When you think of Gen Y’s preferred banking activity, thethought of waiting in the teller line at a branch doesn’t exactlycome to mind.

|But the latest Consumer Trends Survey from technology vendor Fiserv Inc.included a surprising result: Gen Y visits branches more than GenX, Baby Boomers and seniors do.

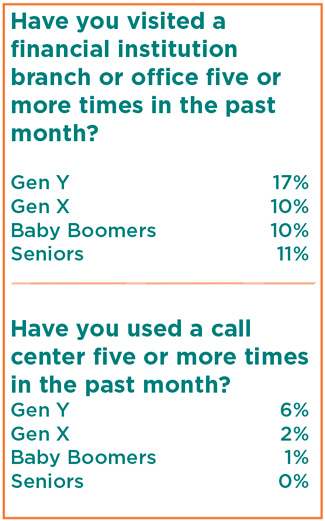

|The data showed that 17% of Gen Y members visited a financialinstitution branch or office five or more times in the previousmonth, compared to Gen X’s 10%, Baby Boomers’ 10% and seniors’11%.

|Daniel Steere, director of consumer insights at Fiserv, said itwas the most surprising finding from the survey, which investigatedconsumer banking behavior by channel and age group.

|“I was expecting to see Gen Y pushing trends toward the digitalchannel, and we did see that,” Steere said. “But they are stillusing channels that are high-cost to financial institutions, likecall centers and branches.”

|Steere said the survey’s Gen Y respondents were not asked whythey are visiting branches and that Fiserv would like to examinethat angle in the future. But he speculates that Gen Y’s branchvisits are due to more complicated needs such as consultations fora first mortgage or auto loan, not routine transactions. Given thatassumption, he believes credit unions should ensure their frontline staff members are trained to educate young members.

|“Based on my personal research, I don’t think anyone says thatthey love to go into a branch and stand in line,” Steere said. “Isuspect that when Gen Y members go into a branch, it’s because theyhave a problem that they can’t solve.”

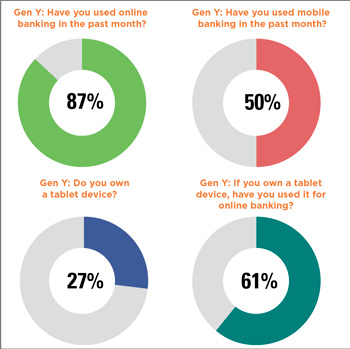

|Fiserv also found that 87% of Gen Y members used online bankingin the previous month and 50% of Gen Y members used mobile bankingin the previous month, Steere said. Survey highlights also showedthat 34% of Gen Y members are high volume ATM users, compared toGen X’s 30%, Baby Boomers’ 22% and seniors’ 12%. Six percent of GenY members are high volume call center users, compared to Gen X’s2%, Baby Boomers’ 1% and seniors’ 0%.

|

At MIT Federal Credit Union, a $335.6 million credit union inCambridge, Mass., where students comprise approximately 28% oftotal membership, young members typically visit a branch once toset up their accounts and then turn to the comfort of theircomputers and smartphones for banking activities, saidPresident/CEO Brian Ducharme.

|“We’re set up for remote access,” Ducharme said. “Members canmake deposits from our ATMs, and we’ll see students doing that whenthey’re only 10 yards away from a teller. They’re very comfortablewith self-service.”

|However, Ducharme said young members do value personalinteraction. He said if a transaction is more complicated, they’lluse the credit union’s call center or visit a branch.

|“It depends on the complexity of the transaction and sometimeson their comfort level,” he said. “For example, with a mortgage,they may want to talk to someone to better understand how to makepayments and how it will affect their taxes.”

|Ben Rogers, research director for the Filene Research Institute, agrees that Gen Y members only maketrips to branches during exceptional circumstances, for example, toopen a new account or solve a specific issue.

|“It’s hard to characterize the whole group as valuing or notvaluing in-person branches,” Rogers said. “It is safe to say,however, that they value them less than prior generations did,because they have not been conditioned to accept waiting inbranches or conducting in-person or paper transactions that can beaccomplished remotely.”

|Rogers said Filene recently found that convenience is the No. 1factor Gen Y considers when choosing a financial institution,followed by product features and service, and financialinstitutions must implement multiple channels to meet the need forconvenience.

|“It used to be your branch locations were the main driver ofconvenience, and then it became branches plus ATMs,” Rogers said.“But today, you have to consider technologies like mobileapplications, remote check deposit and fast, functional webservices.”

|So which channels are priorities for Gen Y? Rogers saidaccording to seven recent, in-depth interviews conducted with sevenGen Y members by bank and credit union-focused research companyFacilitas, six of the seven listed ATM access as necessary and allseven said mobile banking apps are critical.

|Steere emphasized the one device that credit unions should startputting on their radar are tablets. According to Consumer TrendsSurvey Results, 27% of Gen Y members own a tablet device and 61% ofthose Gen Y members said they had used the tablet for onlinebanking. With their larger screens, tablets present an opportunityfor CUs to share information in an interactive, engagingmanner.

|

“Tablets are considered high priced, luxury items, so that datashocked me,” Steere said. “But Gen Y is all about the overallexperience. In the future, I see mobile devices being used forquick transactions and tablets being used for more engagingexperiences and rich interactions.”

|Mobile alerts are another hot feature for Gen Y because theyprovide a sense of control, Steere added.

|“Some Gen Y members are managing their finances on a tightmargin of error and are checking their account balances 10 or 12times a day,” Steere said. “Alerts can help them feel like they’reon top of things.”

|Rogers added that according to a TowerGroup report, the numberof interactions a consumer has with his or her financialinstitution per year is expected to double from 60 to 120 between2007 and 2020. Mobile and online interactions are expected toincrease while branch, ATM and call center interactions shouldremain roughly the same.

|“In-person banking is not going away,” Rogers said. “It’s simplybeing placed as two–branch and contact center–parts of thatfive-part mix.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.