Any major operational change at a credit union, such as a move,merger or core system conversion, can cause an influx of memberservice requests and potentially a call center nightmare.

|But the $499 million Credit Union of America in Wichita, Kan.,said it soared through a merger and headquarters location movewithout a hitch and credits its call center software, the Customer Interaction Center fromIndianapolis, Ind.-based Interactive Intelligence Group Inc., whichit first implemented in 2004.

|Earlier this year, the now 16-branch Credit Union of Americamerged with the competing First Choice Credit Union and built anew location in Wichita to house its headquarters. Richard Logan,senior vice president and chief information officer for CreditUnion of America, said growth at the credit union, in addition toplans for a core banking system conversion, prompted theheadquarters move.

|The credit union will move to an in-house system in December andat that point, will require more space for a data center, Logansaid.

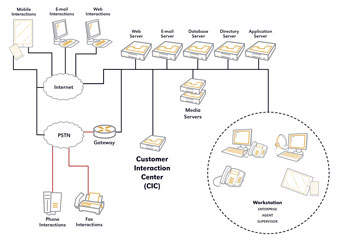

|CIC, an all-in-one contact center platform that facilitatesinteractions on multiple channels, is in use at approximately 120credit unions, according to Interactive Intelligence. ThroughCredit Union of America’s merger, former First Choice staffers weremoved onto CIC’s automatic call distributor platform, which allowedthem to continue serving members whose accounts they were mostfamiliar with, Logan said.

|During the credit union’s headquarters move, half of its callcenter staff moved first and were followed by the other half a weeklater; the credit union reports it did not experience a rise inmember complaints throughout the process.

|Some of the attributes of CIC that won Credit Union of Americaover back in 2004 have been especially beneficial to thecooperative through its recent changes, according to Logan. Theseinclude the fact that CIC is software-based and it compiles eachuser’s emails, instant message conversations and incoming calls inthe order they’re received in a single queue. It also displays theavailability status of each user, which helps employees avoidtransferring members to employees who are out of the office.

|

“CIC enables our employees to initiate calls directly from theiremail or contact lists,” Logan said. “And, they can make conferencecalls by simply dragging names into the desktop client’s callcontrol window.”

|Internal communication has dramatically improved through CIC’spresence management feature by enabling the credit union’s staff tosee the status of colleagues, Logan said. Service has improved aswell since employees can now avoid transferring customer calls tounavailable colleagues.

|CIC’s Web-based nature allows users to access the platformregardless of their location, according to Logan. Each staffmember’s extension number is linked to his or her network login, sothey can receive calls at the same number even when they’re not attheir desks. This is particularly helpful for employees who oftentravel between branches, he noted.

|“Using CIC, our employees simply log in from wherever they areand it’s just like working from headquarters; they get all the samecall control and presence management functionality, and theirlocation is completely transparent to callers,” Logan said. “As acredit union with multiple branch offices, this has had a hugeimpact on productivity and customer service.”

|Another benefit CIC brings to Credit Union of America is asavings on long distance phone calls. The credit union hasconfigured the system so each time an employee makes a longdistance call, it travels across the WAN, through the creditunion’s local office, which allows it to essentially be placed as alocal call, Logan explained.

|CIC also lets the credit union add new extensions, eliminatingthe need to purchase new phone lines. Logan said the long distancecall avoidance feature is especially helpful because the creditunion’s branches are scattered across different area code zones inKansas.

|Brad Herrington, solutions marketing manager for InteractiveIntelligence, added that CIC automatically pulls up memberinformation onto employees’ screens when the member contacts thecredit union, saving employees from having to manually search forthe information. CIC also provides space for future growth. Creditunions and other Interactive Intelligence customers can add up to5,000 users to the platform.

|Additionally, the platform provides support in situations wherea credit union needs to temporarily beef up its support staffduring a hectic event such as a merger. They can add users from athird party service support company or assign platform usage rightsto staffers who don’t normally handle service calls, Herringtonsaid.

|“It provides you with the flexibility to move the system whereyou want to, whether you’re going through a merger or coreconversion,” Herrington said. “You just have to move the people.You’re able to provide multiple types of service from one platform.It’s an all-in-one system that provides everything you need tocommunicate.”

|Logan concluded that as the credit union continues to grow andevolve, CIC helps maintain an essential piece of member serviceincluding responding to member calls, emails and instant messageswithout missing a beat.

|“By not having to put members on hold, we can serve them better.It gives us the flexibility to do business the way we want to dobusiness.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.