The $1.7 billion GECU of El Paso, Texas, just selected GECU Executive VicePresident and Chief Operating Officer Crystal Long to succeedPresident/CEO Harriet May following her retirement on March 31.Meanwhile, the $5 billion, Palo Alto, Calif.-based First TechCredit Union is saying goodbye to President/CEO Benson Porter,who will begin his new position as president/CEO for the $9.7billion, Tukwila, Wash.-based Boeing Employees Credit Union inApril.

|And those changes are just the latest moves in and out of thecorner office.

|Faced with a surge of retirement announcements and a shrinkingtalent pool, finding the best candidate to fill the top leadershiprole is no easy task in the credit union industry, explains DavidHilton, president/CEO for The Woodlands, Texas-based CU consultingand outsourcing firm D. Hilton Associates Inc. Hilton, whose25-year-old company has conducted around 2,500 executive searchesand works with 150 to 200 credit unions every year, said theindustry suffers from a terrible shortage of CEO talent.

|“Not only are we faced with so many CEOs retiring, but there isa scarcity of people with the broad scope of skills needed for theCEO role,” Hilton said.

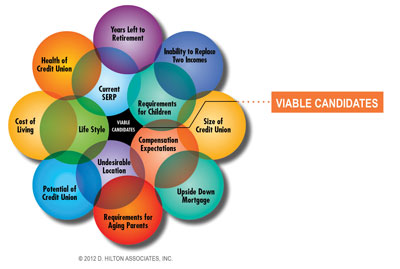

|The disparity of individuals with well-rounded skill sets stemsfrom the fact that credit unions now employ several executive vicepresidents, assigning each a specific set of responsibilities,while in the past just one executive vice president was typicallyemployed, Hilton said. Relocation issues also bring roadblocks intothe CEO search process, he said. Many candidates can’t afford tosell their homes due to housing market woes, and others want tostay put for personal reasons, such as children or agingparents.

|But many credit unions will have no choice but to face thechallenge of finding a new CEO in the next decade, according toHilton. In a D. Hilton Associates Inc. article titled, “TheChanging of the Executive Guard,” he writes that 91% of the CEOsworking for credit unions with $100 million or more in assets areexpected to retire in the next 10 years.

|

The credit union CEO search process varies according to theamount of time allotted for the search, Hilton said. Timeframesoften correlate with the current CEO’s reason forleaving–retirement notice lengths can vary from three to ninemonths or more, but other reasons, such as termination, disabilityand death, can leave CU boards of directors and human resourcedepartments with less time.

|BECU had the luxury of a full 18 months to conduct its mostrecent search, the credit union said. Board Chairperson DesireeSerr said the CU’s board of directors began the process by havingdiscussions about desired characteristics for the new CEO andappointing a six-person committee from within the board to lead thesearch. Anne Shannon, BECU’s senior vice president of humanresources, said defining desired characteristics was crucial priorto beginning the search.

|“Our biggest investment was in the front-end planning,” Shannonsaid. “We wanted to be very clear about the attributes beforegetting the search underway.”

|Next, they enlisted the help of a Seattle-based executiverecruiting firm, Herd Freed Hartz and conducted rounds ofinterviews–first with 25 candidates, then 12, and finally six. Serrsaid the CU chose Herd Freed Hartz in part for its experience withrecruiting executives in cooperative industries.

|“We really wanted our search to be a fair process and to cast abroad net out there,” Shannon said of BECU's decision to work withthe firm.

|Hilton added that enlisting the help of an executive recruitingfirm guarantees CUs that they’re getting a slate of the very bestcandidates out there. As CUs and their partner firms interviewcandidates, Hilton said the key traits they look for include strongleadership skills, a high level of trust and a good knowledge ofhow to run a business. Some seek specific technical skills, such asmulti-lingual capabilities or a background in mortgage lending.Top-notch communication skills are also a must, he said.

|“We find the executives with the most potential are those whocan successfully communicate with all the voices in the creditunion industry, whether it be members, employees, auditors orboards of directors,” Hilton said.

|Serr said the top characteristic BECU desired in its new CEO wasexperience that would allow him or her to be true to the culture ofthe credit union. An ability to grow BECU’s executive team, a deeppassion for the cooperative philosophy and strong customer-centricskills were also high on its list.

|Credit unions are often forced to look outside the credit unionindustry in their search for a new CEO. BECU said it looked atcandidates from a variety of industries, and Hilton said theresimply isn’t enough viable talent in the CU industry to fill everyCEO position, so his firm looks at candidates from within theentire financial services industry.

|A major part of the credit union CEO search and selectionprocess is determining a compensation package for the chosencandidate. Serr said BECU has a year-round compensation committee,which conducts annual reviews to ensure their executives’ packagesremain competitive in the market.

|Hilton said early on in a search process, his firm presents thecredit union’s board of directors with verified salary informationfrom other credit unions and then works on coming up with a figurethat board members can agree on. Retirement plans and otherbenefits are also an important part of the equation. In “TheChanging of the Executive Guard,” he writes that talentedexecutives are now being paid salaries at the 75th to 90thpercentile of the market, and credit union executives should be noexception.

|“How are you going to retain your young, talented executives?”Hilton writes. “The easiest way is by establishing and executing astrong compensation philosophy. It’s no longer adequate to pay yourexecutives an average salary based on the market’s 50th percentile(median) or mean.”

|GECU and First Tech CU declined to comment on their CEOselection processes for this article. But GECU said Long’spromotion to the president/CEO role comes after 32 years of servicewith the credit union, and GECU Chairman Greg Watters commented,“Harriet May, GECU’s former president and CEO, mentored Long andrecommended Long as her successor because she has vast experiencein our credit union and is uniquely qualified to continue buildingon GECU’s momentum, strength and commitment.”

|First Tech CU said Chief Financial Officer Hank Sigmon will actas president/CEO until a new leader is selected. Chairman JohnWeidert stated, “It’s been a pleasure to work with Benson over thepast five years. We knew that with his strong leadership and thegreat work he’s done for us, this would catch the attention ofother organizations.”

|BECU noted that in choosing Porter, a native of the Northwest,as their new CEO, they’d not only have a CEO that’s experienced andtalented but also one that’s tied into his community.

|“He’s a very seasoned executive and has done well in the creditunion industry,” Serr said. “He’s also from the Northwest and heunderstands our community and every community is a littledifferent.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.