Do credit union members think more positively than non-creditunion members do when it comes to the U.S. economy and theirpersonal finances? According to the Discover U.S. Spending Monitor,a monthly consumer survey conducted by banking and payment servicesgiant Discover Financial Services, the answer is yes.

|Financial confidence improved among credit union members—more sothan among non-members—in the fourth quarter of 2010, says theDiscover U.S. Spending Monitor, which surveys more than 8,200consumers, including an average of 2,500 credit unionmembers.

|In January 2012, 10% of credit union members rated the U.S.economy as “good” or “excellent,” while in October 2011, just 5% ofcredit union members gave the economy the same rating. Thepercentage of credit union members who rated the U.S. economy as“poor” dropped from 69% in October 2011 to 53% in January 2012, thesurvey revealed.

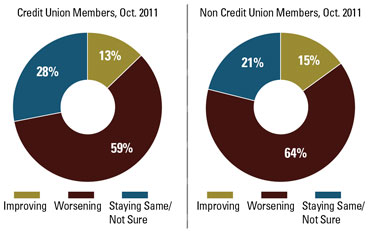

|The percentage of credit union member survey respondents who sayU.S. economic conditions are improving increased from 13% to 34%during the quarter, while the percentage of those who think theeconomy is getting worse declined from 59% to 42%.

|Non-credit union members' attitudes toward the economy'simprovement showed less of a change, according to the survey: fromOctober 2011 to January 2012, the percentage of non-credit unionmembers who feel the economy is improving increased from 15% to26%, and those who believe the economy is worsening decreased from64% to 50%.

|

Discover also reported an upswing in personal financialconfidence among credit union members, with 29% of credit unionmembers stating their personal finances are improving, compared tonon-credit union members' 20%. The percentage of credit unionmembers who rated their personal finances as “good” or “excellent”increased from 32% to 38% during the quarter, while the percentageof non-credit union members who gave their personal finances thesame rating increased by less, from 28% to 31%.

|“Credit union members are more confident with their financialsituations and do a better job than the overall public in managingtheir finances,” Discover spokesman Matt Towson said when asked forhis take on the disparity in confidence between credit unionmembers and non-members.

|Dwight Johnston, president of the Claremont, Calif.-based DwightJohnston Economics and former economist for WesCorp FCU, said he'snot surprised by the results of the Discover U.S. Spending Monitor,particularly because credit unions serve a more financially sounddemographic than other financial institutions do. For example, as awhole, credit unions serve an aging demographic, and individuals 65and older have a higher average net worth than the 35 and youngerset does, he said.

|“Older people tend to be more financially responsible and aremore established in their jobs and careers,” Johnston said. “Although, of course, some of them becamedisestablished recently.”

|Credit unions are also breeding grounds for individuals who puta lot of thought into their finances, he said.

|“Even though credit unions are serving an expanding community,they still have their SEGs, like teachers, who tend to be morestable,” Johnston said. “But if you are not a SEG member and youdecide to join a credit union, you're making a decision and you'velooked at all your options. That automatically puts you in acategory of having more financial sense.”

|Economist Mike Moebs, CEO for the Lake Bluff, Ill.-basedeconomic research firm Moebs Services, also said the survey'sresults make sense given whom credit unions serve. But heemphasizes a different demographic—members of the middle class,whom he believes are “digging themselves out” of economicturmoil.

|“Banks go to the rich and the poor, and credit unions go to themiddle class,” Moebs said. “So the results aren't surprising when you takethat into consideration. The middle class is saying, 'I got a job,I'm able to retain it, my home's price might be down, but I'mdigging out.'”

|Moebs warns that credit union members' positive outlook on theeconomy is not reflective of the credit union community, which hesaid is years from digging its way out, particularly due toproblems within the corporate credit union system. However, somecredit unions are succeeding, and that success has rubbed off ontotheir members, he said.

|“The credit union movement is ignoring the 800-pound gorilla inthe room, which is the corporates,” Moebs said. “But there arecredit unions out there that are in good shape. They're payingtheir assessments, cutting expenses and building capital. Theirmemberships are picking up on what they're doing. The credit unionsare saying, 'We're going to be here forever,' and that reflectsonto the behavior of their members.”

|The Discover U.S. Spending Monitor also revealed positivebehavior related to spending, saving and investing among creditunion members. For example, the percentage of credit union memberswho plan to spend the same or more on discretionary purchases suchas dinner out in the coming month increased by four percentagepoints (46% to 50%), while non-credit union members exhibited a twopercentage point increase (45% to 47%).

|Discover saw a four percentage point increase in credit unionmembers who plan to save and invest the same or more in the comingmonth (58% to 62%). The increase for non-credit union memberstotaled five percentage points, up from 51% to 56%, in the samecategory and time period.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.