The Rundown

- About 30% of CUs use a hosted core.

- Small credit unions particularly find many benefits besidescost savings.

- If CU regulators push for off-site cores, the rush will beon.

Do you want to know a secret? Roughly three in 10 small creditunions do not maintain their core systems in-house, instead using“hosted” or “service bureau” solutions where the core is in factmaintained off-premises by a third-party vendor.

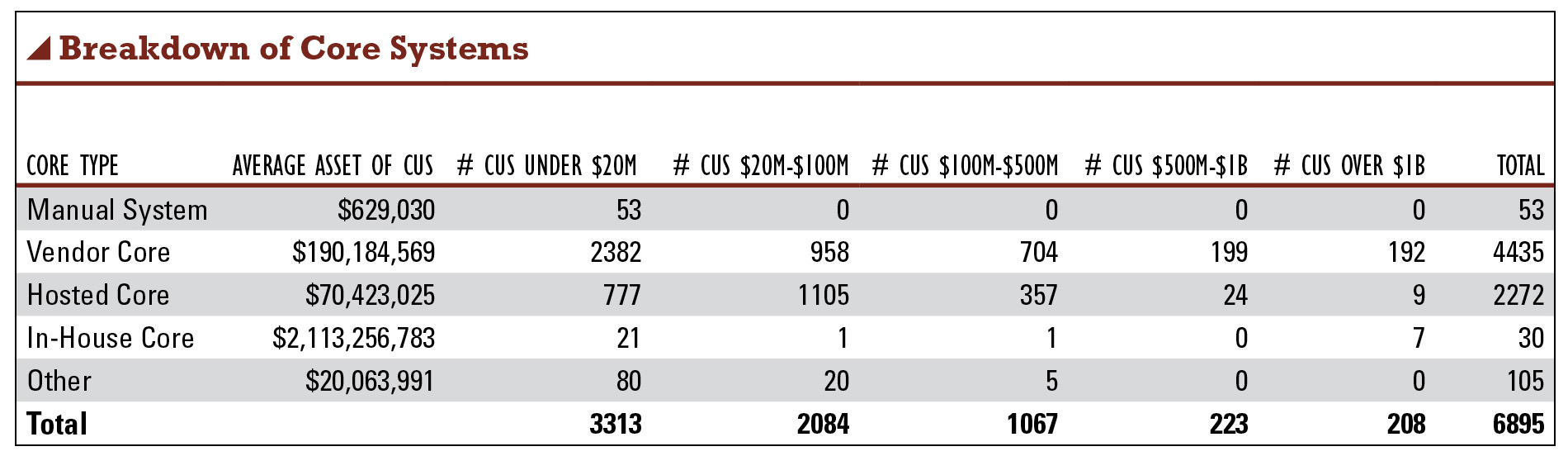

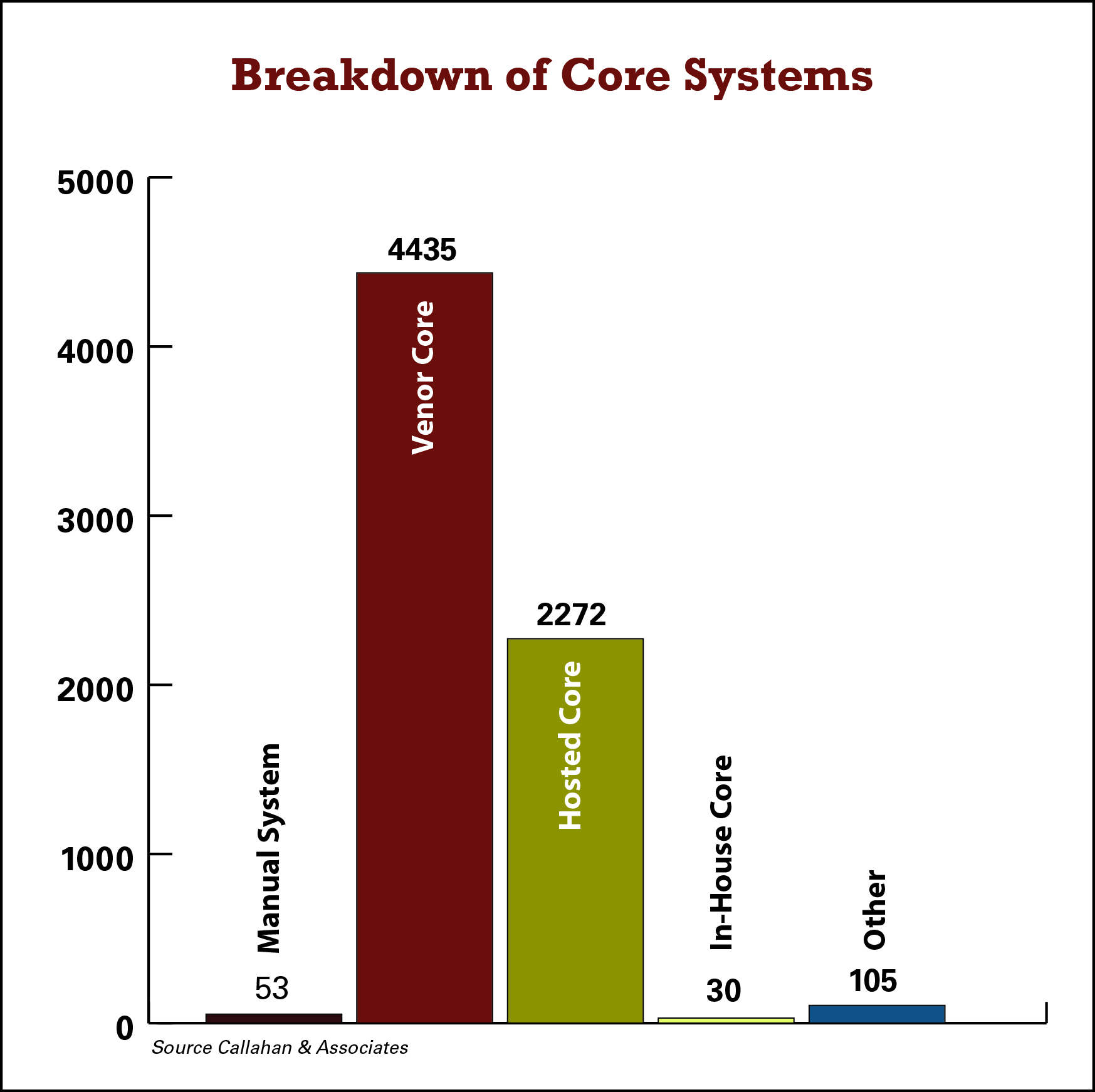

|According to numbers provided to Credit Union Times byCallahan & Associates, 2,272 credit unions presently havehosted cores.

|Also Read:

Small Core Providers Pile On Plugins

Small Core Providers Seek to Make Big Splash

In institutions with under $20 million, 777 have hosted cores.There are 3,313 institutions in that asset category. Of the 208credit unions with assets over $1 billion, nine have hosted cores.“For smaller credit unions, a hosted core is where most will windup,” said David Gibbard, an executive with Birmingham, Ala., core providerEPL.

|“The primary reason is because an in-house solution requires ateam of IT professionals. The smaller credit unions have less moneyso they cannot afford that expenditure and, therefore, they embracea hosted core,” Gibbard added.

|They also save money, said Gibbard. “I estimate that an in-housecredit union could reduce between 25% to 50% of their IT budgetwith a hosted solution.”

|But the question is, will shifting to a hosted core hurt? Willit stymie a credit union's ability to protect its data and serveits members?

| (Click on graphic abovefrom Callahan & Associates to see an expanded view.)

(Click on graphic abovefrom Callahan & Associates to see an expanded view.)

Delaware State Police Federal Credit Union, a $122 millioninstitution based in Georgetown, in July 2011 shifted to a hostedversion of the same Symitar core, Episys, that it had been runningin-house.

|“We thought we would never go to an online solution” saidBlanche Jackson, an executive vice president. But the credit unionhad been on Episys since 2000, and the hardware needed substantialupgrades. “We were looking at large expenses. Going hostedeliminated the need to buy that new equipment, saving us easily$100,000 to $200,000,” said Jackson.

|As for running monthly costs, that's about the same, saidJackson. But she also indicated that the credit union now getsservices, she pointed to disaster recovery as a for instance, thatit wanted but couldn't afford. Now it can afford such upgrades or,as with disaster recovery, it is included with the hostedservice.

|“Our biggest issue with the conversion was fear,” said Jackson.But in the end, “if we hadn't told the staff we were doing it, theynever would have known.”

|“We did not tell our members. The change had no impact on them,”she added. “We converted over a weekend. We had no down time.”

|Many processes got simpler with the move to a hosted core. ACHand share-draft processing, for instance, had been done in-house.Now the host handles those chores for the institution. A lot of ITdrudgery, applying patches and quick fixes, also stopped, as thatwork got outsourced to Symitar.

|Delaware State Police FCU elected to keep its IT staff countunchanged. Said Jackson: “We moved them around. One is managing thecall center. We could put more bodies into services that touch themember.”

At least some experts believe Delaware State Police FederalCredit Union may be a trailblazer. And it won't be alone.

|Theresa Benavidez, president of Corelation in San Diego, which hasthree clients running on a hosted version, said, “Security threatswill force many credit unions to go hosted.”

|(Click on graphic at right to see expanded view.)

|That is, in an environment where savvy IT staff has to work 24/7to keep pace with ever- inventive cybercriminals, the onlydependable solution for many institutions will be to outsource thecore to a company that can invest in the security that isrequired.

|The other factor that may prod more credit unions to embracehosted cores is pressure from regulators, said Scott Hodgins, a core expert with Cornerstone Advisors in Scottsdale,Ariz. He explained that banks have been quicker to rush into hostedcores, in part because of regulator pressures.

|“Credit unions have not had the regulatory scrutiny that bankshave. They are pushing the risk onto the vendor. The regulatorshave not put pressure on the credit unions,” Hodgins said. Werethat to change, suggested Hodgins, the stampede into hostedsolutions would be on.

|Kirk Drake, CEO of Hagerstown, Md., CUSO Ongoing Operations, isstill more optimistic. Over the next 10 years, he said, there willbe a steady march into hosted cores as credit unions. especiallythose below $500 million in assets, struggle to cope with mountingsecurity and regulatory issues.

|“They are already feeling a lot of pressure,” said Drake, andhis strong belief is that many will decide their shrewdest move isto turn a growing number of IT services, including the core, overto third-party hosts. “We believe hosted solutions will be huge,”said Drake. “It will get much bigger, sooner, than many nowexpect.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.