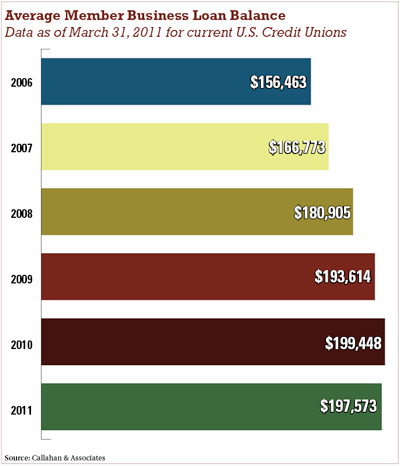

Perhaps reflective of the overall economy, after steadilyclimbing for the past few years average member business loanbalances among U.S. credit unions fell slightly inthe 12-month period ending March 31, according toPeer-to-Peer data from Callahan & Associates.

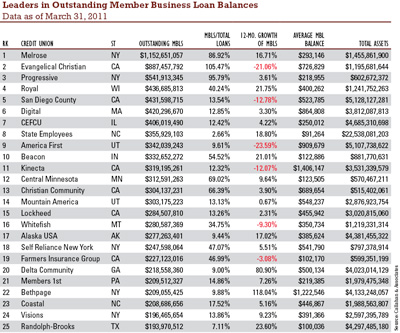

|Some of the largest portfolios are held by credit unions withrelatively small memberships but large asset bases.

|

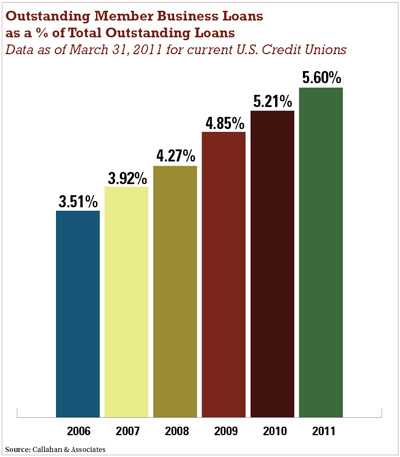

Meanwhile, outstanding member business loans as a percentage ofoutstanding total loans continued a steady incline, according tothe same data.

|

The largest member business loan portfolios in terms ofoutstanding balances are held by the 25,000-member, $1.4 billionMelrose Credit Union in New York and the 12,000-member, $1.2billion Evangelical Christian Credit Union in California.

|

These tables also appeared in the Aug. 31 print editionof Credit Union Times.

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.