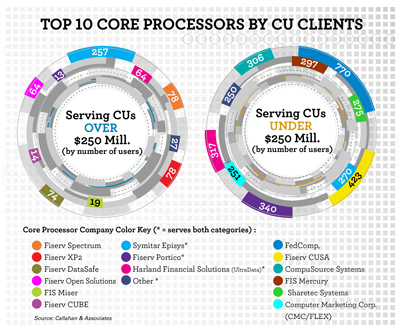

Fiserv and Symitar dominate the discussions around creditunion core systems, but many smaller providers are nipping at theheels of the core giants.

|Part 1 of this series detailed the players inthe field.

|Here, part 2 looks at how the niche players are positioningtheir offerings.

|Probably the single biggest problem facing core system providersthat aren't Fiserv or Symitar is that, for them, the struggle is toseem part of the 21st century conversation. Core systems, in theirguts, generally are over 20 years of age–frequently much older–sothis is a mature IT solution that has been commoditized.

| Where there is profit to bemade it is in the add-ons, the plug-ins that upgrade the core, saidTom Berdan, a vice president at Lake Mary, Fla.-based HarlandFinancial Solutions, who oversees the company's core systems,PhoenixEFE and UltraData, which are found in around 385 creditunions, generally institutions with under $250 million inassets.

Where there is profit to bemade it is in the add-ons, the plug-ins that upgrade the core, saidTom Berdan, a vice president at Lake Mary, Fla.-based HarlandFinancial Solutions, who oversees the company's core systems,PhoenixEFE and UltraData, which are found in around 385 creditunions, generally institutions with under $250 million inassets.

(Click on image at left toexpand.)

|At Harland, Berdan said there is a considerable push to standout by tweaking its cores to do a good job of detecting anomalousbehavior in a member account that may be linked to crime such aselder fraud or account takeover.

|He said that these kinds of frauds are becoming an ever biggerconcern to credit union executives and regulators, and he suspectsthe volume of such criminal activity will shoot up as EMVimplementation in 2015 prompts fraudsters to seek out newvulnerabilities. In his mind, the Harland core can become a part ofthe solution and that he believes may win credit unioncustomers.

|FIS is a huge financial tech company. “We do business with 85%of credit unions,” said Jerry Nissen, a vice president. But it isan also ran in cores with around 308 credit unions customers,mainly smaller institutions, according to Callahan. The companywants to change that and, per Nissen, it feels it may have a timelycard to play in its Miser core, mainly aimed at institutions biggerthan $250 million. That's because Miser has its roots in thebanking world and integral to its structure are strengths inmanaging business lending.

|“Our challenge is market awareness. What we have been doing is alot of innovation–channel integration and tight integration withmobile, online, e-wallets,” Nissen said. “Miser is unique, it isvery powerful. We still have a large presence in banking. We haveone institution that is $45 billion running on it.”

|Nissen, incidentally, also said FIS has been upgrading itsMercury core, aimed at smaller credit unions. “We have been addingfunctionality,” said Nissen, who acknowledged that thus far FIS isnot seeing a boost in traction among credit unions, meaning newadoptions are thin.

|UltraData, Miser, Mercury–these are well-proven cores. That isnot the so at Corelation. There, the question on prospects' mindsis, Is it really going to work? That, said Theresa Benavidez, wasthe constant refrain from prospects in the early months ofCorelation, the San Diego-based developer of one of the industry'sfew truly new core systems.

|Benavidez serves as president of the company and, she said,Corelation now has 14 credit unions under contract. “Creditunions come to us because they want a core provider where they areheard. They don't want to be told which add-on modules they need tobuy. They want their credit union to be important.”

|A Corelation plus, per Benavidez, is that it is truly open.Other cores claim openness, she said, but with Corelation thecredit union truly calls the shots when it comes to integrating addon services. “A year from now we will have at least five morecredit unions on our core. We are growing,” she said.

|Immense changes may be in the near-term future for core systems,particularly in smaller credit unions, and this is for twocompelling reasons. To survive, most of those institutions willneed, and quickly, to offer a fleshed out lineup of bankingservices right down to mobile remote-deposit capture, real-timeperson to person payments, mobile banking and the rest of the hightech goodies offered by big banks. Those small institutions alsowant to pare their costs in operating cores, an expense that moreare grumbling about.

|The two forces seem contradictory. But they just may be drivingsweeping innovation.

|At My CU Services, a CUSO owned by Mid -Atlantic CorporateCredit Union in Middletown, Pa., COO Howard Stein said that CUSO“is actively looking at offering core as a service, especially tosmaller credit unions.” He defined smaller as under $100 million inassets.

|Stein said that in his opinion “there is no question many creditunions are overpaying for their cores. We believe we could drivedown the expenses.”

|My CU Services, accordingly, is now looking for a core systemthat it might buy, tweak and build in new tools such as mobile andonline banking, said Stein.

|Meantime, over at EPL, Senior Vice President David Gibbardponders the viability of a hosted solution. “That's the trend. Toget what they want, credit unions are beginning to move away fromin-house solutions.”

|The key advantages of hosted solutions, already offered invarious flavors by several providers but take up has been slow, isthat in effect core is outsourced to the provider who, at alltimes, can be held accountable for keeping the system running andup to date. Because the system is shared, rather than ownedoutright, costs may also be lower while functionality ishigher.

|“For credit unions with under $750 million in assets, it makesmore economic sense to do core functions in the cloud, in a hostedenvironment,” said Gibbard.

|How long will it take to transition to a point where most creditunions are in fact in hosted cores? Gibbard shrugged. The averagecore contract is five to seven years, he said. Every year, perhaps1,000 credit unions could swap cores. How many will?

|“Credit unions that want to survive need to pull their heads outof the sand,” Gibbard said.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.