Late last year the NCUA published its regulation on expectationsfor credit union directors. The agency focused specifically onfinancial literacy and how it will be measured. As the July 27deadline for compliance looms, Credit Union Leadership Forum conducted a survey of creditunion executives and board members as well as numerous interviewsabout the NCUA regulations and the state of director literacy.

|Following the financial crisis, the role of all directors hasforever been changed in fundamental ways. Among credit unions,there is a frustration that traces back to annoyance with theNCUA's dictates.

|Nobody disputes that financial literacy is a must have forcredit union directors, but beyond agreement on that, it's a fastplunge into acrimony and discord.

So, what did the survey uncover? With around 100 respondents,split between board members and chief executives of credit unions,who answered 29 questions, there was plenty of room for debate.

|When asked to rate the effectiveness of their boards, 58% calledtheir boards “very effective,” 36% said the board was “somewhateffective.” The remaining 6% said their boards were “noteffective.”

|Another question asked respondents to list board committees. Asupervisory committee was the popular with 89%. An asset-liabilitycommittee was No. 2 with 59%.

|Todd Sprang, an accountant in Clifton Gunderson's Oak Brook,Ill., office was struck that only 6% of the respondents said theyhad a risk committee. “A trend we will see in more credit unions isthat they will have risk committees with oversight of the risks theinstitution takes,” predicted Sprang.

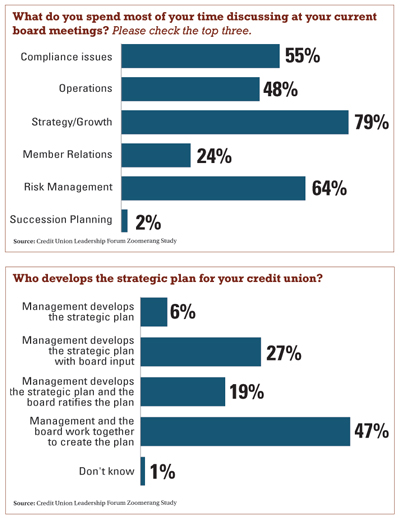

|“Who develops the strategic plan for your credit union?”elicited more contention. The responses revealed a lack ofagreement in the industry about the locus of responsibility forstrategy. “Management and the board work together to create theplan” captured 47% or responses. “Management develops the strategicplan with board input” was No. 2 with 27%.

|Observers also raised eyebrows to responses to: “Does yourcredit union perform an annual evaluation of board committees?”That's because 77% said no.

|The next question, “Does your credit union perform evaluationsof individual board members?” found a large majority, 88%, saidno.

|But evaluation is increasingly emerging as a hot topic in creditunion board composition. Brian Barnier, an executive withValueBridge Advisors, wrote this in an email: “Less than a quarterof boards are conducting annual board performance reviews. Boardsare missing golden opportunities to use board performance reviewsto identify gaps in areas such as strategy and risk insight, thenclose those with recruitment and education. With skills in place,CUs can more easily conduct strategy workshops to drive toward moreliquid and profitable growth to meet the needs of current andfuture members.”

|Steve Winninger, CEO of the $1.5 billion Lake Trust Credit Unionin Lansing, Mich., in an interview elaborated on Barnier's point,saying, “For an effective board you need the right people. Boardshave to become proactive in recruiting new board members who bringneeded skills.” Boards increasingly need a range of skills andsmart boards, per Winninger. They have to identify a need–say,marketing expertise or familiarity with mobile technologies–then goout hunting for people with the needed skills. And that is a bigchange from the old ways of filling board vacancies.

needed skills. And that is a bigchange from the old ways of filling board vacancies.

Responses to question 22 triggered another round of concern:“What do you spend most of your time discussing at your currentboard meetings? Pick the top three.” Strategy/growth topped thislist at 79%, while risk management and compliance rounded out thetop three at 64% and 55%, respectively. Operations ranked next at48% followed by member relations at 24%. Succession planningcaptured just 2%.

|Commented Marty Goldman, a longtime board member at MarineFederal Credit Union, a $569 million institution headquartered inJacksonville, N.C., “I am surprised strategy/growth was No. 1 andcompliance is down the list.”

|Responses to, “Does your board require continuing education fordirectors?” provoked more surprise. Seventy percent answered thatit was required, but a full 30% said it was not required. Oneexpert questioned how one in three credit unions could not requirecontinuing education.

|“That really disappointed me,” Goldman added.

||The tradition of volunteer directors runs deep in the creditunion world, as responses demonstrated. Just 28% said credit unionboard members should be paid and the remaining 72% answered theyshould not.

|It is not just the role of directors in isolation that now isunder review. Also in play is the delicate relationship betweenboard members and credit union management. Some insist the varyingroles are clear. “There's a big gulf between management andgovernance, which is the board's job. Management is aboutimplementing the board's vision,” said Lake Trust's Winninger.

|Blunter is the analysis offered by Dave Osborn, CEO ofAnheuser-Busch Employees' Credit Union, a $1.3 billion credit unionin St. Louis. He explained, “Boards focus on what, managementfocuses on how.” That might be clear in theory but, Osbornadmitted, it's not hard for boards to stray across the line and getmired in operations. That's why Osborn recommends that top creditunion executives themselves serve on boards. “I've been on theCo-Op Financial Services board and also on Missouri Corporate's.Sometimes as a board member you just have to bite your tongue andyou learn that in board service,” he said.

|The survey did not directly ask how people felt about NCUA'sdemand for heightened director literacy, but some respondentssuggested perhaps it should have. Opinions on this are hotlydivided.

|Some directors applaud what the NCUA is doing. ChuckScheithauer, treasurer of the board of directors at the $630million CoastHills Federal Credit Union in central California,said, “I took the NCUA test for director financial literacy. Ithought it would be a pushover; it wasn't.” He added that all themembers of his board have taken literacy classes, said Scheithauer,and the upshot is that this is a board that genuinely understandsthe key ratios, what they mean, and why they matter. “I think it isgood for NCUA to push for more literacy.”

|But Don Oliver, board president at the tiny Greater AbyssiniaCredit Union in Cleveland, with 380 members and assets under $1million, lamented “I feel NCUA is trying to decrease the number ofsmall credit unions.” A particular sticking point with him was thetight deadline for director financial literacy. “A year would havebeen fairer,” said Oliver. He claimed his credit union's directorswould make the deadline but it won't be easy. He also believes manydirectors on other boards of small credit unions will have to stepdown before the year is up. “Are we losing touch with the humanside of credit unions?” he asked.

|Oliver is not alone. Mansel Guerry, CEO of $29 millionBrightview Credit Union in Mississippi and chairman of the CreditUnion 24 board of directors, said, “There is a disconnect betweenregulation and reality. The water level is rising and it isdrowning what this industry started out to do. NCUA will scratchits head and wonder where all the credit unions below $25 millionwent. The answer is: you buried them.”

|NCUA was not alone in winning criticism. Marine Federal's MartyGoldman caustically grumbled, “The [industry] trade organizationsleaped on the NCUA ruling as a money maker, rushing to offerclasses to directors. I find that unfortunate.”

|But do note, not everybody blames NCUA or points blaming fingersat the industry associations. Mike Hanson, CEO of MassachusettsCredit Union Insurance Corp., a quasi-private insurance provider inWestborough, Mass., said that the trend toward better informed,more involved and active credit union boards has been a long timein the making. “The NCUA regs sparked interest but this has beenhappening for some years. The business is more complicated, andboards have had to respond. Boards have been getting better overthe long haul and more credit unions have been spending more timebuilding good boards.”

|Winninger too saw a trend for board improvement. “If one issuestands out for me, it is the notion of boards doingself-monitoring. I think it is a very good thing, and it needs tobe effective. If an employee is not performing, their managergenerally knows it early and has the authority to address it. If aboard member is not performing at an effective level, their manager(the members) generally won't know it unless the credit union ispublicly in trouble. That leaves the action up to the peers, whoare also generally friends and volunteers, so it takes courage totake on those issues. It is very easy to tolerate less thaneffective governance in this situation, so rigorous self-monitoringis not only hard, but extremely critical.”

|Looking to the future, MSIC's Hanson said, “A lot ofinstitutions have been working on this and we are moving in theright direction. There are problems. We have a long way to go, butwe are moving.”

|The other indisputable take away? “Governance will become abigger and bigger deal,” said Barnier. “And it is proving difficultto get people skilled up.”

Complete your profile to continue reading and get FREE access to CUTimes.com, part of your ALM digital membership.

Your access to unlimited CUTimes.com content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical CUTimes.com information including comprehensive product and service provider listings via the Marketplace Directory, CU Careers, resources from industry leaders, webcasts, and breaking news, analysis and more with our informative Newsletters.

- Exclusive discounts on ALM and CU Times events.

- Access to other award-winning ALM websites including Law.com and GlobeSt.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.