are working eight, nine or 10 hours aweek.

|More on Board Director Pay:

Part One – Surprised to Learn Volunteers Paid

Editorial – Time to Talk Turkey on 'Volunteer Boards'

|Of the 26 CEOs at credit unions that pay board members contactedby Credit Union Times, eight agreed to an interview. The other CEOseither declined an interview or did not respond to our interviewrequests.

|The CEOs interviewed said their boards are made up ofprofessionals, such as small business owners, certified publicaccountants, lawyers, executives, real estate developers, insurancebrokers and doctors who leverage their expertise and talents thatkeep the credit union financially sound and help it grow.

developers, insurancebrokers and doctors who leverage their expertise and talents thatkeep the credit union financially sound and help it grow.

(CLICK on each of these graphics at the right and belowto see expanded versions.)

|The CEOs were asked three main questions: Why do they compensateboard members? How do they determine what is reasonablecompensation? And what value does the credit union get from payingboard members?

|Hodges, CEO of the $1.3 billion Associated Credit Union, saidthe challenges that credit unions face today require board membersto spend more time and more work than ever on board businessbecause of greater liability risks.

|“In today's environment, the liability issue is more in yourface, if you will, and regulators are quick to point that out,”Hodges said. Associated paid $76,000 in total compensation to its15 board members in 2011, with a median annual stipend of$5,500.

|Dave Root, president/CEO of the $229 million Coventry Credit Unionin Coventry, R.I., agrees.

|“I know there are some credit unions that are up in arms sayingwe might as well be banks if we compensate board members,” Rootsaid. “But in this day and age, when you want to attract people whohave some financial savvy, it's difficult to do that when you areasking people to volunteer their time, particularly when you haveregulators who stare at board members in the face saying that theyare subject to civil and monetary penalties if they don't do thisor they don't do that.” Root said.

CU paid its 12 board members total compensation of $103,800 in2011, with a median annual stipend of $8,400.

|Gregory Smith of the $4.1 billion Pennsylvania State EmployeesCredit Union in Harrisburg said there is no question thatboards are doing far more work than they did 10 years ago becausethe board's duties and responsibilities have become far morecomplex.

|Smith said his board chair attends 10 to 12 meetings a month. Healso said directors meet twice a month and go to committee meetingsand special meetings that can number up to eight every month.

|“It's a working board and it's not a job for the faint ofheart,” Smith said. “It's not a cake type of job.”

|Smith believes paying a PSECU board member a median annualstipend of $12,429 is reasonable compensation because they do “anawful lot of work.” The credit union, which paid nine board memberstotal compensation of $122,622 in 2011, reports in its IRS 990 formthat directors work eight to nine hours a week

|But how do credit unions determine what is reasonablecompensation?

|IRS regulations require nonprofit organizations to compare whatwould ordinarily be paid to board members for similar services,duties and responsibilities among similar organizations in theregion whether taxable or tax-exempt, according to Linda Lampkin, aWashington, D.C.-based research director for the ERI EconomicResearch Institute, a compensation and benefits research firm. Likecircumstances account for the value of additional benefits such asinsurance.

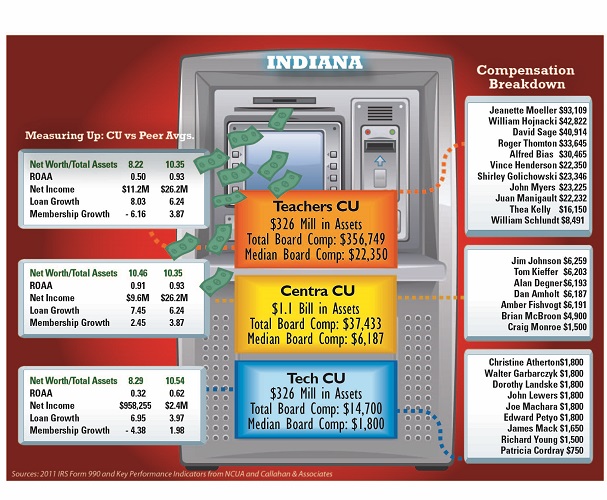

Every two years, the $2.3 billion Teachers Credit Union in SouthBend, Ind., hires Mercer, a well-known HR consultancy to helpdetermine what is reasonable compensation for directors andexecutives.

|“It's something we make sure we get done by a well-regardedthird party because [compensation] is a very delicate and sensitivetopic,” said Teachers CU President/CEO Paul Marsh. “We want to makesure that what we are paying is very reasonable and is right forour members and right for the board members because they do give alarge amount of their time. They have fiduciary responsibilities.They have liability. It is a big job and we want to make sure weare fair to all parties involved.”

|Collectively, the Teachers CU board was paid $356,749 in 2011.One board member was paid $93,109, while two board members werepaid $42,822 and $40, 914. The remaining eight board members werepaid within the range of $8,491 to $33,645.

|Marsh would not comment about compensation for individual boardmembers but added that Mercer helped the credit union set itscompensation philosophy and determined what is reasonablecompensation for a financial institution with $2.3 billion inassets and serves more than 255,000 members.

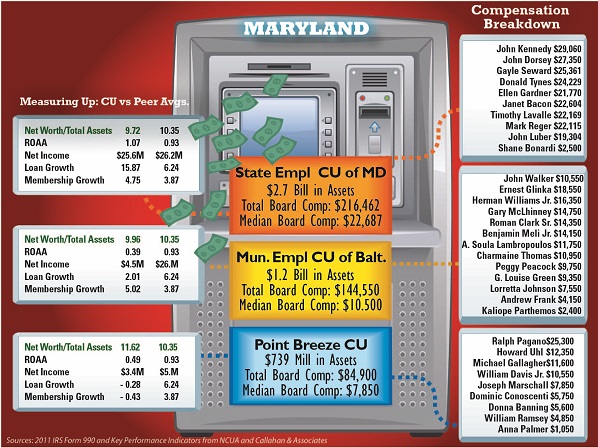

|Bert Hash, president/CEO of the $1.2 billion Municipal EmployeesCredit Union in Baltimore, said his credit union reviewed whatother Maryland credit unions and credit unions in other states werepaying board members to determine reasonable compensation for boardmembers.

“Other banks pay their board members and we are in competitionwith them,” explained Hash. “If we want to attract board memberswho are accountable and responsible, they should becompensated.”

|MECU's median board compensation is an annual stipend of$10,500. Total board compensation was $144,550 in 2011. Hashindicated the credit union's board compensation is reasonable whenconsidering it's not nearly as much as what board members atcompeting banks are receiving in compensation.

|But some executives disagree about what is reasonablecompensation.

|Richard Howdeshell, president/CEO of the $803 million Fort WorthCommunity Credit Union in Fort Worth, Texas, said paying boardmembers too much may invite problems.

|“If you compensate too highly you would attract an element thatmay not be in the best interest of the credit union,” he said. “Ithink those people serve on boards in large part for their ownbenefit, to get something back for their business or for themselvespersonally. It's been our experience that people who are motivatedwith the idea that they are helping their fellow credit unionmembers tend to be better board members.”Fort Worth Community CUprovides its nine board members with a $125 monthly stipend to payfor incidental expenses such as gas for attending meetings. In2011, the credit union's total board compensation amounted to$12,544 with a median board compensation of $1,953.

|“Not many would consider [$125] to be much of a benefit, to behonest,” said Howdeshell. “We don't compensate them for their timeand expertise, but we  didn't feel it wasappropriate to cost them money to serve on the board.”

didn't feel it wasappropriate to cost them money to serve on the board.”

When asked what value their credit unions are getting in returnfor compensating board members, some CEOs struggled with providingspecific examples.

|“As a CEO, I can see the things the board contributes, and no,we don't document every comment that is made and every idea thatthey come up with and attribute it to an individual director,” saidJames Irving, president/CEO of the $370 million Greenwood CreditUnion in Warwick, R.I. “As a CEO, it is an easier job to runthe ship when you have people who understand what is going on.”

|Greenwood CU paid its seven board members a total of $141,100,with annual stipends ranging from $10,000 to $33,200 and a medianstipend of $22,400.

|Next Page: Examples ofContributions

|Some CEOs provided examples about how boardmembers contributed to the growth of their credit unions.

|Hash said the longtime leadership and strategic planningoversight of MECU Board Chair Herman Williams Jr. and Vice ChairErnest Glinka, as well as other board members, were critical to thecredit union's growth. Hash also said Williams provided him withvaluable coaching and advice.

|“MECU was at $350 million with 35,000 members when Herman tookover as board chair 22 years ago,” he said. “Today, MECU has105,000 members and $1.2 billion in assets.”

|Hodges of Associated CU also said the guidance and coaching hereceived from a board member opened his eyes to the importance ofpolitical activism, advancing the credit union's interests andgrowth.

|Nonetheless, other credit union executives are not sure whetherpaid directors tip the odds in their favor. “I don't know whether Ican speak statistically on that,” said Root of Coventry CU. “Butwhen I look at the Call Reports to see how our state-charteredcredit unions are doing, there are a few that are losing money, thelarger ones always make a ton of money and there are those that geta good return.”

|Indeed, the financial performance of credit unions that do paytheir board members compared to their peers, which includes thevast majority of credit unions that don't pay their board members,seems to be a mixed bag.

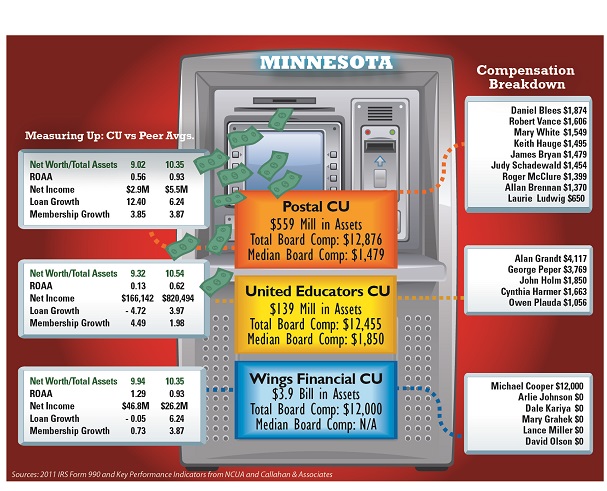

|Data compiled from IRS 990 reports by Credit Union Times (seecharts) show some credit unions that pay their board members haveperformed better than their peers, while a few have performed worsethan peers and others have performed about the same as theirpeers.

|For example, Rhode Island Credit Union paid its board members$224,675 in total stipends in 2011 and has posted a net income lossin four out of the past five years. In 2008, 2009, 2011 and 2012,the credit union had a total net loss of $3.1 million. What's more,at the end of the 2013's first quarter, the credit union lost$176,433, according to NCUA financial performance reports In 2010,the credit union recorded a net gain of $405,765.

|Though Rhode Island CU has a strong net worth/total assets ratioof 11.40, higher than peer average of 10.54, its return on assetsis negative 0.31, lower than the peer average of 0.62 last year.The credit union's loan growth was 7.34 in 2012, above peer averageof 3.97, but it has been losing members. Rhode Island CU'smembership has fallen by more than 2,400 from 27,089 in December2008 to 24,674 in March of this year.

|Meanwhile, Philadelphia's Trumark Financial Credit Union, whichpaid nine board members a total amount of $452,567 in 2011, hasposted strong financial results, doubling its net income from $7.6million in 2008 to $14.5 million in 2012, though in its peer groupof credit unions with more than $1 billion in assets, the averagenet income was $26.2 million.

|However, NCUA financial performance reports show Trumark's loanincome has fallen from $45.4 million in 2008 to $40.7 million in2012 but has more than doubled its fee income from $8.5 million in2008 to $17.6 million in 2012.

|The credit union also posted a net worth/total assets ratio of10.32, only slightly below peer at 10.35, while its return onaverage assets was 1.05, versus peer average of 0.93 in 2012.Trumark's loan growth was 10.81, significantly above peer averageof 6.24, but its membership growth was 1.48, below peer average of3.87 last year.

|The $2.7 billion State Employees Credit Union of Maryland inLinthicum, which paid a total of $216,462 to its 11 board membersin 2011, has produced positive financial results as well.

|Although it had a net loss of $16.5 million in 2008, it posted anet gain of $7.1 million in 2009 and more than doubled its incometo $25.6 million by 2012, primarily by increasing fee income from$26 million in 2008 to more than $41 million in 2012.

|The credit union's loan income has declined, however, from $89million in 2008 to $86 million in 2012, and so has its investmentincome from $13 million to $7 million in the same years.

|SECU's net worth/total assets ratio was 9.72, below the peeraverage of 10.35 in 2012, while its return on average assets was1.07, above peer average of 0.93. The credit union's loan growthwas 15.87, above peer average of 6.24 and its membership growth was4.75, above peer average of 3.87 last year.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.