Never in the history of the credit union industry has so muchemphasis been put on risk concentrations. There is no need towonder why. High concentrations of certain risks are a major causeof credit union failures.

|What is unique about our current environment is the number ofrisks that have materialized into losses during recent years. Soit's no longer just interest rate and default risks that aregetting the attention of examiners. These days other risks arebeing emphasized with equal fervor, such as, collateral, liquidity,transaction, delivery channel and third-party risks, just to name afew.

|And hovering over all these risks is concentration risk, whichis having a proportionately high level of any one risk. The concernis that in the event the risk should materialize, the creditunion's earnings would deteriorate significantly.

|Obviously, most credit unions have not neglected to addressindividual risks in the past. Each has its own method of analyzing,measuring, quantifying and maybe even qualifying various areas ofrisk. But it is probably safe to say that many have not combinedthese individual analyses into one comprehensive assessment thatidentifies the overall level of the credit union's concentrationrisk.

|Simply put, a concentration risk assessment is an umbrellaanalysis that combines all other risk assessments with theobjective of identifying and measuring the credit union's exposurein each risk area and for each product or service.

|

Combining multiple risk assessments into one analysis thatproduces meaningful results can be a daunting task. Developing abalanced scorecard is a great way of concisely documenting theresults of various risk assessments.

|The goal is to combine the individual risk analyses, many ofwhich are very technical, into a single document that quantifiesthe credit union's concentration risk position. Take this processone step further and the scorecard can also help lead strategicdiscussions by adding a qualitative rating that guides the creditunion's posture for the future.

|A concentration risk assessment starts with segmenting assetsand liabilities into groups that share similar riskcharacteristics. Then determine the risk categories that will beanalyzed, but don't forget profitability.

|The essence of the credit union's business model is to beadequately compensated for taking risks. To exclude profitabilityfrom the analysis would result in an incomplete and unbalancedconclusion, which could lead to risk avoidance, instead of healthydiversification. So determining the profitability of each productor service is imperative to conducting a complete concentrationrisk program.

|

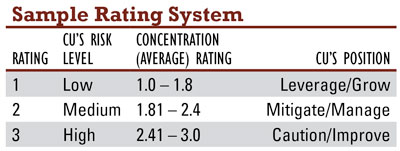

Once metrics have been created to measure levels of each risk, arating system should be developed. Similar to other rating systemsused throughout the financial industry, each credit union can havean internal system that essentially quantifies and qualifies thelevels of risk in each asset group.

|When applied to the scorecard format, the rating system willquantify the levels of concentration risk. Taking this process onestep further, the ratings system can also qualify the creditunion's position, which can then be used to effect strategicplanning and identify opportunities. See the Sample Rating Systemtable.

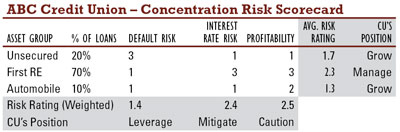

|This ratings system takes all the finding of the individual riskassessments and transforms them into a directional term, such asleverage, mitigate or improve. Applying this rating system in asimple lending concentration scorecard format is presented in theABC Credit Union table.

|ABCCU chose three asset segments and threemeasurement areas. The credit union already performed assessmentson default risk, interest rate risk and product profitability. Theresults of the three assessments were used to assign a rating toeach asset group. The scorecard shows the average rating for eachasset group and the weighted average rating for each risk category.These average ratings make it easy to determine where ABCCUconcentrations lie.

|Having a rating of 2.3, the first-mortgage loan product presentsa significant amount of concentration risk, but not just becausethis loan product accounts for 60% of the credit union's assets.This product has high interest rate risk and is not profitable.

|The scorecard also shows us that the other two asset groups arewell balanced products. In other words, these two products providesufficient income in relation to the risk each presents to thecredit union.

|Now take a look at the weighted average ratings for each area ofrisk. It is apparent that ABCCU's loan portfolio has a lowconcentration of default risk, which would indicate conservativeunderwriting. It has a moderate concentration of interest rate risksince the first-mortgage loan product is entirely comprised oflong-term fixed rate products. Overall, ABCCU is not veryprofitable, and therefore has a high concentration of products(first mortgages) with below average profitability.

|Taking the analysis one step further, this system provides aqualitative rating that can be used to lead strategic discussions.The above example illustrates how this type of concentration riskassessment could sway ABCCU's strategic plans. Before theassessment, ABCCU may have been bearish on unsecured loans becauseof the high default risk. Auto loans may have not been pursuedbased on the marginal profitability of the product and the creditunion may have stopped booking first-mortgage loans to itsportfolio.

|Using the results of the scorecard, ABCCU may have differentplans for the future. It may decide to promote unsecured productsmore aggressively despite the high default risk because these loansare very profitable and the credit union as a whole does not have ahigh concentration of default risk.

|Therefore, the low default risk position and high profitabilityof unsecured loans would be leverage to increase the overall healthof the credit union. Additionally, increasing the proportion ofunsecured loans would improve the credit union interest rate riskposition.

|Another outcome may be to grow the auto loan portfolio, eventhough it is moderately profitable. This decision is made with theobjective of improving the credit union's interest rate riskprofile and to counteract the additional default risk that will beadded when unsecured loan balances grow.

|The above decisions were not made on the basis of avoidingrisks. On the contrary, they seek growth in areas that may havepreviously been avoided. Growing in these areas will improve thecredit union's overall health by lowering concentrations thatcurrently exist.

|Essentially, these decisions will lead to portfolio diversitythrough growth in product lines that possess strengths thatcounteract the current weaknesses of the credit union. Successfullygrowing automobile and unsecured loans will provide balance sheetstrength through balance and diversity.

|The complexity of a comprehensive concentration risk assessmentprohibits a complete discussion in this article. The NCUA'sSupervisory Letter on Concentration Risk provides a completeguidance of how a concentration risk assessment should beincorporated into a credit union's current risk managementprogram.

|But keep in mind–even though the objective is to set limits onconcentrations, the real value of this assessment is to identifyopportunities. From this awareness, strategies can be developedthat lead to a more diverse and therefore healthier balancesheet.

|Pete Sekul isvice president of lending at Andrews Federal Credit Union inSuitland, Md.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.