As the cleanup continues in Oklahoma, the latestinsurance claims filed following the tornado outbreak at the end ofMay offers another glimpse of just how destructive the stormswere.

As the cleanup continues in Oklahoma, the latestinsurance claims filed following the tornado outbreak at the end ofMay offers another glimpse of just how destructive the stormswere.

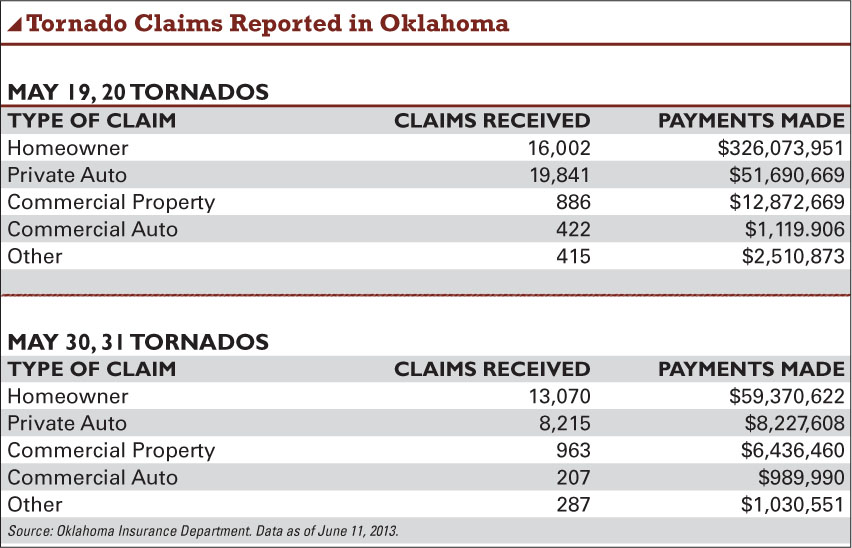

According to the Oklahoma Insurance Department, as of June 11,60,308 claims had been filed with payments surpassing the $470million mark. The agency said calls to its consumer assistancedivision have also risen 59% since the May 20 tornado in Moore,Okla. Approximately 40 requests for assistance forms have gone outeach day since the destructive storm killed more than 24 people andleveled homes and other properties.

|“These numbers are already staggering, and this is just thebeginning,” said Oklahoma Insurance Commissioner John Doak, in astatement. “Many of the victims haven't received their entiresettlement checks yet, so that payment number will continue to goup for a while. This is something the state of Oklahoma is going tobe dealing with for a long time.”

|Meanwhile, credit unions have contributed more than $66,000 tothe Oklahoma Credit Union Foundation's Tornado Disaster Relief Fundto assist those affected by the tornados. The Credit UnionAssociation of Oklahoma has delivered $24,000 in grants, accordingto Gary Jones, president/CEO of CUAOK.

|As some credit unions grappled with water damage and powerinterruptions, it was the $3 billion Tinker Federal Credit Union in Oklahoma City, that sustainedthe most cataclysmic destruction of its branch in Moore. Twenty-twopeople sought safety in the credit union's safe deposit box vaultas the branch was leveled around it. A new branch is set to becompleted before the end of the year, according to Tinker FCU'ssenior management and board of directors.

|“I'm thrilled we are beginning the construction process sosoon,” said Jan Davis, assistant vice president and branch managerat Tinker FCU, on the credit union's website. “I love the Moorecommunity and the people we have served at that branch sinceopening in 2005. We're very excited to be staying in the samearea.”

|While a dollar amount was not disclosed on how much the creditunion's insurance claim was nor how much it would cost to rebuildthe Moore branch, the financial impact the tornado stands to haveon deductibles and other coverage costs remains to be seen.

|As of press time, CUNA Mutual Group was not able to provide a hard number onclaims filed. Losses are spread across multiple coverage plans,which can make it difficult to pinpoint an exact figure, said PhilTschudy, media relations manager for CUNA Mutual.

|In a case like the Tinker FCU branch in Moore, which was reducedto rubble except for the vault, assessing a financial loss is aquicker process, said Mike Retelle, CUNA Mutual Group claims manager and disasterteam leader. More than 6,000 credit unions have property andcasualty coverage with the company. While flood damages fall underfederal guidelines, CUNA Mutual can assist policyholders with theprocessing of those claims.

|“Total losses are easier to assess than partial losses. With abuilding loss, it's all gone. We want to find out what they'regoing to do–whether to build another branch or not,” Retellesaid.

|By the end of the week after Tinker FCU's Moore branch wasdestroyed, the credit union had already had the location cleaned updown to the slab, Retelle said. After making the decision torebuild, other areas were looked at such as inventory and dataprocessing to determine the amount of financial losses, headded.

|Jim Hunt, staff underwriting specialist with CUNA Mutual Group,said the company is in a strong position to pay out claims.

|“We're well-capitalized and we have a very secure financialposition,” Hunt said.

|When major storms such as Hurricane Katrina struck, someinsurance carriers saw the need to raise the cost of coverage tooffset the amount of claims that came in. Hunt said CUNA Mutualtakes a different approach.

|“We have a niche market with credit unions. We are very carefulin that just because there has been a disaster, we don't feel it'sright to increase deductibles and premiums,” Hunt explained. Whilehe didn't want to name companies, Hunt said he is aware that somecarries are adding wind and hail percentages in the Midwest andothers are considering tacking on the coverage forpolicyholders.

|“At this time, we have decided not to do that. In fact, we werethe last to add a hurricane deductible after the major losses inAlabama in 2010 and 2011,” Hunt said.

|

With hurricane season gearing up, based on meteorologicalreports, the storms may not be the only natural disaster to worryabout, Hunt said. In addition to tornados, wildfires andearthquakes are also of concern. A potentially more ominous threatis terrorist acts similar to what happened at the Boston marathonin April, he noted.

|Enacted after the Sept. 11 attacks on the World Trade Center'stwin towers, the Pentagon and the downed airplane in Shawshank,Pa., the Terrorism Risk Insurance Act, is set to expire on Dec. 31,2014. The legislation provides public and private compensation forinsured losses resulting from acts of terrorism. Hunt said he hopesthe federal government will reconsider keeping TRIA in place.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.